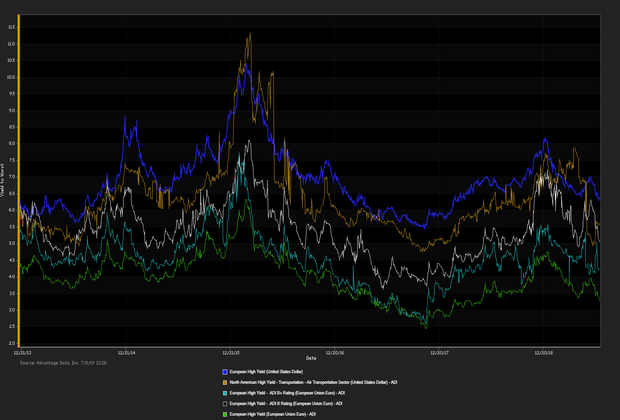

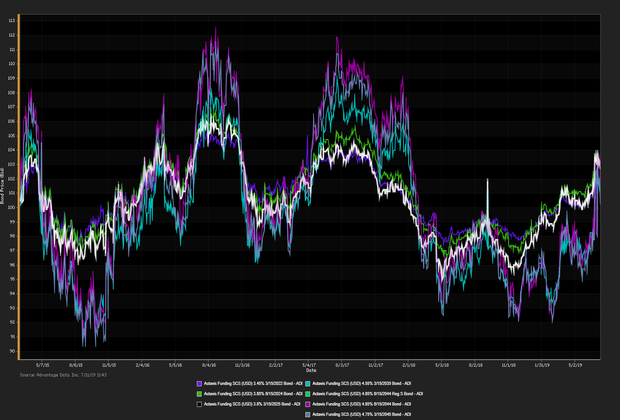

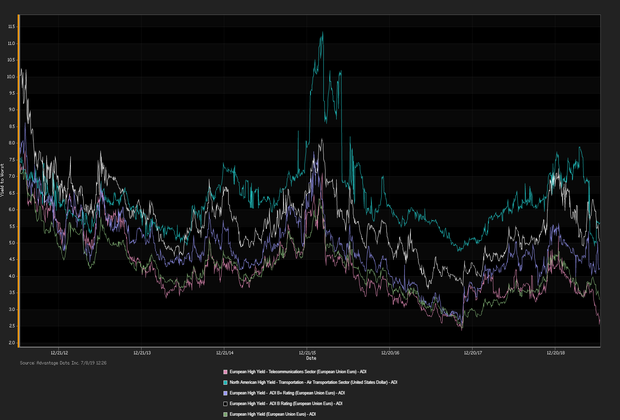

EUROPEAN SHARES INITIALLY RISE following dovish remarks from the US Federal Reserve suggesting a rate cut later this month. The Bank of England announced British banks are prepared for a no-deal Brexit holding enough capital to weather the storm but expect significant economic turmoil. “In a disorderly Brexit, a range of UK asset prices would be expected to adjust sharply, tightening financial conditions for UK households and businesses.” France approves a 3 percent tax targeting French revenues from technology giants including Google, Amazon, and Facebook. The tax is estimated to generate upwards of 750 million euros from thirty companies globally. ADI (Advantage Data Inc.). Extensive corporate-bond index data showed a net daily yield increment for high-grade versus high-yield constituents. High-grade bonds edged out high-yield debt as of 3 PM, London time. Among European high-grade bonds showing a concurrence of top price gains at appreciable volumes traded, Actavis Funding SCS (USD) 3.45% 3/15/2022 made some analysts' 'Conviction Buy' lists. (See the chart for Actavis Funding SCS below). Corey Mahoney (cmahoney@

Credit-Default Swap Market

New Issuance

| New Issues | New Issues [Continued] |

|---|---|

|

1. Westlake Chemical Corp. (EUR) 1.625% 7/17/2029 (07/10/2019):700MM Senior Unsecured Notes, Price at Issuance 99.498, Yielding 1.68%. 2. Banco de Sabadell SA (EUR) 0.875% 7/22/2025 Reg S (07/10/2019): 1000MM Senior Preferred Security, Price at Issuance 99.826, Yielding .905%. |

|

ADI Indexes

| iShares Core EUR UCITS | iShares Euro High Yield UCITS |

| NAV as of 07/11/2019, 133.46 | NAV as of 07/11/2019, 105.42 |

| Daily NAV Change (-0.02%) | Daily NAV Change (%) +0.02% |

OVERALL EUROPEAN CREDIT MARKET:

The euro-zone economy shows signs of positive momentum, although conditions are expected to deteriorate hindered by the termination of quantitative easing, weakening credit rating quality, and uncertainty regarding the outcome of Brexit. Closely watched indicators and rates:

- Eurostat's unemployment rate: currently 7.5% (seasonally adjusted, May2019)

- Eurostat's quarterly GDP: 0.4% (2019 Q1)

- 6-month Euribor: current value -0.329%, as of 07/10/2019

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)