BIDS FOR RISK WERE EXTENDED from yesterday's session, with European junk bonds easily outpacing investment-grade debt in net prices. Financials and mainstream insurance securities came on strong in the afterglow of yesterday's run-up in prices, as high-yield bonds paralleled advances in equities. Shares of Deutsche Bank AG added 3.1%, Commerzbank AG, 2.7%, as the Stoxx Europe 600 Bank Index tacked on another 1.6% gain to yesterday's 1% advance. The automaker sector was also of special note, as Volkswagen AG shares added 1.2%, Peugeot SA was up 3.8%.

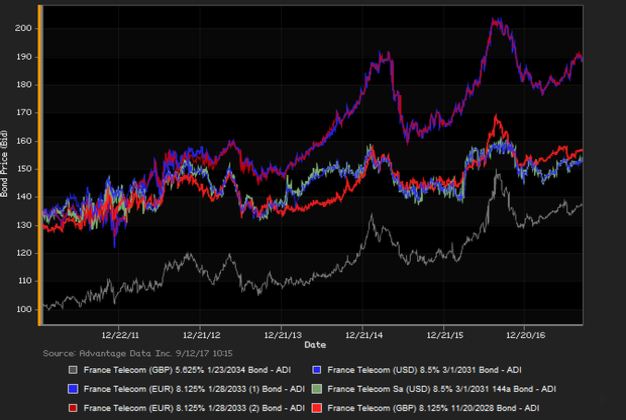

Risk-on sentiment remained in force as investment-grade bonds stayed pressured along with other safe-haven assets, including gold and U.S. Treasuries. Multiple factors continued to support risk-taking among investors in European high-yield bonds, in the afterglow of ramped-down concerns about U.S. hurricane damage and Korean war rhetoric. ING analysts wrote of Europe's 'relief rally' in stocks, "... Whether that equity reaction is Panglossian complacency or a sign of wonderful underlying fundamentals remains open to question ... even Category 5 storms can now be added to the list of things that ‘Don’t Really Matter' ." In addition to run-ups in the banking sector (see above paragraph), bonds of a spectrum of insurance firms extended gains along with equities, as shares of Swiss Re AG, AXA SA, and Beazley PLC all stepped higher. Corporate-bond traders in Europe also took sector cues from gains in shares of Ashtead Group PLC, Novartis AG, Volkswagen AG, and Peugeot SA. ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for investment-grade versus high-yield constituents. High-yield bonds outpaced investment-grade debt in net prices linked to trades, as of 4 PMLondon time. Among European high-yield bonds showing a concurrence of topmost price gains at appreciable volumes, EDP Finance BV 6% 2/2/2018 made some analysts' 'Conviction Buy' lists. (See chart for France Telecom bonds, above.)

.png)