Repricings return, aiming for lower margins at BJ's (ACSF, Hancock Park, CCT), Compass Power (FS Energy) and Travel Leaders (Bain, Triton Pacific)

The first week of the new month was dominated by reactive trading and repositioning in the wake of quarterly reports, even as the new-issue market kept rolling out loans and bonds. In bonds, highlights included $1.25 billion short-term-fix from Intelsat just as the identically sized BMC Software buyout bonds got going on international roadshows for next week’s business following June’s completed loan financing.

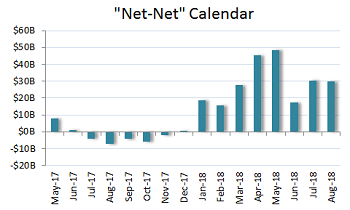

After a somewhat sleepy start last week, loan arrangers piled it on. M&A deals peeled off the calendar late in the week included the long-awaited deal for Penn National Gaming, Cetera, Travel Leaders and Del Frisco Restaurant Group as gross launched volume jumped to $15.6 billion in the busiest week since June 15. M&A volume was a healthy $7.9 billion.

Notable, too, was the modest return of opportunistic volume that included a couple of repricings and some refinancing activity such as Cushman Wakefield’s new deal following last week’s successful IPO. Still, with four-B spread holding at L+256 and two-B loans averaging L+380, opportunities for repricing continue to be isolated. Note, however, that the return of opportunistic activity helped to blunt the net volume launched last week at $6.2 billion, or less than half the gross launched volume.

Portfolios in brief: Holds reflect most recent reporting period available

CCT, Crescent: Alion Science & Technology (B3/B-) — add-on, M&A

A UBS-led arranger group alerted investors to the format of Alion Science & Technology’s proposed acquisition financing, which will center on a $124.2 million add-on first-lien term loan, according to sources. Alion Science has agreed to purchase MacAulay-Brown for an undisclosed price. The Veritas Capital-backed company will also support the deal with a privately placed $43 million add-on to its mezzanine notes and an additional equity contribution, sources noted. A lender meeting is scheduled for 9:30 a.m. ET tomorrow. Corporate Capital Trust holds $2.7M in existing 1L debt (L+450, 1% floor) due August 2021, $68M in 11% subordinated notes due August 2022 and an equity stake valued at $5.4M; Crescent Capital holds $5M in the 11% notes and equity valued at $367,000.

Cion, OCSL, OCSI: Allen Media (TK) —M&A, refi, div recap

Deutsche Bank and Jefferies set talk of L+600 with a 1% floor and a 99 offer price on their $500 million seven-year term loan B for Allen Media, according to sources. Proceeds would back an acquisition, repay existing debt, fund a dividend to management and put cash on the balance sheet, sources added. The loan would be governed by a total leverage maintenance covenant, sources noted. It would carry 12 months of 101 hard call protection. Commitments are due by noon ET Friday, Aug. 10. Holders of existing 1L debt (L+925, 1% floor) due March 2025 include Cion Investment Corp. with $60M in principal amount, Oaktree Specialty Lending Corp. with $64M and Oaktree Strategic Income Corp. with $24M.

ACSF, Hancock Park, CCT: BJ’s Wholesale Club (B1/B) — repricing

A Nomura-led arranger group set talk L+300 with a 0% floor and a par offer price of on the proposed repricing of BJ’s Wholesale Club's first-lien term loan due February 2024 (L+350, 1% floor), according to sources. The repriced loan would include a step to L+275 at 3x net first-lien leverage. The transaction would also reduce the loan’s size to $1.643 billion from the $1.893 billion currently outstanding, sources added. The paydown would come from excess proceeds from the company’s recent initial public offering, combined with revolver borrowings, sources noted. The transaction would refresh the loan’s 101 soft call protection for six months. Commitments are due by noon ET tomorrow. American Capital Senior Floating Ltd. holds $1.9M in existing 1L debt and $845,000 in principal amount of 2L debt (L+750, 1% floor) due February 2025, Hancock Park Corporate Income Inc. has $468,000 in 2L debt and Corporate Capital Trust has $845,000 in 2L debt.

OXSQ, SUNS, CGBD, PSEC, Audax, Guggenheim, ARCC: Capstone Logistics (B3/B-) — add-on, M&A

Goldman Sachs set a 99.5 offer price on $80.5 million of add-on term debt for Capstone Logistics, sources said. Terms will mirror the existing term loan due October 2021, which priced at L+450 with a 1% floor. The issuer is seeking a $60.5 million funded add-on term loan and a $20 million, delayed-draw term loan that carries a 100 bps ticking fee beginning on day 61. The delayed-draw loan is available for three months. Proceeds back the purchases of LoadDelivered Logistics LLC and Logistical Labs LLC. The loan is governed by a net secured leverage test. Commitments are due Thursday, Aug. 9. Holders of the existing 1L debt include Oxford Square Capital Corp. with $10.2M, Solar Senior Capital with $8.2M, TCG BDC with $14.8M, Audax Credit BDC with $1.3M and Guggenheim Credit Income Fund with $4M, while Prospect Capital holds $101.5M in 2L debt (L+825, 1% floor) due October 2022 and Ares Capital Corp. has letters of credit under an unfunded revolver.

FS Energy: Compass Power Generation (Ba3/BB-) — repricing

Morgan Stanley circulated price talk of L+325-350 with a 1% floor and a par offer price for the repricing of Compass Power’s $744.1 million term loan B due December 2024, according to sources. Current pricing is L+375 with a 1% floor. The transaction would refresh the loan’s 101 soft call protection for six months. Commitments and consents are due by 5 p.m. ET Wednesday, Aug. 8. FS Energy & Power Fund holds $3M in existing 1L debt.

OCSI, ARCC: Compuware (B/B2) — refi

Jefferies, J.P. Morgan and Goldman Sachs set talk of L+400-425 with a 0% floor and a 99.5 offer price on the $475 million first-lien seven-year term loan for Compuware, according to sources. The issuer also seeks a $60 million five-year revolver, sources added. Proceeds would refinance existing debt at the holding company in connection with the spinoff of the Dynatrace business. The term loan will include six months of 101 soft call protection. Commitments are due Friday, Aug. 10. Oaktree Strategic Income Corp. holds $5.7M in existing 1L debt (L+325, 1% floor) due December 2021, and Ares has equity stakes valued at $3.8M in total.

OXSQ: Convergint Technologies (B3/B) — add-on, refi

Investors received allocations of Convergint Technologies’ $65 million add-on term loan (L+300, 0.75% floor), which broke to a 99.125-99.5 market from issuance at 99, sources said. Credit Suisse was left lead on the deal, which priced tight to talk with $10 million upsize. Proceeds will repay RC borrowings and are also available for general corporate purposes. Oxford Square lists $1.5M in 2L debt (L+675, 0.75% floor) due February 2026 among its holdings.

Audax, ARCC: Kettle Cuisine (NR) — M&A

BNP Paribas and BMO Capital Markets set price talk of L+400-425 with a 1% floor and a 99.5 OID on the $240 million first-lien term loan for Kettle Cuisine, according to sources. The first-lien offering comes alongside a $50 million revolver and a $71.5 million second-lien term loan, which is being privately placed. Proceeds will support the merger of fresh prepared food manufacturers Kettle Cuisine and Boneworks, both of which are portfolio companies of Kainos Capital, sources said. Kettle Cuisine has outstanding a first-lien term loan due August 2021 (L+500) and a second-lien term loan due February 2022 (L+975). Audax Credit BDC holds $2M in existing 1L debt, and Ares Capital has $28.5M in the 2L.

Bain, Triton Pacific: Travel Leaders Group (B2/B+) — repricing, M&A

Morgan Stanley floated price talk of L+400 with a 0% floor and a 99.75 OID Travel Leaders Group’s term loan B repricing and upsize, according to sources. The financing would reprice the existing $528.5 million covenant-lite term loan B due January 2024, lowering the spread from L+450, and layer in an additional $100 million to support the acquisition of tour operator Bonotel Exclusive Travel, sources noted. The new pricing would incorporate a 25 bps step-down in the case of a qualified initial public offering, sources added. The transaction would refresh the loan’s 101 soft call protection for six months. Commitments are due by 5 p.m. ET Thursday, Aug. 9. Holders of the existing 1L debt include Bain Capital Specialty Finance Inc. with $293,000 in principal amount and Triton Pacific Investment Corp. with $347,000. – Thomas Dunford

Download LFI BDC Portfolio News 8-6-18 for BDC investment details provided by AdvantageData; click through links to view stories by LFI.

.png)