BDC Filing season is in full swing. This report will analyze BDCs that have filed in the last 2 weeks. Last week’s analysis is available here.

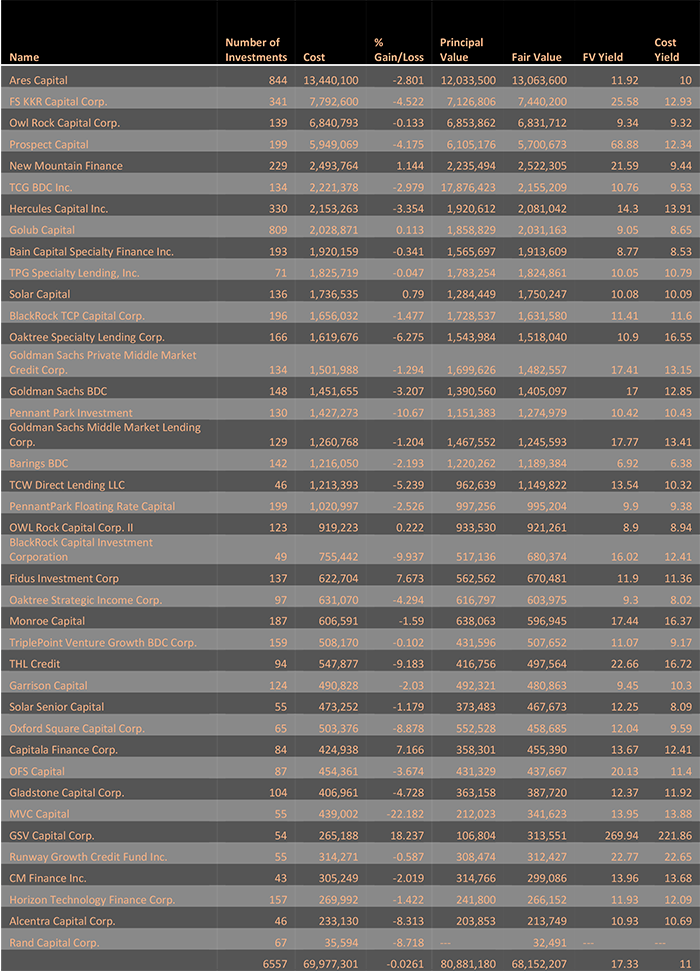

Aggregate Fair Value reported by BDCs that have filed in Q1 2019 is 68.1 Billion USD which is approximately 70% of aggregate AUM of all BDCs. BDCs have reported 48.8 Billion USD AUM in this week alone.

Please contact info@advantagedata.com for BDC Holdings Data.

Please contact info@advantagedata.com for BDC Holdings Data.

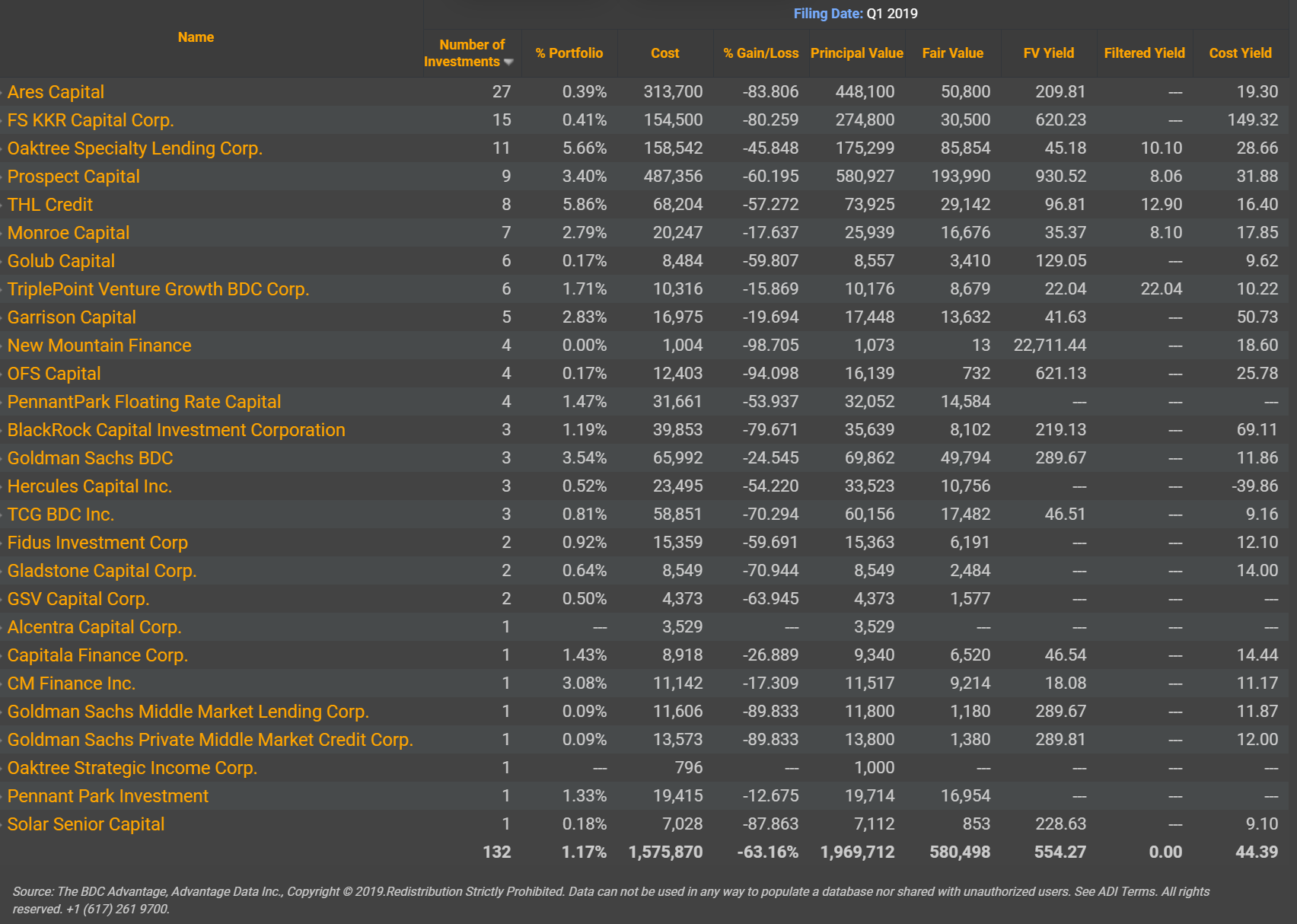

Non-Accruals

Out of 40 BDC’s that have filed so far, 27 BDC’s have reported at least one Non–Accrual in their portfolio. Aggregate Non-Accruals so far amounts to 1.575 Billion USD in Cost. Fair Value of these Non-Accruals are reported at a significant Mark Down of 580.4 Million USD.

Ares, FS KKR and Oaktree Specialty Lending Corp. are leading the Non-Accruals list. Compared to Q4 2018, Ares has reported 5 more Non-Accruals while FS KKR and Oaktree Specialty Lending Corp. have not reported any new Non-Accruals in Q1 2019.

Below Table summarizes Top 20 Portfolio Companies by Cost that are in Non-Accrual.

Please contact info@advantagedata.com for a complete list of Portfolio Companies that are in Non-Accrual.

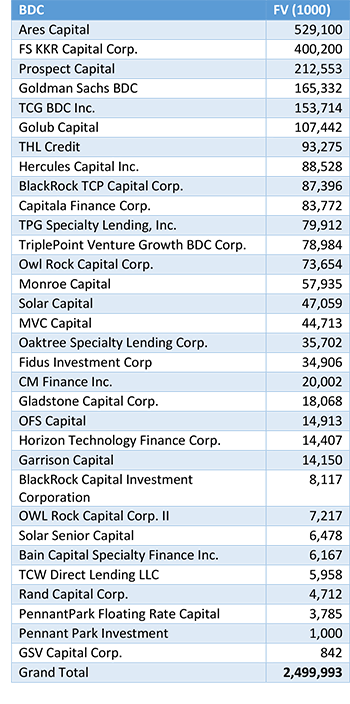

BDCs Investments Maturing in the next 12 Months

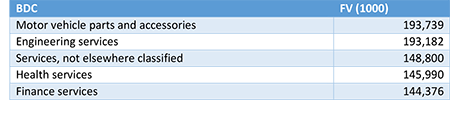

In the next 12 months, the aforementioned BDC’s will have Investments worth 2.5 Billion USD in Fair Value maturating. Below table summarizes aggregate Investments by Fair Value of BDCs in portfolio companies that are maturing in the next 12 months. Below Table summarizes Top 5 Industries by Fair Value where Investments of BDCs in portfolio companies are maturing in the next 12 months.

Below Table summarizes Top 5 Industries by Fair Value where Investments of BDCs in portfolio companies are maturing in the next 12 months.

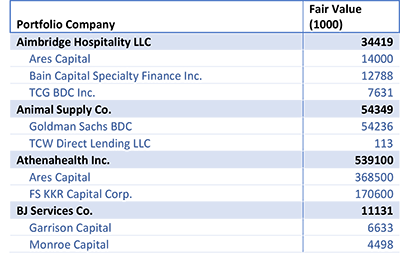

BDC Co-Invested Deal

Based on BDC’s filing as of Q1 2019, there are 30 New Investments originated where BDC’s have worked with each other.

Below Table summarizes four such selected investments where BDC’s have worked with each other.

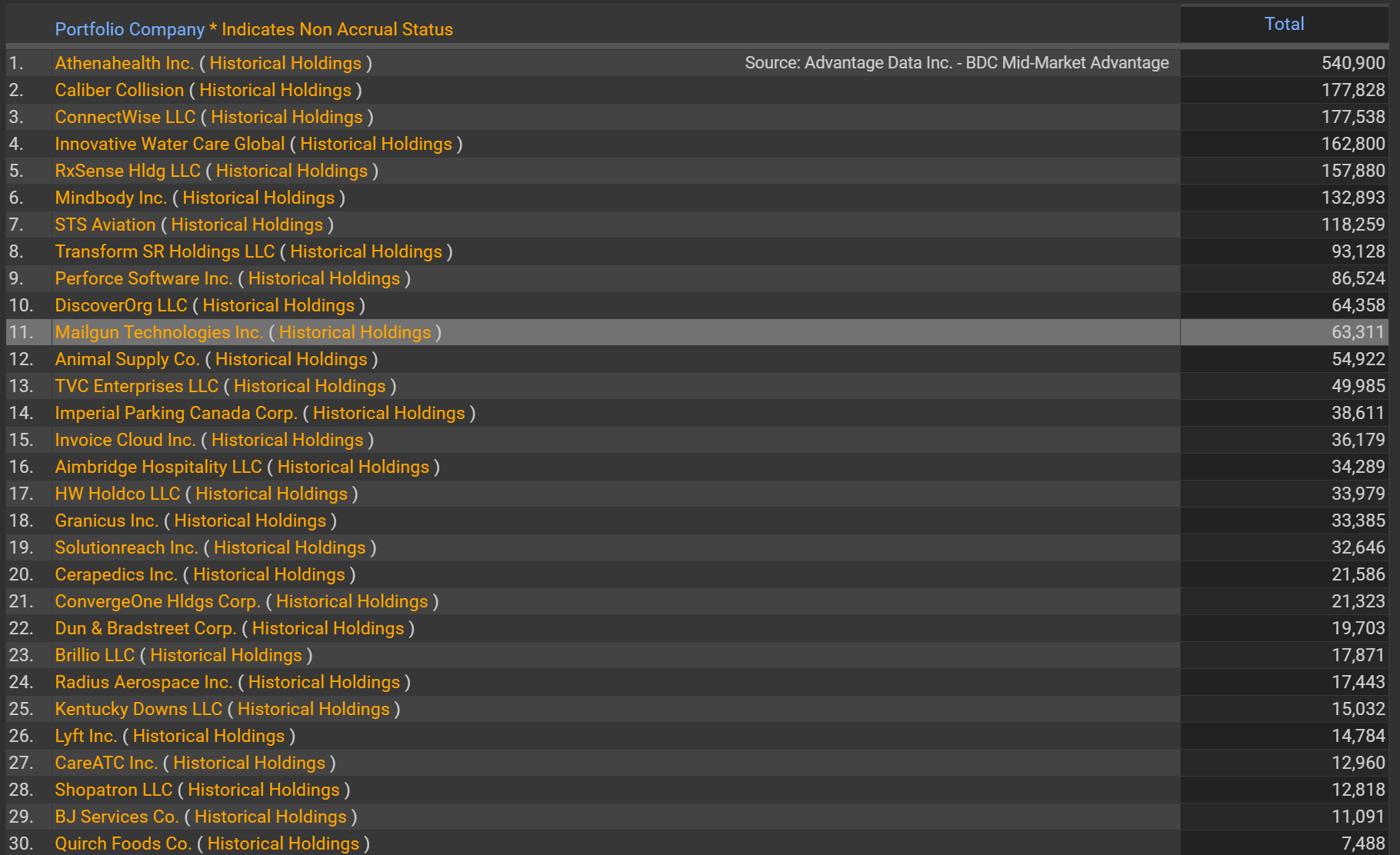

Top 10 BDC Investments

Top 10 Investments of BDCs that have filed in Q1 2019 amount to 22.5 Billion USD accounting to 33% of their aggregate holdings. Click the button below to download the data!

.png)