Below is the full list of public Business Development Companies found in AdvantageData's BDC Advantage. This post was originally published on October 18th, 2016. The contents on this post, and the business development companies herein, have been updated with the latest information available as of July 8, 2019. View an updated list as of November 2019 here.

Full List of Public Business Development Companies (BDC)

Topics: Loans, Middle Market, BDC, business development company, BDC Filings, Fixed Income

BDC Common Stocks Market Recap: Week Ended April 26, 2019

BDC COMMON STOCKS

Follower

The rising tide of higher market indices seems to be lifting BDC common stock prices.

Topics: Loans, Analytics, BDC, market analytics, business development company, Fixed Income, bdc reporter, research, market update

Datto moves forward on refi; existing debtholders include TCPC, GSBD, OCSL, SUNS, CGBD, GBDC

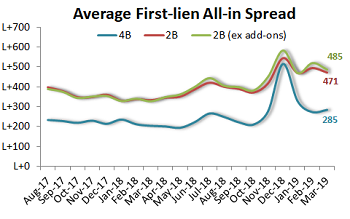

Power Solutions’ cross-border loan-and-bond deal was the focal point of last week’s activity, with loan demand magnified by the lack of available product elsewhere and both the secured and unsecured bonds playing well amid a bull-market run. Indeed, several other issuers pushed ahead with secured bonds as last week’s high-yield volume raced north of $10 billion, further depressing loan activity.

Topics: Loans, Analytics, BDC, market analytics, business development company, Fixed Income, LevFin Insights, News

BDC Preview: Week Of March 4 – March 8, 2019

A very busy week ahead for BDC investors including fast moving prices; eleven new earnings releases and the vote on whether Medley Capital will merge into Sierra Income. We pledge to keep readers updated as a critical week unfolds.

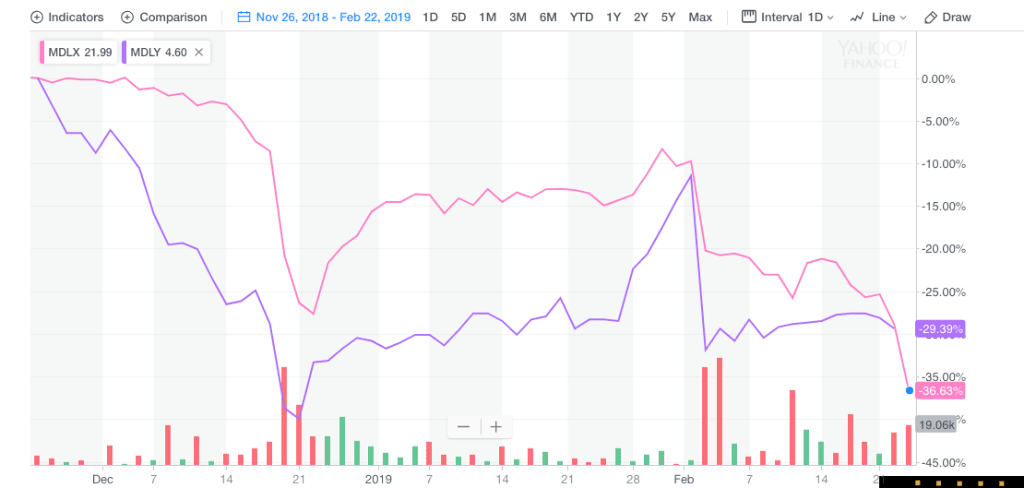

Markets: Given that last week the BDC sector – as measured by the Wells Fargo BDC Index and the price of the UBS Exchange Traded Note with the ticker BDCS – dropped every day, the direction of the market will be a critical factor. Last week’s pullback occurred while the broader markets continued to rise and other forms of non investment grade credit remained strong, begging the question as to whether this was just a short term pause in a continuing rally or a turning point, and prices will be down from here. As we’ll discuss in greater detail below, BDC earnings season is still in process, and individual fund results may influence sector performance. By mid-month, though, all the latest quarterly updates will be in and investors will have positioned themselves. We’ll be keeping track not only of BDCS and the Wells Fargo BDC Index but of the trends amidst the 45 different public BDCs we track. Last week, 42 dropped in price and 20 are now trading at a price below that of 4 weeks ago in the very midst of the rally. If that proportion of underwater stocks rises, or we see an uptick in BDCs trading within 5% or even 10% of their 52 week lows (the current numbers are zero and one respectively) we’ll be worried that the rally that began December 24, 2018 has run its course. On the other hand, if BDCS breaks through the August 30, 2018 high of $21.03, we’ll know that this rally lives and has broken through a critical threshold. For reference, as of Friday, BDCS was at $19.73.

Topics: Analytics, market analytics, business development company, Finance, Fixed Income, News, bdc reporter

BDC Preview: Week Of February 25 – March 1, 2019

Earnings: This is going to be a busy week for BDC earnings as the season rolls on. We’re already blanching at the prospect, with 11 separate releases coming. Far and away the most important will be the report by FS KKR Capital (FSK). This will be the first time since the merger with Corporate Capital Trust (ex-CCT), and after a name and ticker change. More importantly, we’re going to hear more about the ever huger BDC’s credit status. Reviewing the filing and listening to the Conference Call should tell investors whether the ambitious folk at this unusual arrangement between a firm best known for raising capital and another for investing capital will be successful at lending capital. To be honest, our impression from reviewing the portfolios at both entities (CCT and FSK) for some time now is that management is going to be in turnaround mode for some time to come. Much of that – if we’re right – can be laid at the underwriting taken by FS Investment’s prior partner in leveraged lending GSO Blackstone, which was not shy about taking some very large positions on behalf of the shareholders of multiple FS Investment funds in what now appear to have been some dicey propositions. KKR – now in charge of day to day investment management – re-underwrote those assets when taking over and adding their initials to the door and will have to be responsible for the consequences, if not the original credit decisions. However, KKR will benefit from being in control of many of the debt tranches through the multiple funds now under their co-tutelage with FS Investment, which will aid any work out efforts (but also prolong the time it will take to determine the final outcome). Also worth mentioning – as Oaktree Specialty Lending did last week (OCSL) when discussing their own escape from under two troubled portfolio companies – is that the LBO market remains flooded with private equity buyers with huge untapped resources; hungry lenders of all stripes and an economy which is humming along (despite all the “next recession is around the corner” talk). As OCSL’s management noted, with a little luck and those favorable conditions, FSK may be able to dig itself out of the hole dug by another party, but which they enthusiastically adopted.

Topics: Loans, Analytics, BDC, market analytics, business development company, Finance, Fixed Income, News, bdc reporter

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)