Summary

A pull-back in the BDC sector in this holiday shortened week, and a couple of unexpected developments.

To the BDC Reporter, though, the outlook remains the same.

Back To Business

In the semi-official, Labor Day shortened, first week back after the summer holidays, the BDC sector dropped back a little.

The UBS Exchange Traded Note with the ticker BDCS – which we use to measure the whole group – was off 1.0% to end at $20.79.

Likewise, the Wells Fargo BDC Index was down 1.05%.

The number of BDC stocks up in price, or at least unchanged, numbered just 14, versus 27 last week.

No BDC common stock increased more than 3.0% in price on the week, but three dropped by 3.0% or greater.

Not Giving Up

Still, we’re far from saying the bloom is off this BDC rose.

Other data points we look at – both with short and medium term perspectives – suggest market confidence remains essentially unabated.

For example, we note that there are still 27 stocks trading over their 50 Day Moving Average and 33 over the 200 Day Moving Average.

That’s only slightest below last week’s respective numbers: 28 and 36.

Even more importantly, we note that the number of BDCs trading within 5% of their 52 Week Low is only 3, same as last week.

Likewise, the number of BDC stocks trading within 5% of their 52 Week High is up to 15, from 14 the week before and at a 5:1 ratio to the lowest performing stocks.

Surprise

There were a few unexpected developments during the week, but none had any material impact on the BDCs involved.

The last BDC to report earnings – CM Finance (CMFN) – posted a very high Net Investment Income Per Share, as we reported in the Daily News Table.

However, all that income above what was expected turned out to be due to an unusual booking of dividend income as part of an investment disposition.

This will not be a recurring event and does not presage some major shift in future recurring earnings,

CMFN closed Friday August 31 at $9.20, and closed this week (September 7, 2018) at $9.25 as markets adjusted to the true nature of what had happened.

Zig Zag

A bigger surprise was Hercules Capital’s (HTGC) decision to have its Board approve the new higher leverage standard and seek shareholder approval for the move in a special vote.

That was only a matter of weeks after HTGC boasted of its investment grade debt rating and its intention not to change its leverage profile.

With little fanfare, S&P Global Ratings cut the BDC’s debt rating to below investment grade.

HTGC asked S&P to withdraw its ratings and – badda bing badda boom – another BDC gave up investment grade status for the allure of a much bigger portfolio.

The BDC joins Apollo Investment (AINV) and Goldman Sachs BDC (GSBD) who’ve trodden a similar path.

In and Out

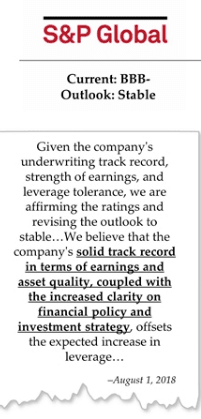

However, in an interesting case of splitting hairs – S&P have left TPG Specialty(TSLX) and Ares Capital (ARCC) with an investment grade rating despite their election to leverage up in a measured way.

The rating group’s argument – at least where ARCC is concerned – was that their prior rating was one notch above the lowest investment grade.

So the downgrade that followed the leverage election – a relatively modest one by some lights – still left ARCC with that investment grade imprimatur.

(Moody’s apparently actually placed ARCC on its Watchlist for a possible upgrade, according to the BDC’s Conference Call transcript).

Here’s what S&P said about TSLX after reviewing the leverage increase:

Back To Hercules

We’ll have to wait till the next time HTGC raises debt capital to see if not having an S&P investment grade rating makes any difference to their cost of capital.

We doubt that in today’s heady atmosphere – and with the promise of a maximum debt to equity of 1.25x – HTGC will suffer too much.

Maybe a 0.25% or 0.50% difference.

For a BDC that can generate yields in the mid-teens that might be a trade-off – in the eyes of management and the Board – worth taking.

We believe shareholders will go along with proposal when the vote comes up on December 6, which could allow HTGC to grow beyond the prior level very shortly, even if management says reaching the new limit is years away.

Meh

The market, though, was underwhelmed by HTGC’s change of heart.

The stock price of the venture-debt BDC was $13.52 at August 31 and closed this week at $13.25.

Maybe the market had already figured out that HTGC was not going to stick with the old asset coverage limit or is not convinced that any meaningful earnings growth will be happening any time soon.

In Other News

Otherwise, there was not much in way of earth shaking news.

Main Street Capital (MAIN) issued press releases about the booking of 2 loans and Capitala Group did the same for one new facility, which may or may not have involved its BDC Capitala Finance (CPTA).

Elsewhere, Barings BDC (BBDC) completed its modified “Dutch Auction” and bought back $50mn of its stock at the lowest price in its pre-determined range: $10.20 a share.

With that out of the way – and we were never clear why a “Dutch Auction” of any kind was required – the stock price jumped up, only to slump back at week’s end to close at $10.34.

Looking Forward

Last week we predicted that the BDC rally would continue in September.

However, we anticipated that there might be short term reversals along the way.

Like any self respecting stock market rally, BDC prices have not moved up in a straight line.

Despite the 1.0% drop in BDCS this week, we continue to believe the most likely direction is up.

Or, at the very least, sideways.

Here’s the chart for BDCS since March 1, 2018 when the current rally – now in its seventh month – first began:

With no earnings to report for many more weeks, there’s no obvious catalyst for higher prices.

On the other hand, there’s also no obvious catalyst for a major pull-back either unless the broader markets go into a tail spin, which they’ve been threatening to do for months.

The proof of the pudding will be in the metrics of the weeks ahead.

We shall keep readers apprised.

Disclosure: I am/we are long ARCC,BBDC,HTGC,GSBD, TSLX,CPTA,BDCS.

.png)