Horizon Technology Finance Corporation announced 5 new loans originated in Q3 ending on September 30th, 2017, adding $40 million of new loan commitments:

Sean Riddell

Recent Posts

Horizon Technology Finance Corp Q3 Investment Portfolio Update

Posted by

Sean Riddell on Oct 12, 2017 4:07:47 PM

0 Comments Click here to read/write comments

Topics: BDC, 8-K, Horizon Technology Finance Corporation

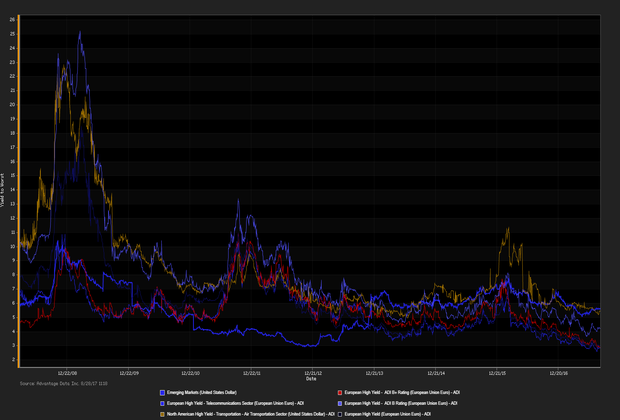

EUROPEAN JUNK BONDS INCHED UP

in price overall, paralleling an upside fluctuation in stocks of Europe's bourses. The

higher-yielding securities edged out less-risky investment-grade debt

on the heels of yesterday's statements from Federal Reserve Chief Janet Yellen. The

Fed's intention to commence winding down its $4.5 trillion balance sheet, along with its underpinning of

raised expectations of a December rate hike, set the stage for upside moves in European financials today.

Deutsche Bank AG

shares gained 2.9%,

Societe Generale

added 2.2%, while M&A (Mergers & Acquisitions) news sent

Commerzbank AG

up 3.5%, as of

3:40 PM, London time.

0 Comments Click here to read/write comments

BIDS FOR RISK WERE EXTENDED

from yesterday's session, with European junk bonds easily outpacing investment-grade debt in net prices.

Financials and mainstream insurance securities came on strong

in the afterglow of yesterday's run-up in prices, as high-yield bonds paralleled advances in equities. Shares of

Deutsche Bank AG

added 3.1%,

Commerzbank AG, 2.7%, as the

Stoxx Europe 600 Bank Index

tacked on another 1.6% gain to yesterday's 1% advance.

The automaker sector was also of special note, as

Volkswagen AG shares added 1.2%,

Peugeot SA was up 3.8%.

0 Comments Click here to read/write comments

RISK-OFF SENTIMENT NOTCHED LOWER

among investors in European corporate debt. Relative to yesterday's levels of risk aversion, trades in corporate bonds reflected a

very slight favor for junk bonds in price gains linked to actual trades. Nonetheless

geopolitical overhang amid N. Korean nuclear warhead posturing

kept a lid on gains in risk assets. So too did

pressure on the European insurance sector ahead of projected damage by intense hurricane

Irma, headed for Puerto Rico and Florida. The

Stoxx 600 index vacillated in the shallow red amid data showing a dip in Germany's manufactured-goods orders, although shares of

Deutsche Bank AG

and

Micro Focus International PLC

posted notable gains.

0 Comments Click here to read/write comments

Topics: bonds, CDS, New Issues

European stocks

bounced back from

6 month lows

on Wednesday, seeing levels rise after a downturn

on Tuesday

due to

political risk in Asia. The

FTSE 100 and Stoxx Europe 600 saw gains of 0.51% and 0.78% after investors

fled to safe havens

like bonds, yen, and gold

on Tuesday. Meanwhile, the

Euro saw a loss of -.54295% against the dollar due to

strong jobs and GDP growth data

out of the US.

0 Comments Click here to read/write comments

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)