CONSUMER BORROWING RISES IN JULY as Americans racked up credit card debt surging 11.2 percent. Additionally, borrowing increased at the fastest rate in almost 2 years. Overall consumer credit growth clocked in at 6.8 percent up from 4.1 percent in June. Home purchasing sentiment ticks higher as mortgage rates fall upon global uncertainty, “We do expect housing market activity to remain relatively stable, and the favorable rate environment should continue supporting increased refinance activity,” Fannie Mae chief economist Doug Duncan. The 10-year note rose 7.8 basis points. S&P -0.17%, DOW +0.07, NASDAQ -0.56%.

| Key Gainers and Losers | Volume Leaders | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

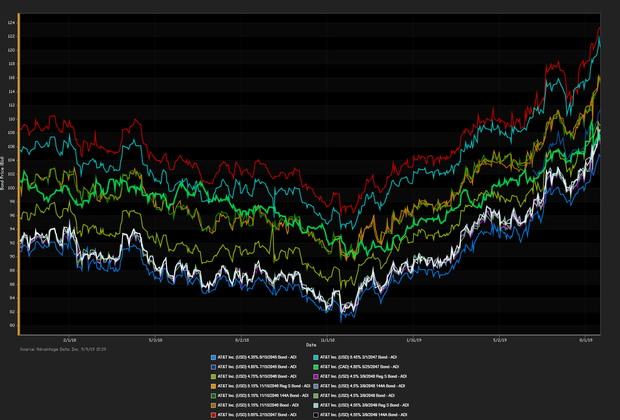

AT&T Inc. 4.55% 3/9/2049 |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | New Issues [Continued] |

|---|---|

|

1. Plains All American Pipeline LP (USD) 3.55% 12/15/2029 (09/09/2019): 1000MM Senior Unsecured Notes, Price at Issuance 99.801, Yielding 3.57%. 2. Principal Fin Gobal (USD) 2.5% 9/16/2029 144A (09/09/2019):400MM Secured Notes, Price at Issuance 99.325, Yielding 2.58%. |

|

Additional Commentary

Spirit Realty LP. The most recent data showed a significant flow into fixed income ETFs for the month of August, with a net inflow of $14.0 billion.

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Weatherford International LTD (5Y Sen USD XR14) Hertz Corp. (5Y Sen USD CR14) |

SuperValu Inc. (5Y Sen USD MR14) San Miguel Corp. (5Y Sen USD CR14) |

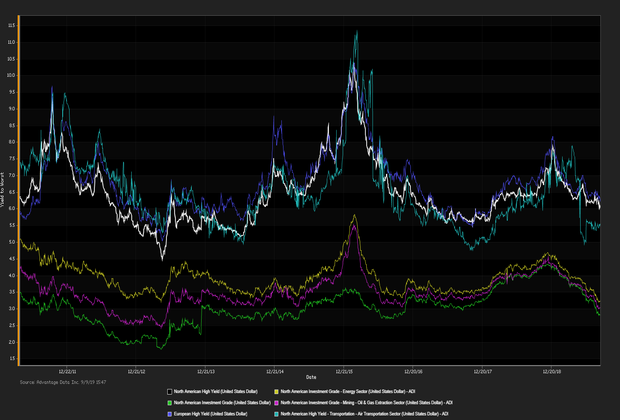

Loans and Credit Market Overview

Deals recently freed for secondary trading, notable secondary activity:

- Murphy Oil USA Inc., Electronic Arts Inc., AutoData, PaySimple Inc., Nike Inc., US Foods Inc.

- TED spread held below 19 bp (basis points), as of 09/09/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)