EUROPEAN STOCKS WERE MIXED TODAY amid the Brexit stalemate. British Prime Minister Boris Johnson hopes to appeal to the Liberal Democrats and Scottish National Party, in order to draw a vote for secession on December 9th. The proposition of holding an election in December is the subject of widespread disagreement between parties. FTSE 100 +0.06%, German DAX -0.38%, CAC 40 +0.13%, STOXX Europe 600 -0.16%. The 10-year Gilt fell 2.7 basis points.

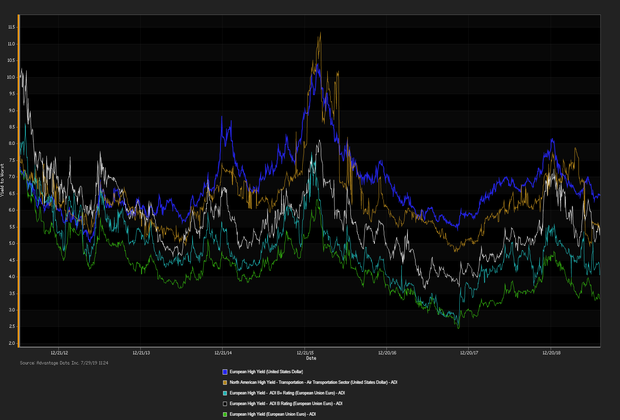

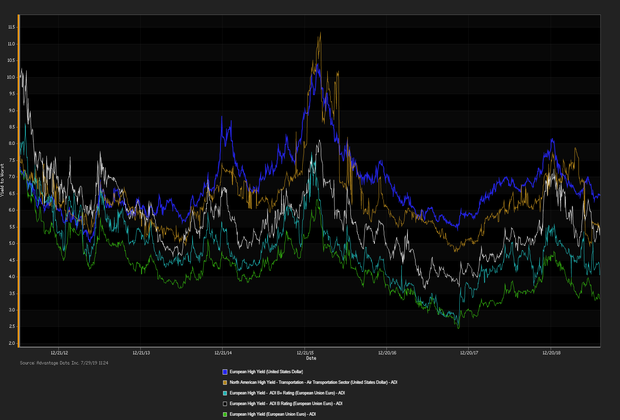

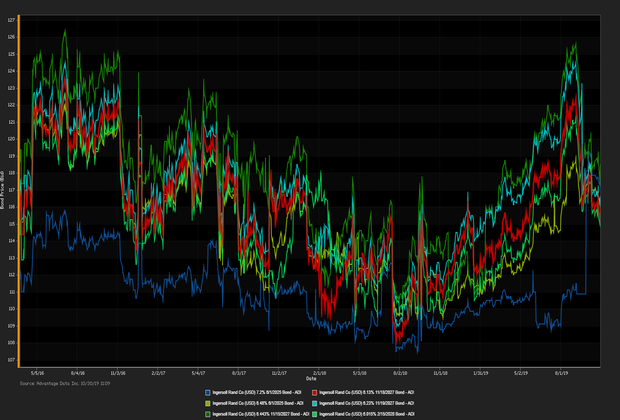

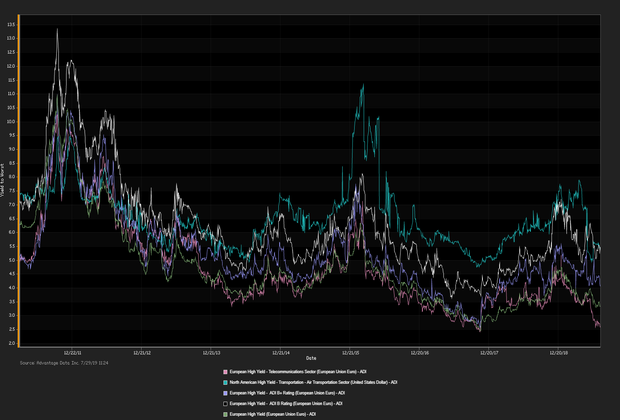

IN THE EUROPEAN LABOR MARKET, some employers believe there is a skills gap causing manufacturing jobs to go unfilled. In Italy, this is due in part to decreased enrollment in vocational schools and an overall negative sentiment towards the manufacturing sector. (Advantage Data Inc.). Extensive corporate-bond index data showed a net daily grade increment for high-grade versus high-yield constituents. High-grade bonds edged out high-yield debt as of 3 PM, London time. Among European high-grade bonds showing a concurrence of top price gains at appreciable volumes traded, Ingersoll-Rand Co. LTD (USD) 3.55% 11/1/2024 made some analysts 'Conviction buy' lists. (See the chart for Ingersoll-Rand Co. LTD bonds below). Andrew Robartes

Credit-Default Swap Market

LATEST NEWS: Top moves, sovereign tighteners (5Y): Germany 9.045 and Greece 161.31. Sovereign wideners (5Y): France 18.66 and Spain 34.895.

New Issuance

| New Issues |

New Issues [Continued] |

|

1. Banco de Sabadell SA (EUR) 0.625% 11/7/2025 (10/29/2019): 500MM Senior Unsecured Notes.

2. Eli Lilly & Co. (USD) 1.7% 11/1/2049 (10/30/2019): 1000MM Senior Unsecured Notes, Price at Issuance 99.442, Yielding 1.72%.

|

|

ADI Indexes

DATA CHECK:

| iShares Core EUR UCITS |

iShares Euro High Yield UCITS |

| NAV as of 10/30/2019, 134.25 |

NAV as of 10/30/2019, 103.27 |

| Daily NAV Change (%) -0.03% |

Daily NAV Change (%) -0.08% |

|

OVERALL EUROPEAN CREDIT MARKET:The euro-zone economy shows signs of negative momentum, weakening credit rating quality, and uncertainty regarding the outcome of Brexit. Closely watched indicators and rates:

- Eurostat's unemployment rate: currently 7.5% (seasonally adjusted, May 2019)

- Eurostat's quarterly GDP: 0.4% (2019 Q1)

- 6-month Euribor: current value -0.346%, as of 10/28/2019

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

Topics:

High Yield,

Investment Grade,

Loans,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

New Issues,

Finance,

Fixed Income,

News,

Syndicated Bonds,

syndicated,

research,

market update

.png)