U.S. MANUFACTURING CONTRACTED IN AUGUST falling below the pivotal reading of 50 indicating contraction within the manufacturing sector. “(The ISM data) was confirmation that manufacturing has been in a decline since reaching a peak a year ago,” Pavlik added. “It’s not a great sign, not the kind of sign you want to see in a slowing economy.” Weakening global economies and trade tensions are starting to show effects on the US economy. The 10-year note dipped 2.7 basis points. S&P -0.64%, DOW -1.02, NASDAQ -1.01%.

| Key Gainers and Losers | Volume Leaders | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Comcast Corp. 4.7% 10/15/2048 Credit Agricole London 2.75% 6/10/2020 Reg S |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | New Issues [Continued] |

|---|---|

|

1. PPL Electric Utilities Corp. (USD) 3% 10/1/2049 (09/03/2019):400MM Secured Notes, Price at Issuance 98.321, Yielding 3.09%. 2. Deere & Co. (USD) 2.875% 9/7/2049 (09/03/2019): 500MM Senior Unsecured Notes, Price at Issuance 99.96, Yielding 2.88%. |

|

Additional Commentary

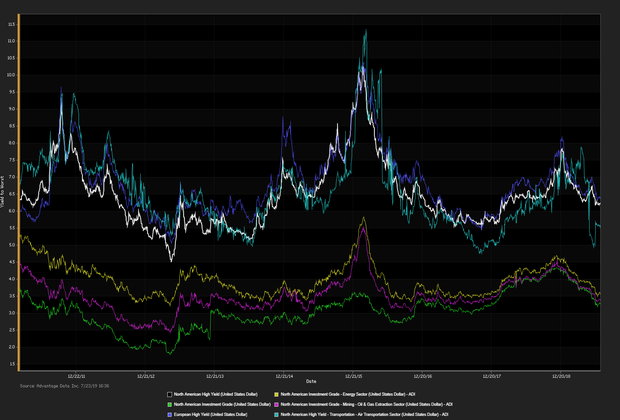

Deere & Co. The most recent data showed money flowed out of high-yield ETFs/mutual funds for the week ended 8/16/19, with a net outflow of $4.07 billion.

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Hertz Corp. (5Y Sen USD XR14) Hovnanian Enterprises Inc. (5Y Sen USD MR14) |

Cable & Wireless Communication (5Y Sen USD CR14) SuperValu Inc. (5Y Sen USD MR14) |

Loans and Credit Market Overview

Deals recently freed for secondary trading, notable secondary activity:

- Electronic Arts Inc., AutoData, PaySimple Inc., Nike Inc., US Foods Inc., Duerre Group

- TED spread was 15 bp (basis points), as of 09/03/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)