US STOCKS FELL TODAY AFTER the Federal Reserve announced it will cut interest rates for the first time since 2008. According to Jerome Powell, the 25 basis point cut is a ‘mid-cycle adjustment’ and future cuts may not be necessary. He added that it will provide insurance against global economic risks and boost inflation. The 10-year note lost 4.2 basis points. S&P -1.09%, DOW -1.23%, NASDAQ

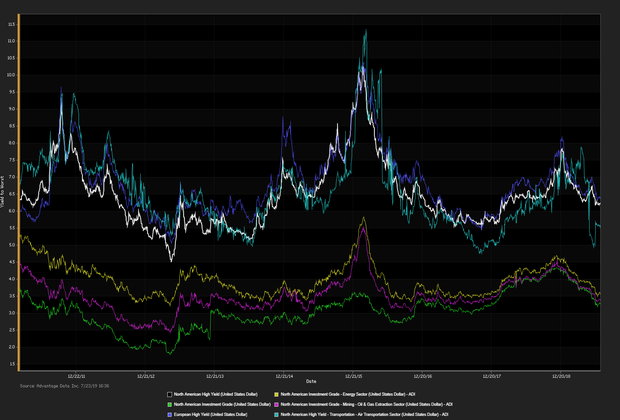

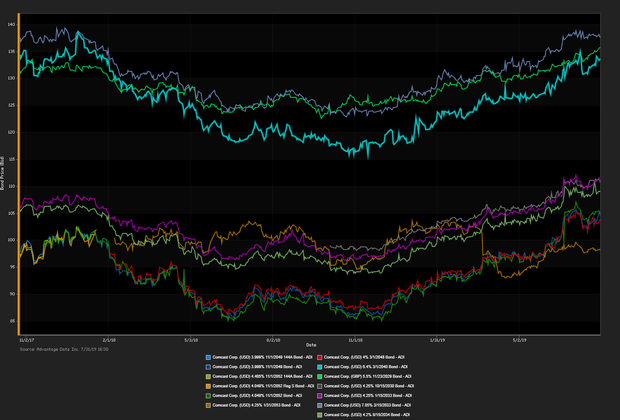

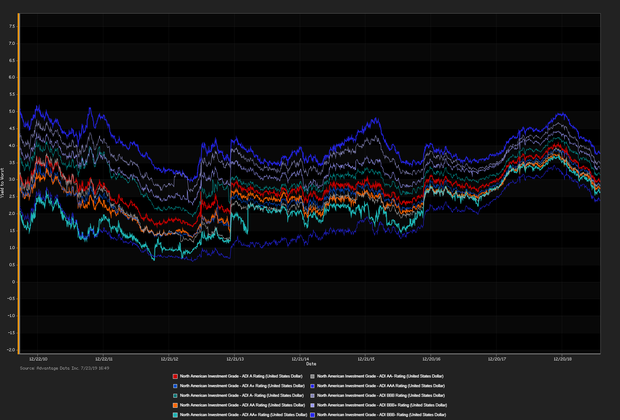

IN THE CORPORATE BOND SPACE, Las Vegas Sands Corp. recently announced its pricing of $3.5 billion in senior notes. The notes are broken up into 3 separate tranches yielding 3.2% due 2024, 3.5% due 2026, and 3.9% due 2029. The casino and resort company will use the proceeds to repay outstanding term loans and for general corporate purposes. ADI proprietary index data showed a net yield increment for high-grade versus high-yield bonds. High-grade edged out high-yield. Among high-grade bonds showing topmost price gains at appreciable volumes traded, Comcast Corp (USD) 6.5% 11/15/2035 made analysts' 'Conviction Buy' lists. (See the chart for Comcast Corp below.) Andrew Robartes

| Key Gainers and Losers | Volume Leaders | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

CVS Health Corp. 5.05% 3/25/2048 General Electric Co. FLT% PERP (1) |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | New Issues [Continued] |

|---|---|

|

1. Las Vegas Sands Corp. (USD) 3.9% 8/8/2029 (07/30/2019):750MM Senior Unsecured Notes, Price at Issuance 99.712, Yielding 3.93%. 2. Honeywell Intl. Inc. (USD) 2.15% 8/8/2022 (07/30/2019): 600MM Senior Unsecured Notes, Price at Issuance 99.899, Yielding 2.18%. |

|

Additional Commentary

Las Vegas Sands Corp. The most recent data showed money flowed out of high-yield ETFs/mutual funds for the week ended 7/26/19, with a net inflow of $1.3B, Seven week total $9.0B flowed into high-yield.

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Hertz Corp. (5Y Sen USD CR14) Hovnanian Enterprises Inc. (5Y Sen USD MR14) |

Cable & Wireless Communication (5Y Sen USD CR14) Atmos Energy Corp. (5Y Sen USD MR14) |

Loans and Credit Market Overview

Deals recently freed for secondary trading, notable secondary activity:

- Maxamcorp Holding SL, PLZ Aeroscience Corp., AIR Comm Corp. LLC, Nascar Holdings Inc.

- TED spread held below 19 bp (basis points), as of 07/31/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)