JEROME POWELL SIGNALED A RATE CUT IS LIKELY IN JULY citing the Fed will “act as appropriate to sustain the expansion” despite global weakness and the ongoing trade spat. “Manufacturing, trade and investment are weak all around the world ... We have agreed to begin (trade) discussions again with China, and that is a constructive step. It doesn’t remove the uncertainty.” Gold rallied 1.33 percent following Powell’s dovish remarks and the major indices finished near all-time highs. The 10-year note dipped 0.3 basis points. S&P +0.45%, DOW +0.29, NASDAQ +0.77%

| Key Gainers and Losers | Volume Leaders | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Quest Diagnostics Inc. 4.25% 4/1/2024 Kinder Morgan Inc. 5.55% 6/1/2045 |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | New Issues [Continued] |

|---|---|

|

1. FS KKR Capital Corp. (USD) 4.625% 7/15/2024 (07/09/2019):400MM Senior Unsecured Notes, Price at Issuance 99.52, Yielding 4.73%. 2. Sumitomo Mitsui Fin Grp Inc. (USD) 3.04% 7/16/2029 (07/09/2019):2500MM Senior Unsecured Notes, Price at Issuance 100, Yielding 3.04%. |

|

Additional Commentary

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Hertz Corp. (5Y Sen USD MR14) Hovnanian Enterprises Inc. (5Y Sen USD XR14) |

SuperValu Inc. (5Y Sen USD MR14) Atmos Energy Corp. (5Y Sen USD MR14) |

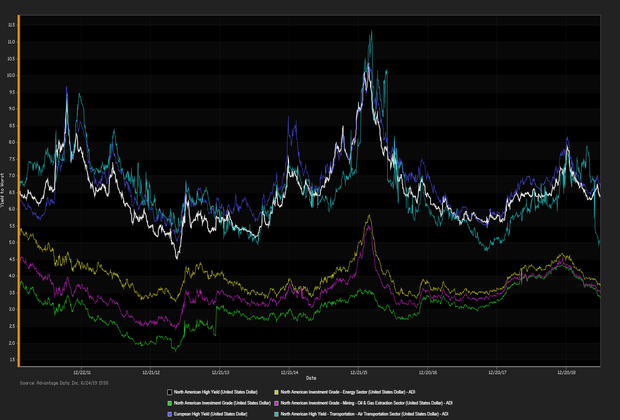

Loans and Credit Market Overview

Deals recently freed for secondary trading, notable secondary activity:

- Heritage Power, LLC, Piaggio & C. SpA, Goshawk Aviation Ltd, Valence Surface Technologies

- TED spread held below 10 bp (basis points), as of 07/10/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)