European stocks bounced back from 6 month lows on Wednesday, seeing levels rise after a downturn on Tuesday due to political risk in Asia. The FTSE 100 and Stoxx Europe 600 saw gains of 0.51% and 0.78% after investors fled to safe havens like bonds, yen, and gold on Tuesday. Meanwhile, the Euro saw a loss of -.54295% against the dollar due to strong jobs and GDP growth data out of the US.

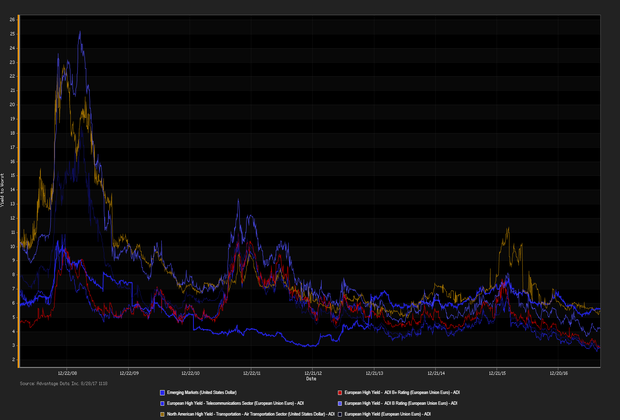

European stocks rallied on Wednesday after dropping Tuesday as a direct result of a North Korean missile flying over Japan. Investor sentiment towards instability in Asia has since cooled, but remains a major component in fluctuating world economies. The deliberate response by world leaders, including US President Donald Trump, eased tensions amongst market analysts worried over proliferation between the parties. ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for high-yield versus investment-grade constituents. High-yield bonds outpaced investment-grade debt in net prices linked to trades, as of 4 PM, London time. Among European high-yield bonds showing a concurrence of top price gains at appreciable volumes traded, Bahia SUL Hldgs Gmbh (USD) 5.75% 7/14/2026 made some analysts' 'Conviction Buy' lists. (See chart for France Telecom bonds, next page.)

.png)