Summary

With little holiday news, the BDC Reporter is reviewing what we've written about individual BDC stocks in 2017.

The goal - with the benefit of hindsight - is to determine what we got right and what wrong. We also seek to describe the main challenges coming up.

As always, the BDC Reporter describes our own investment approach, both during the soon-to-end year and for 2018.

PREAMBLE

With little BDC news to write about and with 2017 coming to a close the BDC Reporter is reviewing many of the BDCs that we wrote about in a series we’ll unimaginatively call “Year In Review“. We aim – with the benefit of hindsight – to determine what we got right and got wrong on these pages, and project what the key challenges are for these BDCs in 2018. As we’ve done all year we’re also sharing with our readers how we invested our own capital and with what results to date. We’re starting out with Alcentra Capital or ABDC, both to keep things alphabetical and because this was one of the Big Stories of 2017, with the BDC going from “hero to zero” in a very short period. The BDC Reporter – as we’ll show – proved to be both prescient and not.

YEAR IN REVIEW

Oft Mentioned

We wrote about or mentioned ABDC nearly 40 times in 2017. After reviewing everything written, we can say the BDC Reporter was pretty much spot on, and warned readers about problems ahead early and often. However, there’s an ironic twist that we’ll get to a little later.

Credit Questions

As early as November 2016 – after reviewing the IIIQ 2016 10Q – the BDC Reporter became concerned about ABDC’s credit quality. At the time, ABDC – which had no non accruals on the books at June 2016 – fessed up to 2 new non performers. However, there was much else besides that the BDC Reporter – going through the portfolio company by company noted. Here’s a quote from the full length November 6, 2016 article:

At the end of June 2016, ABDC had 33 companies in portfolio, of which 10 were on our Watch List with an aggregate fair market value of approx. $82mn. That was a whopping 43% of Net Asset Value at the time, and worth worrying about.

At the time, ABDC’s stock price was at $12.280, just coming off – as many BDCs were at the time – a big run-up from an All Time Low of $9.030 in February 2016.

We revisited the credit theme after reviewing the 10-K in an article on March 19, 2017.

ABDC does not offer a portfolio risk rating in its quarterly filings. Readers will have to rely on the BDC Reporter’s analysis. We won’t get into great detail here, but can report that out of 32 companies in portfolio, 30 are yield producing, and 8 are on our Watch List (including Black Diamond Rentals) and 7 of those are income producing. That last fact is important in assessing the potential risk to recurring income and to distributions. In total, Watch List assets are valued at $53mn, a not insubstantial 30% of the BDC’s equity at year end 2016. Yes, no loans are on non accrual, but having a quarter of the portfolio companies on the books on a Watch List status deserves-as we like to say-watching.

At the time, both ABDC and the BDC Sector generally, were riding high, just days away from what would be the highest level in the Bull run that began in February 2016 and topped out on March 31, 2017 by our measuring stock. ABDC’s stock price was at $13.47.

On April 12, 2017 – on the occasion of an upgrade of ABDC’s stock by an analyst, the BDC Reporter took the opportunity to throw some shade and point out the relatively high risk profile which investing in ABDC involved. Here’s the full comment:

The oft-quoted KBW set a price target of $14.0 for ABDC, which is currently trading towards a two year high just below that level. Frankly, the BDC Reporter does not understand most analyst ratings or how investors are supposed to use them because we undertake our own research. We’re focused less on the price (what are you supposed to do if ABDC reaches $14.0 ?) but on the long term sustainability of any BDC’s earnings. We rate every public BDC we track between A and F (no E), reflecting our view of what we expect will happen to the distribution level and NAV in the years ahead. An A rating is reserved for securities expected to remain unchanged, or even increase, in the years ahead. Most of our A rated investments are BDC Baby Bonds. A B rating means we anticipate-over time and happening in fits and starts- a 2% annual decline in recurring earnings. C means a 4% annual decline. D a 6% annual decline and F is anything higher.

Anyway, ABDC has performed pretty well since going public and has managed to maintain its distribution unchanged since its $15.0 a share IPO in May 2014. Nonetheless, given the risk profile of the BDC, our rating for ABDC is a C. Or in other words we expect credit losses to erode earnings power over the next several years. Five years from now we expect-especially if there’s been a recession in the interim- that earnings, NAV and the distribution will be 20% lower than today. Currently ABDC trades at a 1% premium to book value.

At that point, ABDC’s stock price was already at its highest level since coming public.

A couple of weeks later, we were disturbed by the news of managerial changes at the BDC – a subject that nobody else appeared to be commenting on publicly. Here’s a quote from the April 28, 2017 BDC News Of The Day:

Admittedly, in an externally managed BDC, which depends on an outside firm’s personnel for everything (ABDC has no employees of its own) changes in the C-suite do not resonate too loudly. Nonetheless, the changing of the guard in the day-to-day role of Chief Executive Officer deserves a moment’s attention. Mr Echausse has been the point man for the BDC and was a founding member of Bank of New York’s Alcentra Middle Market platform, dating back to 1998. Mr Scopelliti, by that standard, is a relative newcomer, arriving at the Investment Advisor in July 2014. He’s been involved both with the Investment Advisor and the BDC ever since, principally in “deal sourcing“, as the corporate bio shows.

Given the new CEO’s three years experience on the ABDC C-suite bench, and the continuing role of Messrs Echausse and Hatfield on the Board and at the Advisor, we doubt any drastic changes in ABDC’s strategy, business model and personnel will ensue from this change. However, every new CEO -even a part time one appointed by a third party firm- imprints an organization with their own style and tone. Shareholders of ABDC might want to pay more attention than usual to the next few Conference Calls, starting in the second half of the year. ABDC might be changing.

Specifics

The BDC Reporter – wherever possible – was also seeking to keep tabs on what was happening to ABDC’s loan portfolio. On May 2, 2017, we briefly mentioned leadership changes at Media Storm.

Today, the $2.5mn loan is on non-accrual and written down (38%). At the time, ABDC was carrying the Subordinated Debt – according to Advantage Data records – at par.

Timing Is Everything

On May 17 2017, based on its track record of an unchanged distribution and for other reasons that we’ll discuss, ABDC issued new common stock in a secondary offering. The BDC Reporter – on May 18 – had an in-depth look at the developments underway. We were – very explicitly – not pleased with what we saw. We shared our concerns about continuing credit problems at the BDC; the sale by Bank of New York of the bulk of its equity interest in the BDC as part of the transaction and the sustainability of the distribution, which we questioned. This was a hard call with analysts recommending the stock and the stock price riding high. We named ourselves a “contrarian”, and we were at the time. Here’s an extract of what we wrote:

…investors may want to worry both about the sale of ABDC’s stocks by its Investment Advisor; the uncertainty surrounding any change in leadership and the BDC Credit Reporter’s warning that the credit trend is headed downward. As we said at the outset- for the BDC Reporter – the combination of the above – as well as the absence of any explanation by the Investment Advisor for its stock sale and the continued absence from the BDC’s financial statements of a risk rating of the portfolio (which most BDCs offer up) – leaves us disconcerted.

The stock price of ABDC closed May 18 at $13.51.

Wet Blanket

On July 5th, 2017 an analyst provided a Buy recommendation for ABDC and the BDC Reporter chimed in with its own view, to provide readers with a different perspective. As you’ll have surmised by now, we were cautious in our assessment of the risks involved in buying ABDC:

Given the credit uncertainties, as well as intangibles such as the Investment Advisor recently selling much of its ownership in the BDC and the dilution from the latest share offering and the ongoing “spread compression” in leveraged lending, we would rather be safe than sorry and avoid ABDC so close to its highs, even if the current price is at or slightly below NAV and at a double digit yield.

If the market priced ABDC in 2016 at $10.36 just a year and a half ago on strong earnings and an unchanged dividend what would happen if credit losses caused lower earnings/distribution. And if general market enthusiasm waned.

In our assessed that could readily bring ABDC to a sub-$10 price with only minimal negative news.

Given the limited upside and the potentially much higher downside, we would play the odds and stay away.

On July 5, 2017 ABDC closed at $13.53.

Later in the month, on July 20th we reviewed the bad news coming from one of ABDC’s previously noted portfolio companies My Alarm Center, one of several items that was to fell the BDC’s stock and cause its dividend reduction.

By the time we reviewed ABDC’s IIQ 2017 results on August 7, 2017, some of the problems that we’d been anticipating were showing up. We were full of analogies, as in this quote:

Typically where there is smoke in BDC credit matters, a fire is likely to pop up shortly thereafter.

Judging from the second quarter results that’s just what happened. The BDC wrote down its portfolio value by a net ($10mn), bringing Net Asset Value Per Share from $13.43 to $12.73 in just a quarter. That was quite a drop, and caused no incentive fee to be earned.

By then, ABDC’s stock price was on the descent at $11.02.

On October 4, 2017, the BDC Reporter noted more portfolio company troubles that had not been on the radar earlier in the year. In the twinkling of an eye – going by the BDC valuations of their exposure, GST Autoleather got into deep trouble and filed Chapter 11. For ABDC, the news was very bad, as we surmised at the time:

However, we would be very surprised if TCAP and ABDC did not have to take a substantial further reduction in their debt value, potentially all the way down to zero.

In the IIIQ 2017 results- which came out subsequently – TCAP wrote down its exposure by 89% and ABDC by 100%.

Implosion

Of course as investors will know when the IIIQ 2017 results came out ABDC reported an increase in non performing and under-performing loans; a big drop in book value and reduced its dividend from$1.36 annually to $1.00. The BDC Reporter wrote an in-depth article with the title “What Went Wrong“. Much of what we covered were the credit problems that we’d been noting for the past year at Show Media, My Alarm Center, Media Storm and – more recently- GST Autoleather. Unfortunately, waiting in the wings were several other names that may or may not cause trouble in the future, most of which we’d been aware of.

What was new – besides the rapid write-off of GST Autoleather (worthy of an article unto itself) – was the change in strategy announced by the new CEO David Scopelliti, which we’d foreshadowed a few months before but was not formally figured into our calculations. ABDC promised to greatly reduce its load of riskier credits – while working out of the troubled loans. There’s nothing wrong with a change of direction – and the goal of taking less credit risk – but the economics of a BDC are bound to change dramatically as a result. However, that change happens over multiple periods and adds another level of uncertainty beyond the “will they ? won’t they ?” of troubled credits. How much will portfolio yield drop ? By 10% ? Or 20% . What will happen to leverage ? Up or down ? Will borrowings get cheaper ? Will Unsecured Notes get jettisoned to reduce interest expense ? Will the Investment Advisor permanently reduce fees or just waive for a couple of quarters but continue to charge the same rate as envisaged for a different strategy ? Etc. Here is how we summed the situation after the latest results were published and we reviewed the portfolio in depth and peered into an uncertain future:

A lot has gone wrong at Alcentra Capital and a lot more could still be coming. Only time will tell if the 5 companies we have on our own Watch List, beyond the 3 non-accruals- will be added to the ranks of the non-performers. Moreover, the very actions to be taken to ensure “this never happens again” are likely contributing to the drop in the stock price as investors doubt that the $1.0 a year distribution can be maintained for long. (By the way, management addressed directly the long term sustainability of the new distribution level and made a case that the chosen level was very defensible. Obviously Mr Market does not agree). A glass half empty investor can make a case for an even bigger dividend reduction coming not so slowly down the pike. A glass half full investor will hope that the worst of the write-offs is past and ABDC’s fee waivers and additional capital will be sufficient fingers in the proverbial dike.

ABDC’s stock price dropped like a stone, reaching an All Time Low of $7.00 intra-day on November 15 2017.

Up To Date

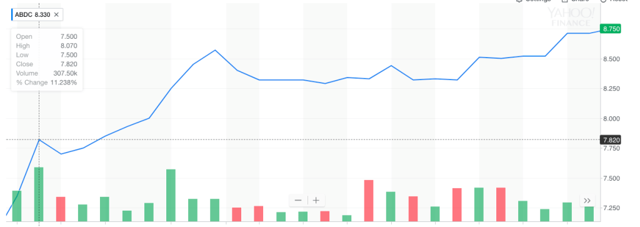

We’ve written about ABDC since the last results were made public. There was an insider sell by the former CEO on November 14 , which deserved mention and was made close to the lowest price and underscores that insiders can panic too. We’ve mentioned ABDC in many of our BDC Market Recaps, but only in passing. However, there has been very little new “news” except the modest increase in an announced stock buy-back program from $2.5mn to $5mn. The market – judging by the stock price – has gone from panic to anticipation. The stock has risen from its $7.00 low to $8.71 at the close on December 26, 2017.

2018

The key question going forward is whether the new distribution level at $1.00 a year has been set at a sustainable level ? Or will – like many other BDCs before them – ABDC be forced to cut again within a few quarters. If the $1.0 payout can be maintained, ABDC will be yielding 11.4%, and there is some prospect – based on the multiples achieved by other BDCs when the market sounds the all clear on further dividend cuts- that the stock price might climb back to a $10.0 or higher price. (Stable dividend paying BDCs typically trade at multiples of 10x-14x the distribution). If 2017 was a watershed year for ABDC – with the dividend getting cut for the first time since the BDC went public, 2018 will also be critical. Will the new CEO, armed with a new strategy but still working through several troubled credits be able to re-position ABDC on a strong footing ? Or will ABDC – like Triangle Capital and Fifth Street Finance and OHA Investment in prior years just continue to step down in performance, payout and price ?

As always, it’s a matter of odds. The market appears to believe the odds are pretty good given the recent price run-up. The BDC Reporter is more optimistic than we were for most of 2017, now that the problems we began to identify in late 2016 have been brought to the surface. Nonetheless, we are far from certain that ABDC’s troubles are in the rear view mirror. Before the IVQ 2017 results are published in February, the BDC Reporter will be keeping a close eye on any public information about ABDC’s portfolio companies. Any news there – for good or ill – could be critical in the short term.

INVESTMENT APPROACH

Common Stock

Now for the ironic twist. Armed with our skepticism about ABDC’s credit quality since late 2016, we avoided any investment in ABDC’s common stock through much of 2017. As a result, we avoided buying the stock as the price rose through the first 5 months of the year to $14.50. Moreover, we avoided the initial descent that began May 11 and continued through the summer and fall even prior to the publication of the IIIQ 2017 results in November. However, on October 2, with ABDC trading well below book value and at an 18 month low, we purchased a position for our Special Situation strategy at a $10.48 price. Our premise was that the upcoming IIIQ 2017 results would not be as bad as the market – which had written down the stock price by (29%) from its high in a complete switch from the approach earlier in the year- anticipated. We thought a dividend cut likely, but less drastic than the stock price suggested. We comforted ourselves with the notion that we were buying ABDC at n already reduced price. If we were wrong, we anticipated a Plan B that we would still be able to generate a positive Total Return over a longer period by holding onto the investment.

Of course, the IIIQ results from a credit standpoint were worse than even we had expected (although earnings were buoyed by fee waivers) and the stock price drop one of the largest ever recorded in such a brief period. (ABDC dropped -38% from 9/27 to 11/15 and -60% from its spring high). So much for catching a falling knife. After reviewing the IIIQ results- and given the depth of the price decrease – we dollar cost averaged our position with an additional purchase on November 11 at a $7.58 price, a week before ABDC reached its All Time Low. At our current average cost of $9.86 and with ABDC trading at $8.70, we’re still hopeful that our Plan B will bring our investment into the black within a year or less.

Fixed Income

We have been invested in ABDC’s hard to find 2020 and 2021 Inter Notes for several quarters. The credit problems the BDC experienced does not appear to have any impact on the value of either Note.

During the year, we reviewed the asset coverage of the Notes under our Stress Test scenario and concluded the risk of loss remains very remote, notwithstanding the small number of loans in ABDC’s portfolio.

The stated intention by the new CEO to reduce the BDC’s risk profile going forward and the reduced dividend are both positive factors for Note Holders.

We expect to continue to hold the Inter Notes, which were recently quoted at 98.5% and 99.5% of par, generating an effective yield over our cost of between 6.25%- 6.50% per annum.

Disclosure: I am/we are long ABDC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We are Long ABDC's Inter Notes

Nicholas Marshi is the Editor-In-Chief of the BDC Reporter

.png)