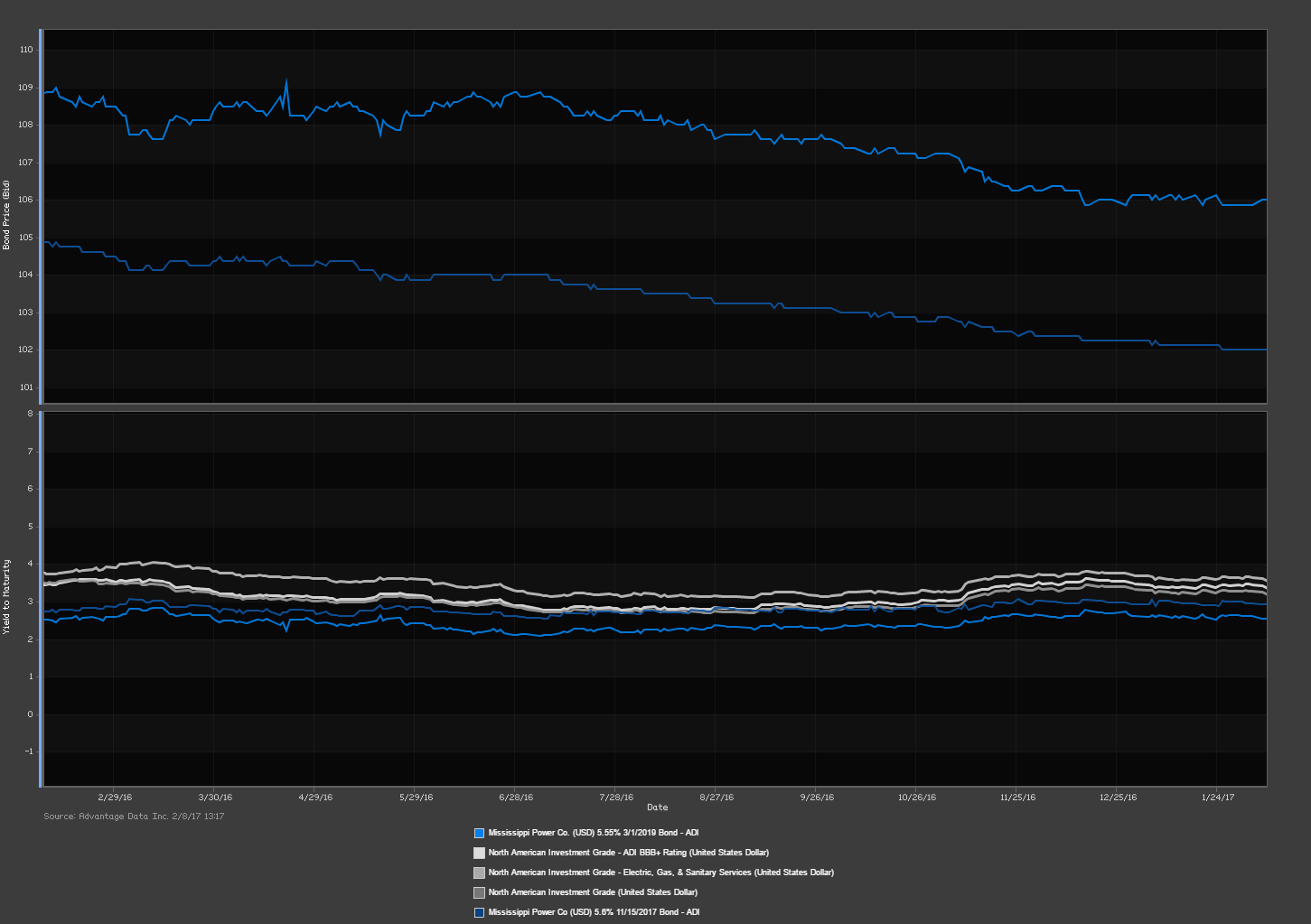

Mississippi Power Co. (NYSE: MP-D) is under review for a credit downgrade as a result of an ongoing investigation of continued delays and cost overruns for its coal gasification plant in Kemper County. The energy company last experienced a downgrade of its debt in November 2015, which brought its Moody's rating down to near junk status of Baa3. If the review goes poorly for the plant, Mississippi Power Co. will be in danger of crossing over into non-investment grade status.

0 Comments Click here to read/write comments

Topics: energy, junk bonds, Downgrade, Crossover

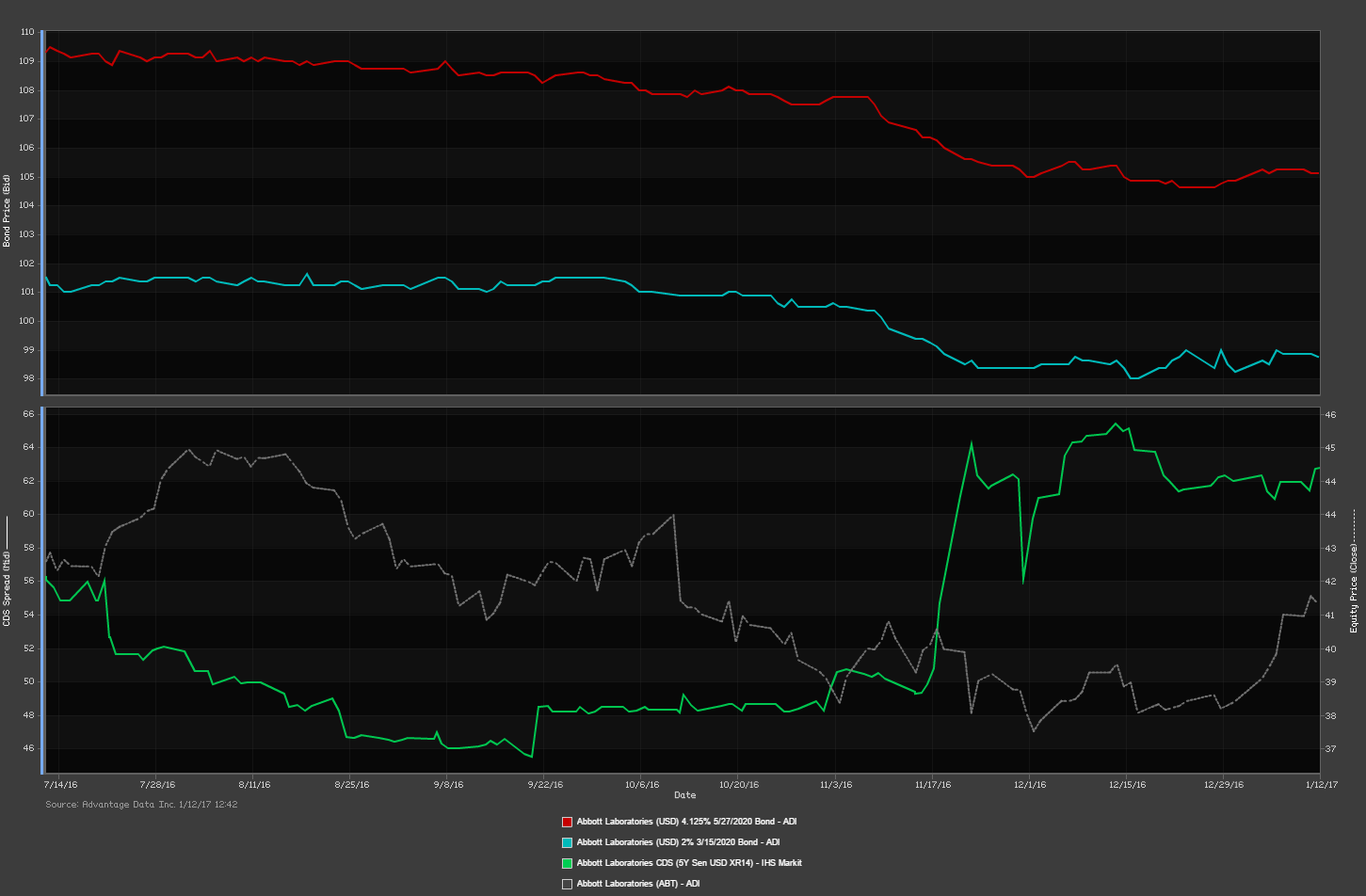

Abbott Laboratories Debt Experiences Downgrade

Posted by

Nick Buenaventura on Jan 12, 2017 1:55:50 PM

Abbot Laboratories (NYSE:ABT) saw a series of bond issues downgraded this past week from A2 to Baa3. This rating downgrade follows the aquisition of St Jude Medical Inc. (NYSE:STJ) on January 4th and the concerns that Abbott will struggle with deleveraging in the future. Since the acquisition and downgrade, ADI's CDS screener has shown Abbott Laboratories 5Y Sen USD XR14 CDS (green) drop and then widen to 62 Basis Points. Over the same period, ABT's equity (grey) had been on the rise until a drop yesterday.

0 Comments Click here to read/write comments

Topics: debt, Abbott Labs, Downgrade

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)