.png?width=620&name=unnamed%20(96).png)

BREXIT DELAY PUTS BANKERS AT EASE FOR THE TIME BEING allowing the Bank of England to focus on the condition of the economy rather than fearing the worst with Brexit. George Buckley an economist at Nomura economist predicts a rate hike in November, “While we see the need to raise interest rates slowly ... the Bank of England is likely to sit on its hands until more clarity on the Brexit outcome is received”. The European Union announced they accepted an offer by Visa and MasterCard trimming fees related to payments made on cards outside the bloc. Businesses ultimately carry the cost of the transaction. “This, together with our January 2019 decision on Mastercard’s cross-border card payment services, will lead to lower prices for European retailers to do business, ultimately to the benefit of all consumers”. ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for high-grade versus high-yield constituents. High-

Sovereign-Debt Snapshot

| Country | Maturity (Y) | Yield (%) | Previous (%) | Spread (bp) | |

|---|---|---|---|---|---|

| Australia | 10 | 1.788 | 1.796 | -71.7 | |

| Belgium | 10 | 0.449 | 0.469 | -205.6 | |

| France | 10 | 0.354 | 0.371 | -215.1 | |

| Germany | 10 | -0.018 | -0.006 | -252.3 | |

| Italy | 10 | 2.583 | 2.695 | 7.8 | |

| Japan | 10 | -0.047 | -0.029 | -255.2 | |

| Netherlands | 10 | 0.165 | 0.176 | -234.0 | |

| Portugal | 10 | 1.128 | 1.186 | -137.7 | |

| Spain | 10 | 1.032 | 1.092 | -147.3 | |

| Sweden | 10 | 0.127 | 0.157 | -237.8 | |

| U.K. | 10 | 1.145 | 1.157 | -136.0 | |

| U.S. | 10 | 2.505 | 2.536 | ... | |

Credit-Default Swap Market

New Issuance

| New Issues | New Issues [Continued] |

|---|---|

|

1. ACS Actividades de Construccion y Servicios SA (EUR) FLT% 6/28/2023 (04/29/2019): 50MM Senior Unsecured Notes, Price at Issuance 100. 2. Cie De St-Gobain (EUR) 1.875% 5/3/2035 (04/29/2019): 100MM Senior Unsecured Notes. |

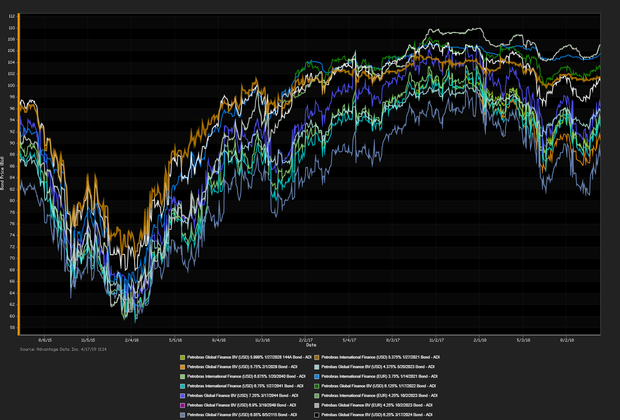

ADI Indexes

.png?width=620&name=unnamed%20(98).png)

| iShares Core EUR UCITS | iShares Euro High Yield UCITS |

| NAV as of 04/29/2019, 132.01 | NAV as of 04/29/2019, 104.35 |

| Daily NAV Change (%) -0.02% | Daily NAV Change (%) -0.02% |

OVERALL EUROPEAN CREDIT MARKET:

The euro-zone economy shows signs of positive momentum, although conditions are expected to deteriorate hindered by the termination of quantitative easing, weakening credit rating quality, and uncertainty regarding the outcome of Brexit. Closely watched indicators and rates:

- Eurostat's unemployment rate: currently 7.8% (seasonally adjusted, February 2019)

- Eurostat's quarterly GDP: 0.2% (2018 Q3 Final)

- 6-month Euribor: current value -0.229%, as of 04/26/2019

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)