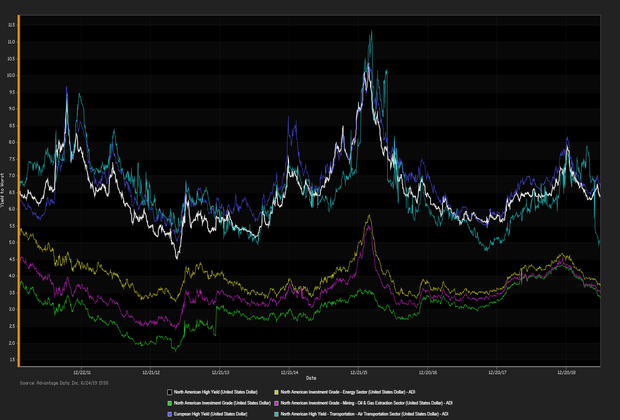

INVESTMENT-GRADE DEBT ROSE AGAINST high yield bonds in net prices linked to actual trades following weak GDP data from China revealing the country’s second-quarter growth rate fell to a 27-year low. In June retail sales and industrial production figures exceeded estimates relieving investor sentiment. S&P +0.02%, DOW +0.10, NASDAQ +0.17% The 10-year note dipped 3.5 basis points.

CITIGROUP BEATS PROFIT ESTIMATES setting a precedent for the other major banks scheduled to report later in the week. Consumer lending

boosted profits during the second quarter countering soft trading revenue. In a statement, Michael Corbat CEO of Citigroup stated,

“We navigated an uncertain environment successfully by executing our strategy, and by showing disciplined expense, credit and risk management”. The market awaits two key reports to be released this week, June retail sales figures on Tuesday and June housing starts on Wednesday.

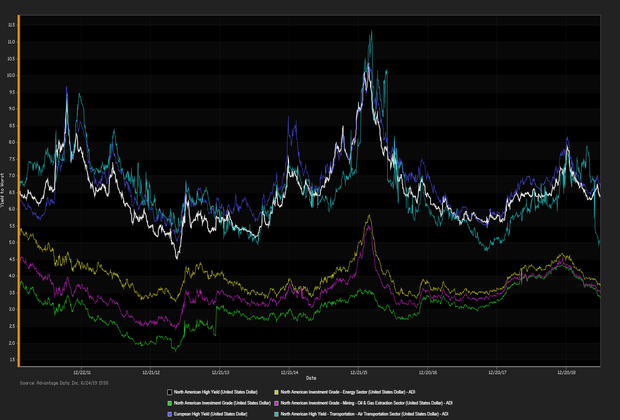

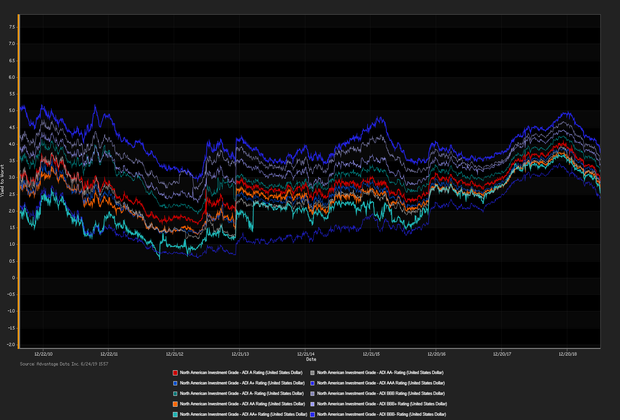

ADI proprietary index data showed a net

yield increment for high-yield versus high-grade bonds.

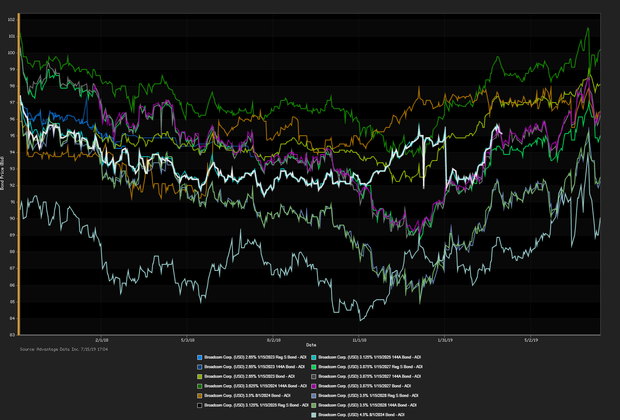

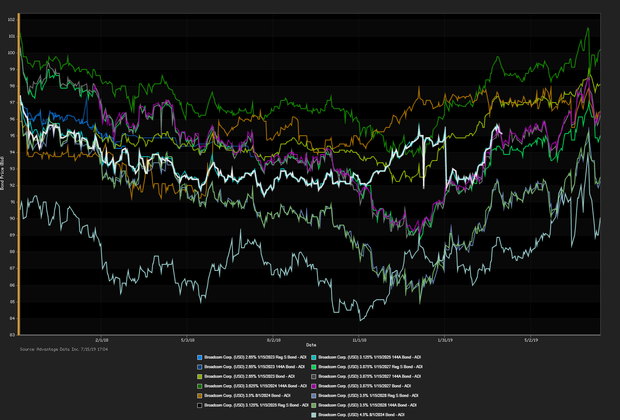

High-grade edged out high-yield. Among high-grade bonds showing topmost price gains at appreciable volumes traded,

Broadcom Corp. (USD) 3.875% 1/15/2027 made analysts' 'Conviction Buy' lists. (See the chart for

Broadcom Corp. bonds below.)

Corey Mahoney (

cmahoney@advantagedata.com).

| Key Gainers and Losers |

Volume Leaders |

| + |

General Electric Co. FLT% PERP (1) |

+ 1.8% |

| |

CVS Health Corp. 5.05% 3/25/2048 |

+ 0.4% |

| - |

Vodafone Group PLC FLT% 1/16/2024 |

-0.0% |

|

Broadcom LTD 3.625% 10/15/2024 144A

General Electric Co. FLT% PERP (1)

|

| Industry Returns Tracker |

| Industry |

Past Day |

Past Week |

Past Month |

Past Quarter |

YTD |

Past Year |

| Agriculture, Forestry, Fishing |

0.02% |

-0.11% |

0.54% |

2.96% |

6.54% |

5.13% |

| Mining |

-0.06% |

-0.62% |

1.49% |

2.80% |

8.83% |

7.86% |

| Construction |

0.06% |

-0.45% |

1.05% |

3.99% |

7.51% |

7.91% |

| Manufacturing |

-0.05% |

-0.44% |

1.14% |

3.28% |

7.16% |

6.90% |

| Transportion, Communication, Electric/Gas |

-0.13% |

-0.79% |

1.42% |

4.13% |

9.25% |

9.20% |

| Wholesale |

-0.07% |

-0.45% |

0.86% |

3.15% |

7.98% |

7.46% |

| Retail |

-0.10% |

-0.58% |

1.24% |

3.36% |

7.53% |

7.58% |

| Finance, Insurance, Real-Estate |

-0.00% |

-0.26% |

0.78% |

2.77% |

6.28% |

7.26% |

| Services |

-0.06% |

-0.51% |

1.08% |

3.39% |

7.19% |

7.87% |

| Public Administration |

0.11% |

-0.03% |

0.26% |

2.09% |

3.19% |

4.70% |

| Energy |

-0.09% |

-0.67% |

1.49% |

2.93% |

9.15% |

8.36% |

| |

| Total returns (non-annualized) by rating, market weighted. |

|

| New Issues |

New Issues [Continued] |

|

1. John Deere Capital Corp. (USD) 2.8% 7/18/2029 (07/15/2019):600MM Senior Unsecured Notes, Price at Issuance 99.922, Yielding 2.81%.

2. Cooperatieve Rabobank U.A. (USD) 2.625% 7/22/2024 Reg S (07/15/2019): 1000MM Senior Non Preferred Notes, Price at Issuance 99.763, Yielding 2.68%.

|

|

Additional Commentary

NEW ISSUANCE WATCH: on 7/15/19 participants welcome a $825MM new corporate-bond offering by Burlington Northern Santa Fe Corp. The most recent data showed money flowed out of high-yield ETFs/mutual funds for the week ended 6/21/19, with a net outflow of $602MM, year-to-date $8.9B flowed into high-yield.

| Top Widening Credit Default Swaps (CDS) |

Top Narrowing Credit Default Swaps (CDS) |

Weatherford International LTD (5Y Sen USD XR14)

Hertz Corp. (5Y Sen USD CR14) |

Cable & Wireless Communication (5Y Sen USD CR14)

SuperValu Inc. (5Y Sen USD MR14) |

Loans and Credit Market Overview

SYNDICATED LOANS HIGHLIGHTS:

Deals recently freed for secondary trading, notable secondary activity:

- Consolidated Precision Products, Starwood Property Trust Inc., Heritage Power, LLC

OVERALL CREDIT MARKET:Long-term bond yields are expected to hit a cyclical peak in 2019 given tight fiscal policy and lagging global economies. Europe remains checked by stubbornly low inflationary forces. Positive effects remained in force:

- TED spread held below 19 bp (basis points), as of 07/12/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)