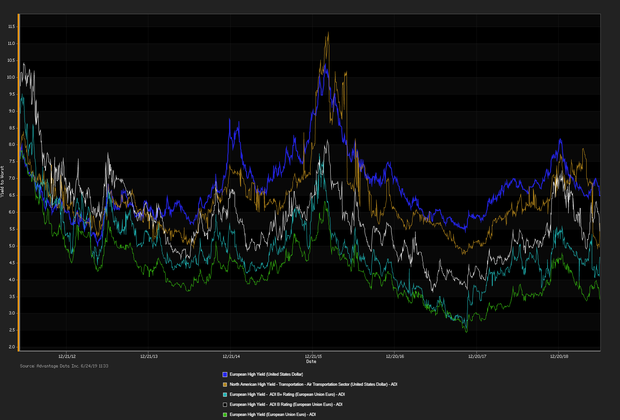

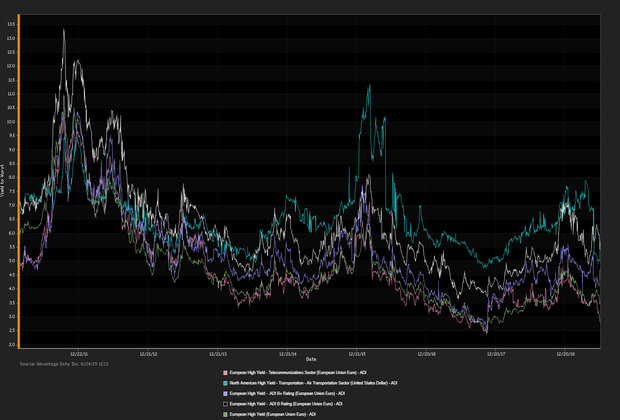

BRITAIN’S ECONOMY IS FEELING THE PRESSURE of a slowing global economy and domestically Brexit uncertainties. Economists estimate the economy contracted by 0.2 percent in the span of April to June meanwhile the Bank of England reduced its forecast to zero for the second quarter. Euro zone factory activity continued to shrink in June and May’s data was revised lower, contracting for the fifth month this year. “Euro zone manufacturing remained stuck firmly in a steep downturn in June, continuing to contract at one of the steepest rates seen for over six years” ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for high-yield versus high-grade constituents. High-

Credit-Default Swap Market

New Issuance

| New Issues | New Issues [Continued] |

|---|---|

|

1. Banque Fed du Credit Mutuel (EUR) 0.125% 2/5/2024 (07/01/2019): 1000MM Senior Unsecured Notes. 2. Bank Julius Baer (Gg) (AUD) 1.01% 10/1/2019 (07/01/2019): 96MM Senior Unsecured Notes, Price at Issuance 100, Yielding 1.01%. |

|

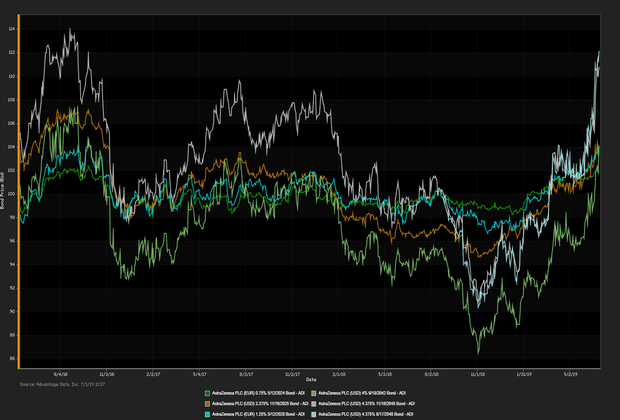

ADI Indexes

| iShares Core EUR UCITS | iShares Euro High Yield UCITS |

| NAV as of 07/01/2019, 134.29 | NAV as of 07/01/2019, 105.32 |

| Daily NAV Change (%) +0.28% | Daily NAV Change (%) +0.22% |

OVERALL EUROPEAN CREDIT MARKET:

The euro-zone economy shows signs of positive momentum, although conditions are expected to deteriorate hindered by the termination of quantitative easing, weakening credit rating quality, and uncertainty regarding the outcome of Brexit. Closely watched indicators and rates:

- Eurostat's unemployment rate: currently 7.7% (seasonally adjusted, March 2019)

- Eurostat's quarterly GDP: 0.4% (2019 Q1)

- 6-month Euribor: current value -0.311%, as of 06/28/2019

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)