Business development company managers are seeking creative ways to increase their portfolio yields in the best risk-adjusted manner. The BDC leverage limitation of one-to-one as outlined in the Investment Company Act of 1940 (the 40 Act) prevents them from increasing their direct leverage.

Sean Dougherty

Sean is a JD/CPA with extensive experience working in the middle market loan industry and with middle market CLOs. He was an initial member of CIFC's (a public leveraged loan investment manager) executive team where he was responsible for the issuance of 7 CLOs and numerous warehouse facilities.

Prior to that experience, Sean was a Director in S&P's CDO rating group, where he specialized in rating middle market CLOs.

Recent Posts

0 Comments Click here to read/write comments

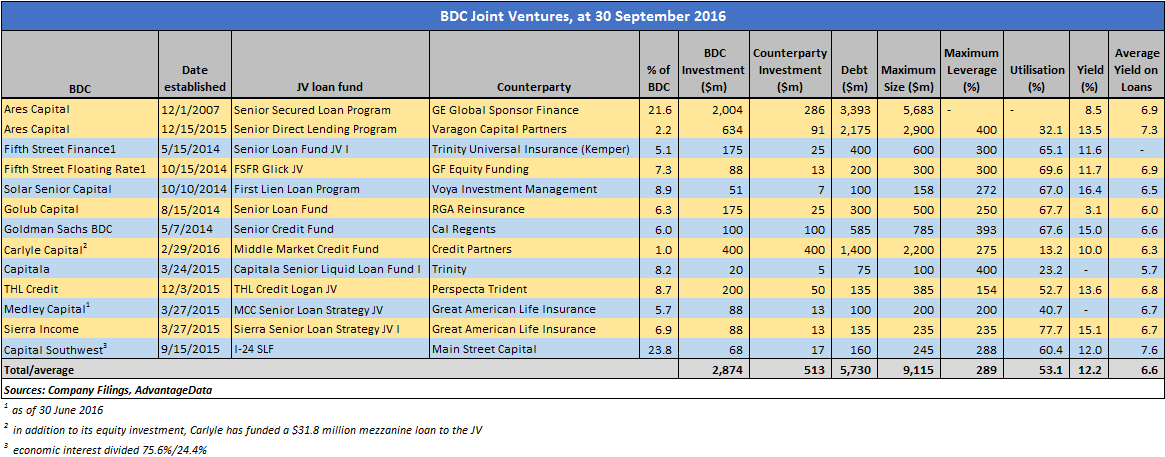

Topics: Middle Market, joint ventures, business development company

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)