THE US ADDED 164,000 JOBS IN JULY according to the Department of Labor, just below the expected figure of 165,000. The unemployment rate remained unchanged at 3.7%. Despite the report of steady job growth, stocks fell again today as investors continue to focus on trade threats. The 10-Year Treasury note fell to 1.846%, its lowest yield in nearly 3 years. S&P -0.73%, DOW -0.37%, NASDAQ -1.32%.

| Key Gainers and Losers | Volume Leaders | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Goldman Sachs Group Inc. 6.75% 10/1/2037 IBM Corp. 3.5% 5/15/2029 |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | New Issues [Continued] |

|---|---|

|

1. Crown Castle Intl Corp. (USD) 3.1% 11/15/2029 (08/01/2019):550MM Senior Unsecured Notes, Price at Issuance 99.811, Yielding 3.12%. 2. Southern California Edison Co. (USD) 2.85% 8/1/2029 (08/01/2019): 400MM Secured Notes, Price at Issuance 99.845, Yielding 2.87%. |

|

Additional Commentary

Ryder System Inc. The most recent data showed money flowed out of high-yield ETFs/mutual funds for the week ended 7/26/19, with a net inflow of $1.3B, Seven week total $9.0B flowed into high-yield.

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Rite Aid Corp. (5Y Sen USD XR14) Weatherford International LTD (5Y Sen USD MR14) |

Cable & Wireless Communication (5Y Sen USD CR14) SuperValu Inc. (5Y Sen USD MR14) |

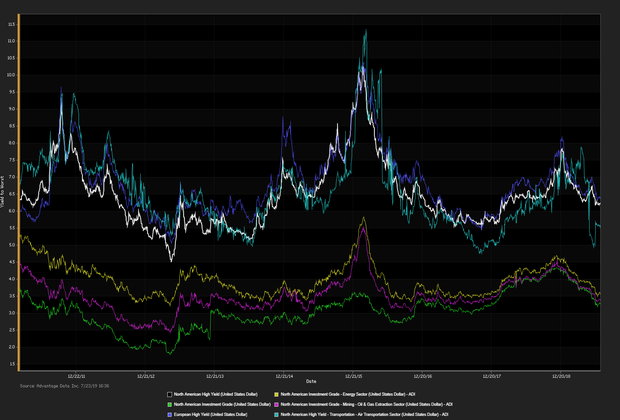

Loans and Credit Market Overview

Deals recently freed for secondary trading, notable secondary activity:

- Helical PLC, London Stock Exchange Group PLC, Maxamcorp Holding SL

- TED spread held below 21 bp (basis points), as of 08/02/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)