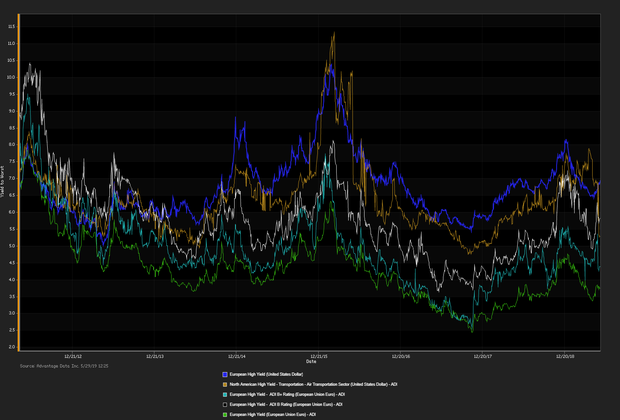

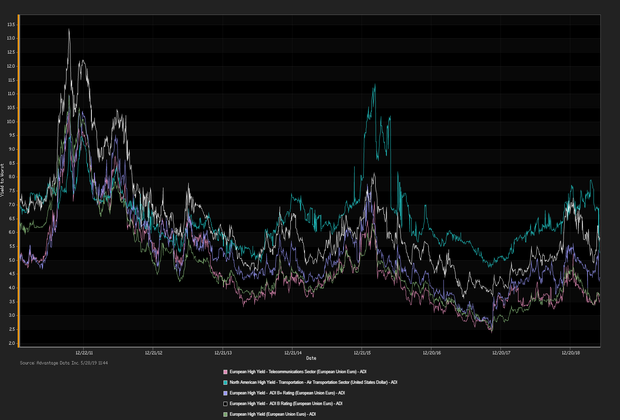

BRITAIN’S ECONOMY CONTRACTED FOR THE SECOND STRAIGHT MONTH on a significant decline in car production. GDP dipped 0.4 percent in the month of April as automotive production slipped 2.7 percent month-over-month. Rob Kent-Smith, head of GDP at the government statistic agency blames softening orders on Brexit stockpiling, “There was also widespread weakness across manufacturing in April, as the boost from the early completion of orders ahead of the UK’s original EU departure date has faded”. The slowdown is a result of businesses stockpiling goods in the first quarter, the economy should pick up in the third quarter as companies return to normal buying schedules. Surprisingly, the labor market has strengthened in a result of strong wage growth maintaining an unemployment rate near 50-year lows. ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for high-grade versus high-yield constituents. High-

Sovereign-Debt Snapshot

| Country | Maturity (Y) | Yield (%) | Previous (%) | Spread (bp) | |

|---|---|---|---|---|---|

| Australia | 10 | 1.482 | 1.479 | -60.1 | |

| Belgium | 10 | 0.155 | 0.191 | -192.7 | |

| France | 10 | 0.082 | 0.122 | -200.0 | |

| Germany | 10 | -0.254 | -0.237 | -233.6 | |

| Italy | 10 | 2.350 | 2.486 | 26.8 | |

| Japan | 10 | -0.115 | -0.121 | -219.7 | |

| Netherlands | 10 | -0.092 | -0.057 | -217.4 | |

| Portugal | 10 | 0.618 | 0.669 | -146.4 | |

| Spain | 10 | 0.551 | 0.612 | -153.1 | |

| Sweden | 10 | -0.081 | -0.049 | -216.3 | |

| U.K. | 10 | 0.817 | 0.827 | -126.5 | |

| U.S. | 10 | 2.082 | 2.120 | ... | |

Credit-Default Swap Market

New Issuance

| New Issues | New Issues [Continued] |

|---|---|

|

1. Cooperatieve Rabobank UA (NL) (USD) 1.88% 6/18/2024 (06/10/2019): 185MM Senior Unsecured Notes, Price at Issuance 100, Yielding 1.88%. 2. JP Morgan Chase Bank NA (USD) 0% 6/20/2049 (06/10/2019):70MM Senior Unsecured Notes, Price at Issuance 100, Yielding 0%. |

ADI Indexes

| iShares Core EUR UCITS | iShares Euro High Yield UCITS |

| NAV as of 06/10/2019, 132.6 | NAV as of 06/10/2019, 103.81 |

| Daily NAV Change (%) +0.05% | Daily NAV Change (%) +0.25% |

OVERALL EUROPEAN CREDIT MARKET:

The euro-zone economy shows signs of positive momentum, although conditions are expected to deteriorate hindered by the termination of quantitative easing, weakening credit rating quality, and uncertainty regarding the outcome of Brexit. Closely watched indicators and rates:

- Eurostat's unemployment rate: currently 7.7% (seasonally adjusted, March 2019)

- Eurostat's quarterly GDP: 0.4% (2019 Q1)

- 6-month Euribor: current value -0.256%, as of 06/07/2019

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)