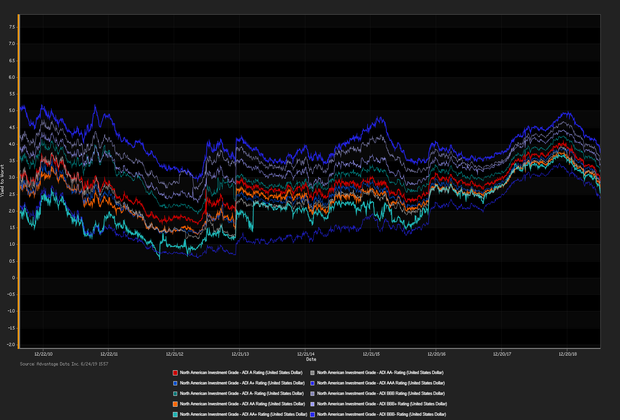

BOND INVESTORS TURN BEARISH on longer-dated U.S. government debt following the release of asound June payroll report and reducing bets the Fed will cut interest rates this month. Analysts say a prolonged inverted yield curve is a predictor of a recession and has foreshadowed the last nine recessions. “It has to stay there for a couple of months before you start to worry. One month or so, we wouldn’t consider it a lengthy period of time,” said Falconio. “We believe it’s an indicator of a long-term recession, however, it isn’t signaling a recession any time soon.” The spread between the two and ten-year notes narrowed to 14.2 basis points, the closest since May 31st. The 10-year note advanced 0.8 basis points. S&P +0.12%, DOW -0.08, NASDAQ +0.54%

| Key Gainers and Losers | Volume Leaders | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Vodafone Group PLC 6.15% 2/27/2037 Morgan Stanley VAR% 1/24/2029 |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | New Issues [Continued] |

|---|---|

|

1. Virginia Electric & Power Co. (USD) 2.875% 7/15/2029 (07/08/2019): 500MM Senior Unsecured Notes, Price at Issuance 99.965, Yielding 2.88%. 2. Total Capital SA (USD) 2.829% 1/10/2030 (07/08/2019): 1250MM Senior Unsecured Notes, Price at Issuance 100, Yielding 2.83%. |

|

Additional Commentary

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Hertz Corp. (5Y Sen USD XR14) Hovnanian Enterprises Inc. (5Y Sen USD MR14) |

Cable & Wireless Communication (5Y Sen USD CR14) SuperValu Inc. (5Y Sen USD MR14) |

Loans and Credit Market Overview

Deals recently freed for secondary trading, notable secondary activity:

- Piaggio & C. SpA, Goshawk Aviation Ltd, Valence Surface Technologies

- TED spread held below 11 bp (basis points), as of 07/09/19

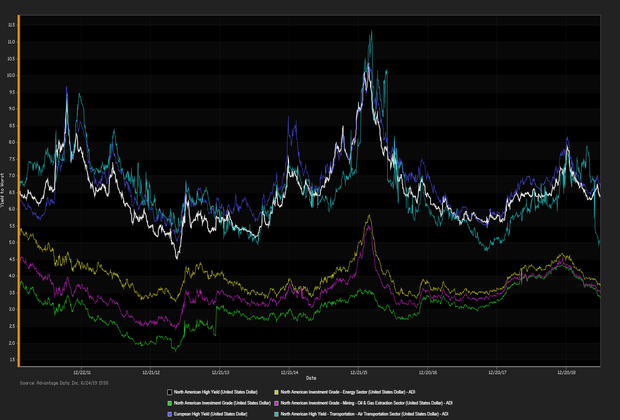

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)