The Week Of Nothing Much

We’ve been writing these Market Recaps for more weeks than a shark has teeth and we’re hard pressed to remember 5 consecutive days as uneventful as these have been.

As the BDC Reporter has been saying in the preamble of our articles of late, there is very little new to report.

We counted just 4 stories on our Daily News Table and one Stock Watch alert (as OFS hit a new 52 Week Low) during the week. The week before ? 18 different items.

The same applies to BDC common stock prices, which barely shifted over this, admittedly brief, period between January 19 and 26.

Only 1 stock was up or down more than 3% on the week (our traditional standard for notice). That was TCAP up 4.5% on higher hopes.

Our usual measuring stick – the sector focused UBS Exchange Traded Note with the ticker BDCS– closed at $20.40, just two cents down from last week.

There were 10 BDCs trading above their 200 Day Moving Average versus 8 last week.

Last week we reported from our own records that 27 BDCs were trading within 0%-10% of their 52 Week Lows. This week the number is just 1 BDC lower: 26.

The number of BDCs within 5% of their 52 Week Highs remains unchanged at 4.

You get the idea.

Nothing Stays The Same

Of course, that’s all about to change.

The IVQ 2017 BDC Earnings Season will shortly be upon us in six business days, starting on February 5, 2018, with at least 8 BDCs scheduled to publish and discuss their results in the week.

Doubt

There are several BDCs reporting in Week One of Earnings Season that we have “dividend sustainability ” doubts about in 2018.

The first three most intriguing BDC earnings releases – where there is the most uncertainty about the outcome – are MCC, AINV and CMFN.

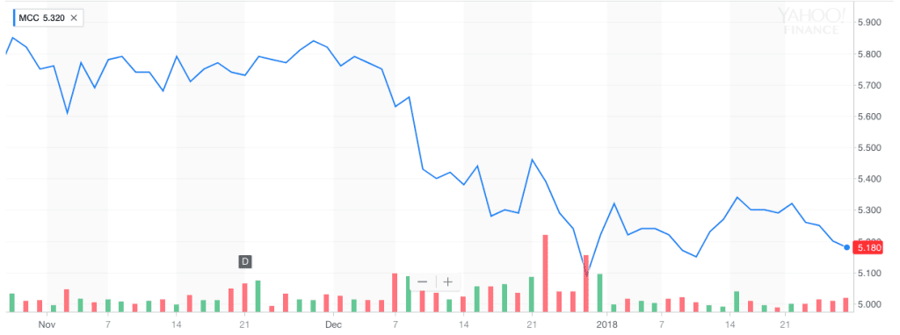

MCC Down

As this chart shows MCC has dropped about (10%) in price in the past 3 months, although its distribution has remained unchanged at $0.16 for 3 quarters.

The BDC Reporter expects a DECREASE in the payout in 2018, but not necessarily this quarter.

AINV Not So Much

AINV, by contrast, is down just (2%) in the last months as many investors believe the worst is over and the BDC will be able to maintain its 6 quarters of a $0.15 distribution.

We are less sanguine – especially if the Investment Advisor stops waiving a portion of its fees at some point in the year. Our rating remains for AINV’s distribution AT RISK, but we don’t expect anything to be decided this quarter.

CMFN Heads Higher

Finally CMFN is only down modestly over the past 3 months and has actually been moved up 10% in price since late December 2017.

The markets are increasingly encouraged that CMFN can add more quarters of a $0.25 dividend, with 4 already in the rear view mirror.

There has not been much in the way of insider purchases to support that view – just one 1,000 share purchase by the CFO. Nonetheless, CMFN’s Investment Advisor worked hard to get shareholders to approve the BDC’s right to sell shares below book.

Which the shareholders agreed to.

That’s made the BDC Reporter nervous.

In any case, our rating for CMFN is for a DECREASE in 2018.

Investors may be telling themselves that with CMFN already trading at a (31%) discount to book, and just 8.6x the current distribution level, a dividend drop is baked in.

We’ll refrain from comment as there is only one – unfortunate – way to find out.

Coming Up

Thus – in a nutshell – what lies ahead is likely to bring us much in way of news and price changes as markets reassess.

Next week we might get some last minute BDC price changes as investors pile on or pull off their chips or we could have another week of the Quiet Before The Storm.

BDC FIXED INCOME

Not So Great

The BDC Fixed Income Sector – as we warned last week – is not faring so well in 2018.

The median price of the now 35 public issues we track has dropped to $25.36.

That’s off from $25.46 last week and $25.51 in the very different rate expectation atmosphere of last year at this time.

Compared to last year that’s (0.6%) off. Not in itself a huge number but in a sector where average yields are just over 6.0% noteworthy.

We don’t ascribe the shift to BDC credit concerns but to arrival of higher interest rates and the fear of inflation.

Only 1 BDC Fixed Income issue closed the week trading above $26.00 and 5 are trading below par.

Of the latter the tickers are GECCM (more on that newcomer below), CPTAL,CPTAG, OCSLL and OSLE.

The long awaited erosion of BDC Fixed Income prices is here.

Last Minute News

At the close on Friday MCC announced the raising of $121mn from issuing 2024 Unsecured Notes on the Tel Aviv Stock Exchange.

We’ll have a full article about the subject next week as we had a comprehensive chat with the underwriter just hours before the announcement.

This is Good News for MCC but Bad News for existing holders of the BDC’s existing Baby Bond with the ticker MCV, which is likely to be redeemed.

In this case, the BDC Reporter seems to have been right to rate the risk of early redemption at MCV as High. The debt traded at $25.08 at Friday’s close.

Also Bad News for BDC Fixed Income investors: U.S. investors cannot access the new MCC Notes because of their foreign location and because they are targeted principally at institutional investors.

Easy Come. Easy Go.

Ironically, this was the week that we formally added a 35th issue to the BDC Fixed Income: GECC’s second Baby Bond with the ticker GECCM.

The issue first came to market a few weeks ago but is now has a ticker and can be tracked on your favorite financial site.

However, if MCV does get redeemed – we’re still waiting on a formal notification – and with HTGX on its way out the door as well, the number of publicly traded Fixed Income issues could shortly drop to 33.

With new Fixed Income issues increasingly either being placed with institutional investors or in Israel (PFLT was the pioneer in this area) the risk of the supply of publicly traded Baby Bonds drying up increases.

Thinking Positively

The Good News for existing holders of the remaining BDC Fixed Income issues is that an ever increasing shortage of investments may hold up prices in the future.

Further down the road in 2018, if the government relaxes the rules for BDC leverage issuers may come stampeding back to U.S. investors with a plethora of new offerings.

However, the risk factor will increase but that’s a story for another time.

By Nicholas Marshi, BDC Reporter

.png)