EUROPEAN INVESTMENT GRADE DEBT ROSE AGAINST its high yield counterparts in net prices linked to actual trades. German consumer confidence slipped in August to 135.1 from 135.8 marking the lowest reading in six-and-a-half years as economic expectations in the country are suffering “significant losses”. FTSE 100 +0.12%, German DAX -0.78%, CAC 40 -0.75%, STOXX Europe 600 -0.58%. The 10-year Gilt lost 4.7 basis points.

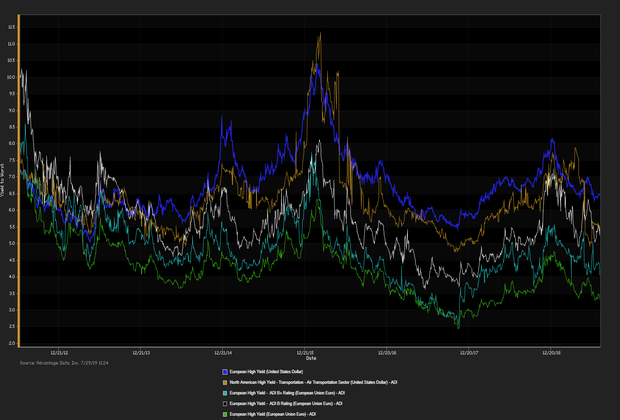

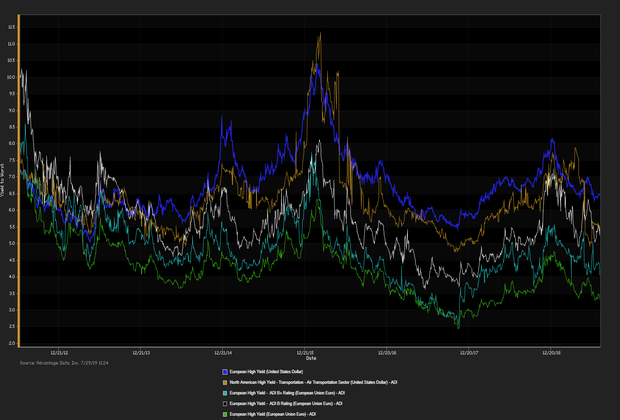

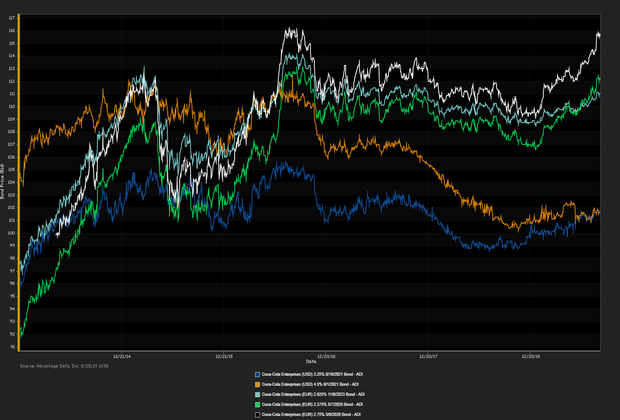

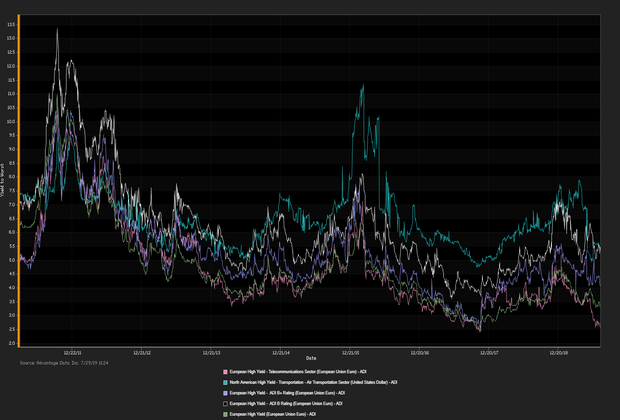

BRITAIN’S QUEEN ELIZABETH approved a request to suspend parliament by Prime Minister Boris Johnson until October 14th, two weeks prior to the Brexit deadline leaving the opposition little to no time to act. ADI (Advantage Data Inc.). Extensive corporate-bond index data showed a net daily yield increment for high-grade versus high-yield constituents. High-grade bonds edged out high-yield debt as of 3 PM, London time. Among European high-grade bonds showing a concurrence of top price gains at appreciable volumes traded, Coca-Cola European Partners PLC (USD) 4.5% 9/1/2021 made some analysts' 'Conviction buy' lists. (See the chart for Coca-Cola European Partners PLC bonds below). Corey Mahoney

Credit-Default Swap Market

LATEST NEWS: Top moves, sovereign tighteners (5Y): Korea 33 bp and France 21 bp. Sovereign wideners (5Y): Germany 10 bp and UK 33 bp.

New Issuance

| New Issues |

New Issues [Continued] |

|

1. Hella GmbH & Co. Kgaa (EUR) 0.5% 1/26/2027 (08/27/2019):500MM Senior Unsecured Notes, Price at Issuance 99.928, Yielding .51%.

|

|

ADI Indexes

DATA CHECK:

| iShares Core EUR UCITS |

iShares Euro High Yield UCITS |

| NAV as of 08/28/2019, 135.7 |

NAV as of 08/28/2019, 105.74 |

| Daily NAV Change (%) -.01% |

Daily NAV Change (%) +.02% |

|

OVERALL EUROPEAN CREDIT MARKET:The euro-zone economy shows signs of negative momentum, weakening credit rating quality, and uncertainty regarding the outcome of Brexit. Closely watched indicators and rates:

- Eurostat's unemployment rate: currently 7.5% (seasonally adjusted, May 2019)

- Eurostat's quarterly GDP: 0.4% (2019 Q1)

- 6-month Euribor: current value -0.415%, as of 08/27/2019

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)