JUNK BONDS FLUCTUATED HIGHER in overall price gains linked to trades, outpacing investment-grade debt on the European trading front. A strong showing by Europe's carmakers was a major element in today's market dynamic, as Volkswagen AG shares jumped 3.1%, Fiat Chrysler NV was up 1.6%, and Renault SA added 1.3%, as of 3:30 PM, London time. Today's rebound in risk assets, on the heels of the worst run of sell-offs since October of '16, was fed also by upbeat data from heavyweight conglomerate Bouygues SA, 3i Group PLC, and British Land Co. PLC. Nymex oil prices stabilized around $55.30, supporting a rebound in the oil-and-energy sector as the view grew that U.S. shale producers will be more disciplined, going forward.

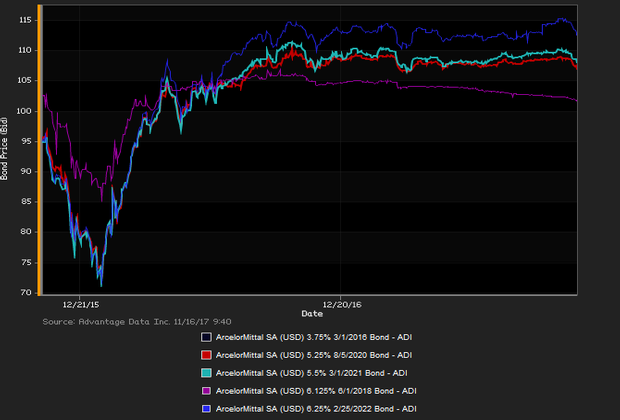

Risk-off trades eased notably in Europe's bourses and bond-trading centers, as the pan-European Stoxx 600 equities index posted a 0.80% gain. Strength in earlier Asian markets, notable upbeat data in Europe's carmaker sector (see notes above), and a leveling off of crude-oil's slide earlier in the week, all factored into a rebound from yesterday's acute defensive tone. Commodities fared better overall as well, amid news that China's central bank has injected cash into its economic structure, offsetting concerns about a slowdown in global demand for minerals and other building materials. That news helped European mining firms take back a modest layer of recent losses, as BHP Billiton Ltd. and Glencore PLCshares fluctuated to the shallow green. Sector cues for corporate-bond traders were also given by gains in BNP Paribas SA, Genmab A/S and Wirecard AG shares, while Sodexo SA, GKN PLC, and Electrolux AB pulled back. ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for high-yield versus high-grade constituents. High-yield bonds edged out high-grade debtin net prices, as of 4 PM London time. Among European high-yield bonds showing a concurrence of top price gains at appreciable volumes, Intelsat Jackson Holdings SA 7.25% 10/15/2020 made some analysts' 'Conviction Buy' lists. (See chart for ArcelorMittal bonds, above.)

.png)