THE FEDERAL RESERVE HOLDS THE CURRENT INTEREST RATES but suggests a rate cut on the horizon if the economy slows down. The Federal Reserve Chairman, Jerome Powell indicated they “will act as appropriate to sustain the expansion” going on 10-years and refrained from mentioning the word “patient”. Treasury yields dipped following the Feds announcement, the 10-year note fell 2.1 basis points. S&P +0.41%, DOW +0.29, NASDAQ +0.40%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

US INVESTMENT GRADE DEBT ROSE AGAINST JUNK BONDS in net prices linked to actual trades after the European Central Bank President Mario Draghi announced the possibility of more stimulus if inflation stays low. US Treasury prices rallied for the second day as the Fed kicks off its two-day meeting. The 10-year note dipped 3.2 basis points. S&P +0.98%, DOW +1.36, NASDAQ +1.42%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

ATTENTION WILL FOCUS ON THE FED’S two-day meeting this week concluding with a monetary policy statement on Wednesday. A recent survey indicated 40 percent of economists polled expect the Fed to ease economic policy next month. Over the past 30 days, the 10-year note fell 45 basis points following tariff uncertainties and slowing economic data. The 10-year note held steady losing 0.4 basis points. Gold slips from 14-month highs, however, continues to see significant inflows as investors flee to the safe-haven asset. S&P +0.16%, DOW +0.15, NASDAQ +0.69%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

STOCKS INITIALLY FELL ON FRIDAY following weak industrial growth from China surprising investors reporting a 17-year low. “The China data certainly is far-reaching, impacting not only China but global markets as well.” Investors will keep a keen eye on the Feds meeting next week speculating on a rate cut. The 10-year note lost 0.1 basis points. Equities recovered in the afternoon from China's disappointing data, S&P +0.03%, DOW +0.14, NASDAQ -0.28%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

INVESTMENT GRADE DEBT ROSE AGAINST JUNK BONDS in net prices linked to actual trades as a risk-off sentiment continues. Crude oil spiked following two tankers being attacked near the Strait of Hormuz threatening the global supply, delivery of July crude shot up more than 4 percent before settling up 2.09 percent. Director of research at GraniteShares stated, “The nature of these events is that the outcomes are quite binary: either a major supply disruption event transpires or it does not.” The 10-year note lost 2.0 basis points. S&P +0.15%, DOW +0.15, NASDAQ +0.34%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

SUBDUED INFLATION REINFORCES the Fed’s case to “act as appropriate to sustain the expansion" by slashing interest rates. Risk-off sentiment prevailed as investment grade debt rose against high yield bonds in net prices linked to actual trades. The Treasury yield curve steepened on Wednesday ahead of the Fed’s meeting next week signaling expectations of a rate cut. The 10-year note dipped 2.2 basis points. S&P -0.20%, DOW -0.17, NASDAQ -0.38%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

JUNK BONDS ROSE AGAINST INVESTMENT GRADE debt in net prices linked to actual trades as a risk-on sentiment continues. Margaret Patel, a senior portfolio manager at Wells Fargo, sees further gains in the high yield market, “The risk-taker will be rewarded” thanks to the Feds patient stance on monetary policy. The 10-year note dipped 0.4 basis points. S&P -0.03%, DOW -0.05, NASDAQ -0.01%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

THE GAP BETWEEN JOB OPENINGS AND THE UNEMPLOYED WIDENED by the largest margin ever in April. Job openings in education, retail, and construction far exceeded the number of unemployed Americans, at the end of April there were 7.449 million unfilled jobs. Gold retreated after nine consecutive sessions of gains, settling 1.3 percent lower as U.S. and Mexico trade tensions regress. The 10-year note rose 6.0 basis points. S&P +0.56%, DOW +0.43, NASDAQ +1.18%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

INVESTMENT GRADE DEBT EDGED HIGHER as investors flee to safe-haven assets predicting the Fed will cut interest rates. BlackRock anticipates the Fed to cut rates “over the next few months” by 25-50 basis points following a weak employment report and continued trade tensions. Gold rose for the eighth straight session. The 10-year note sank 3.5 basis points. S&P+1.19%,DOW+1.16,NASDAQ+1.74%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

RISK-ON SENTIMENT PREVAILED THURSDAY following a report the U.S. is delaying tariffs on Mexican goods and a stable unemployment report contrary to ADP’s data on Wednesday.New claims fell by 2,500 as employers struggle to source labor in a tight market.The gap between the two and ten-year note narrowed by 4.4 basis points standing at 23 basis points. The 10-year note lost 0.2 basis points. S&P+0.79%, DOW +0.90, NASDAQ +0.66%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

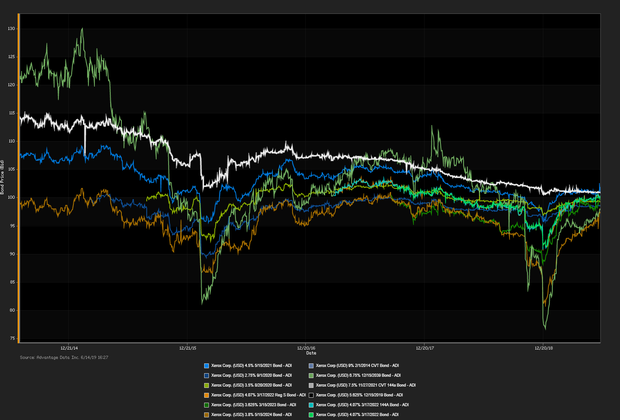

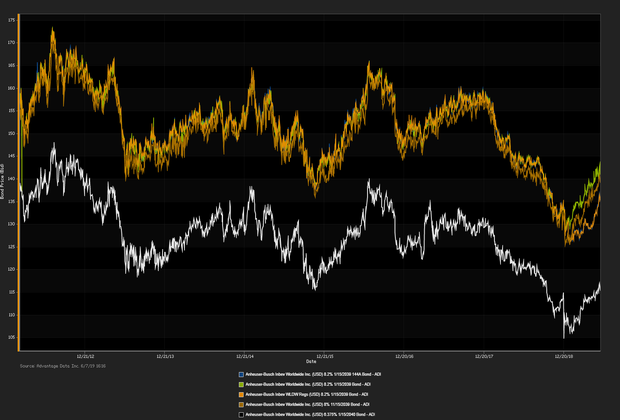

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)