.png?width=620&name=unnamed%20(96).png)

U.K. MANUFACTURING DECLINED to a two-month low of 53.1 in April compared to 55.1 in March; analysts expected PMI to come in at 53. “The upturn in the UK manufacturing sector eased at the start of the second quarter…There were also reports of overseas clients acting now to re-route their supply chains away from the UK in advance of Brexit.” The collateral damage associated with Brexit is becoming evident and as uncertainties persist businesses will continue to mitigate risk. U.K. house prices ticked 0.4 percent higher in April an increase from the 0.2 percent rise in March. It appears buyers are braving uncertainties related to Brexit aided by the lowest interest rates in more than 40 years. ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for high-grade versus high-yield constituents. High-

Sovereign-Debt Snapshot

| Country | Maturity (Y) | Yield (%) | Previous (%) | Spread (bp) | |

|---|---|---|---|---|---|

| Australia | 10 | 1.799 | 1.800 | -70.5 | |

| Belgium | 10 | 0.446 | 0.457 | -205.8 | |

| France | 10 | 0.368 | 0.364 | -213.6 | |

| Germany | 10 | 0.016 | 0.007 | -248.8 | |

| Italy | 10 | 2.566 | 2.582 | 6.2 | |

| Japan | 10 | -0.029 | -0.029 | -253.3 | |

| Netherlands | 10 | 0.190 | 0.181 | -231.4 | |

| Portugal | 10 | 1.113 | 1.124 | -139.1 | |

| Spain | 10 | 1.005 | 1.010 | -149.9 | |

| Sweden | 10 | 0.162 | 0.147 | -234.2 | |

| U.K. | 10 | 1.188 | 1.159 | -131.6 | |

| U.S. | 10 | 2.504 | 2.527 | ... | |

Credit-Default Swap Market

New Issuance

| New Issues | New Issues [Continued] |

|---|---|

|

1. Bank of America Corp. (EUR) 0.808% 5/9/2026 (04/30/2019):1250MM Senior Unsecured Notes. 2. Guardian Life Global Funding (USD) 2.9% 5/6/2024 Reg S (04/30/2019): 300MM Secured Notes, Price at Issuance 99.894, Yielding 2.92%. |

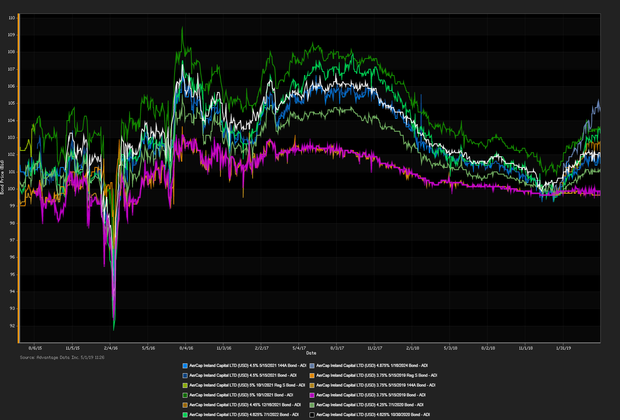

ADI Indexes

.png?width=620&name=unnamed%20(98).png)

| iShares Core EUR UCITS | iShares Euro High Yield UCITS |

| NAV as of 05/01/2019, 132.11 | NAV as of 05/01/2019, 104.25 |

| Daily NAV Change (%) +0.08% | Daily NAV Change (%) -0.08% |

OVERALL EUROPEAN CREDIT MARKET:

The euro-zone economy shows signs of positive momentum, although conditions are expected to deteriorate hindered by the termination of quantitative easing, weakening credit rating quality, and uncertainty regarding the outcome of Brexit. Closely watched indicators and rates:

- Eurostat's unemployment rate: currently 7.7% (seasonally adjusted, March 2019)

- Eurostat's quarterly GDP: 0.4% (2019 Q1 Preliminary)

- 6-month Euribor: current value -0.231%, as of 04/30/2019

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)