STOCKS INITIALLY FELL ON FRIDAY following weak industrial growth from China surprising investors reporting a 17-year low. “The China data certainly is far-reaching, impacting not only China but global markets as well.” Investors will keep a keen eye on the Feds meeting next week speculating on a rate cut. The 10-year note lost 0.1 basis points. Equities recovered in the afternoon from China's disappointing data, S&P +0.03%, DOW +0.14, NASDAQ -0.28%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

INVESTMENT GRADE DEBT ROSE AGAINST JUNK BONDS in net prices linked to actual trades as a risk-off sentiment continues. Crude oil spiked following two tankers being attacked near the Strait of Hormuz threatening the global supply, delivery of July crude shot up more than 4 percent before settling up 2.09 percent. Director of research at GraniteShares stated, “The nature of these events is that the outcomes are quite binary: either a major supply disruption event transpires or it does not.” The 10-year note lost 2.0 basis points. S&P +0.15%, DOW +0.15, NASDAQ +0.34%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

| Key Gainers and Losers | Volume Leaders | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

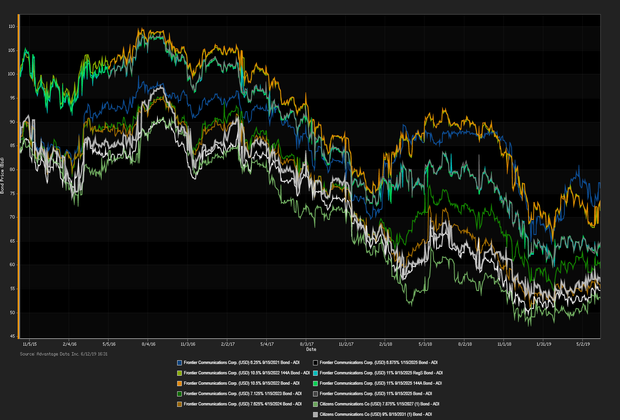

Frontier Communications Corp. 11% 9/15/2025 Chesapeake Energy Corp. 8% 1/15/2025 |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | Forward Calendar |

|---|---|

| 1. Outfront Media Capital LLC (USD) 5% 8/15/2027 Reg S (06/13/2019): 650MM Senior Unsecured Notes, Price at Issuance 100, Yielding 5%. 2. Harsco Corp. (USD) 5.75% 7/31/2027 Reg S (06/13/2019): 500MM Senior Unsecured Notes, Price at Issuance 100, Yielding 5.75%. |

1. Diamondback Energy Inc.: High-yield notes, Expected Q2 2019 |

Additional Commentary

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Hertz Corp. (5Y Sen USD XR14) Hovnanian Enterprises Inc. (5Y Sen USD MR14) |

SuperValu Inc. (5Y Sen USD MR14) Atmos Energy Corp. (5Y Sen USD MR14) |

Loans and Credit Market Overview

SYNDICATED LOANS HIGHLIGHTS:Deals recently freed for secondary trading, notable secondary activity:

- Perforce Software Inc., Avantor Performance Materials Inc., United PF Holdings LLC

- TED spread held below 22 bp (basis points), as of 06/13/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

SUBDUED INFLATION REINFORCES the Fed’s case to “act as appropriate to sustain the expansion" by slashing interest rates. Risk-off sentiment prevailed as investment grade debt rose against high yield bonds in net prices linked to actual trades. The Treasury yield curve steepened on Wednesday ahead of the Fed’s meeting next week signaling expectations of a rate cut. The 10-year note dipped 2.2 basis points. S&P -0.20%, DOW -0.17, NASDAQ -0.38%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

| Key Gainers and Losers | Volume Leaders | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Goodyear Tire & Rubber Co. 5% 5/31/2026 Western Digital Corp. 4.75% 2/15/2026 |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | Forward Calendar |

|---|---|

| 1. Graphic Packaging International Inc. (USD) 4.75% 7/15/2027 144A (06/11/2019): 300MM Senior Unsecured Notes, Price at Issuance 100, Yielding 4.75%. 2. Hilton Domestic Operating Co. (USD) 4.875% 1/15/2030 144A (06/11/2019): 1000MM Senior Unsecured Notes, Price at Issuance 100, Yielding 4.88%. |

1. Nexstar Media Group Inc.: Possible new bonds, Expected Q3 2019 |

Additional Commentary

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Hertz Corp. (5Y Sen USD XR14) Hovnanian Enterprises Inc. (5Y Sen USD MR14) |

Cable & Wireless Communication (5Y Sen USD CR14) Atmos Energy Corp. (5Y Sen USD MR14) |

Loans and Credit Market Overview

SYNDICATED LOANS HIGHLIGHTS:Deals recently freed for secondary trading, notable secondary activity:

- Avantor Performance Materials Inc., United PF Holdings LLC, Packers Holdings

- TED spread held below 20 bp (basis points), as of 06/12/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

JUNK BONDS ROSE AGAINST INVESTMENT GRADE debt in net prices linked to actual trades as a risk-on sentiment continues. Margaret Patel, a senior portfolio manager at Wells Fargo, sees further gains in the high yield market, “The risk-taker will be rewarded” thanks to the Feds patient stance on monetary policy. The 10-year note dipped 0.4 basis points. S&P -0.03%, DOW -0.05, NASDAQ -0.01%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

THE GAP BETWEEN JOB OPENINGS AND THE UNEMPLOYED WIDENED by the largest margin ever in April. Job openings in education, retail, and construction far exceeded the number of unemployed Americans, at the end of April there were 7.449 million unfilled jobs. Gold retreated after nine consecutive sessions of gains, settling 1.3 percent lower as U.S. and Mexico trade tensions regress. The 10-year note rose 6.0 basis points. S&P +0.56%, DOW +0.43, NASDAQ +1.18%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)