MOSTLY SIDEWAYS TRENDING, BUT WITH A SLIGHT UPSIDE SLOPE, bids for European high-yield corporate bonds edged out investment-grade securities. Nonetheless an extended push-pull mode kept overall price moves channeled in fairly tight bands, resembling much of yesterday's market dynamic. U.K. inflation touching the highest level in about five years served to push the British FTSE and some Stoxx 600 equities and junk debt higher. However Germany's ZEW data pointed to disappointing German economic confidence, coming in at 17.6 versus 20.4 expected, pulling some upside moves back, in mean reversion. Spanish banks remained pressured amid acute political risk linked to a Catalonian bid for independence, exemplified by pullbacks in CaixaBank SA shares.

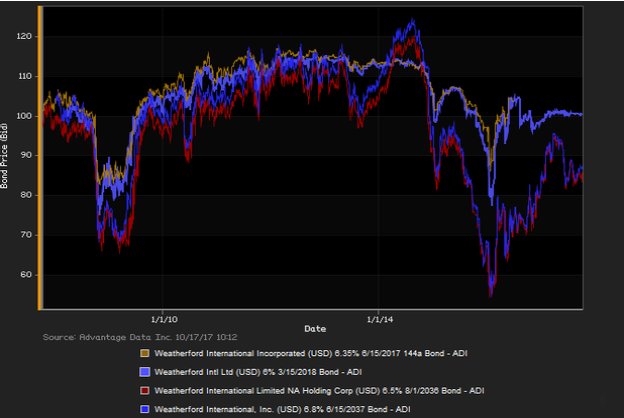

An overall wait-and-see mode kept prices collimated in fairly thin bands for many European corporate bonds. The market dynamic carried elements of the previous session, although with a fresh array of market forces in push-pull countering moves. As cited above, a jump in U.K. inflation countered the effect of disappointing ZEW confidence out of Germany. As pricing power (inflation) touched the highest levels in about 5 1/2 years, BOE governor Mark Carney indicated the Bank of England may be very near implementing a lending-rate increase: "... having seen some evidence of building domestic pressures, the judgment of the majority of the committee is some raise in interest rates over the coming months may be appropriate." Meanwhile early oil prices continued to hover around $52, supporting some gains in the oil-and gas group, countering to a degree the risk-off bias attending continued political risk amid Catalonians' push for independence from Spain. High-yield bonds edged out investment-grade debtin net prices, as of 4 PM, London time. Among European high-yield bonds showing a concurrence of top price gains at appreciable volumes traded, Deutsche Bank AG 4.5% 4/1/2025 made some analysts' 'Conviction Buy' lists. (See the chart for Weatherford International bonds, above.) M. F. Brown

.png)