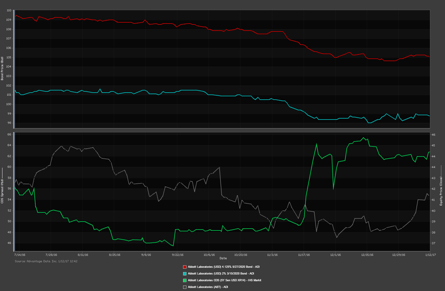

Abbot Laboratories (NYSE:ABT) saw a series of bond issues downgraded this past week from A2 to Baa3. This rating downgrade follows the aquisition of St Jude Medical Inc. (NYSE:STJ) on January 4th and the concerns that Abbott will struggle with deleveraging in the future. Since the acquisition and downgrade, ADI's CDS screener has shown Abbott Laboratories 5Y Sen USD XR14 CDS (green) drop and then widen to 62 Basis Points. Over the same period, ABT's equity (grey) had been on the rise until a drop yesterday.

Two of the downgraded bonds depicted in the chart, a 2.25%/20 (blue) and a 4.125%/20 (red), show a similar trend in their pricing. The 4.125%, however, was issued post-crisis in 2010, as opposed to the 5 year tenor of the 2.25% bond. The difference in demand is shown in their trading levels leading to their maturity in 2020.

Monitor the movement of Abbott and other downgraded securities by requesting a free trial of AdvantageData today.

.png)