Horizon is an externally managed Business Development Company (BDC) that makes secured loans to development-stage companies backed by venture capital and private equity firms within the technology, life science, healthcare information and services, and clean-tech industries.

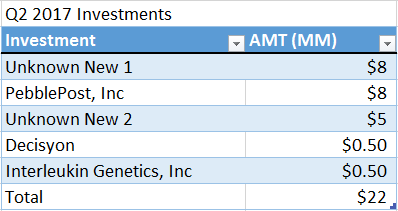

NEW LOANS:

During Q2 of 2017, Horizon funded new loans to 5 different companies, totaling $22 million in new investments:

- $8 million new loan to an online legal software and attorney marketplace platform.

- $8 million new loan to PebblePost, Inc, who invented Programmatic Direct Mail and a digital-to-direct mail platform that integrates segmentation, campaign management, production, analytics, and optimization.

- $5 million new loan to a next generation technology provider to health insurance

- $0.5 million loan to an existing portfolio company Decisyon, Inc, who creates collaborative enterprise software solutions to Global 1000 companies.

- $0.5 million loan to an existing portfolio company, Interleukin Genetics, Inc, a genetics based personalization health testing company.

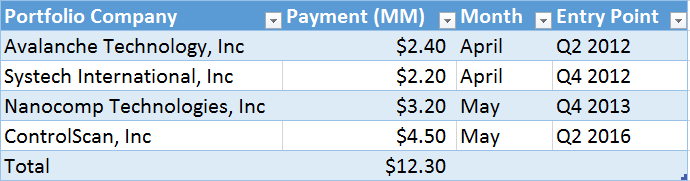

LIQUIDITY EVENTS:

Horizon had four liquidity events (sales of warrants or equity in portfolio companies, loan prepayments, sale of owned assets, or receipt of success fees) during Q2 totaling $12.59 million.

In April, Avalanche Technology, Inc prepaid $2.4 million in outstanding principal on their venture loan, interest, end of term payment, and prepayment fee. However, Horizon still holds warrants in Avalanche.

In April, Systech International, Inc. prepaid $2.2 million in outstanding principal on one of their venture loans with Horizon, plus interest, end of term payment, and prepayment fee. Horizon still holds both a debt investment and warrants in Systech.

In May, Nanocomp Technologies, Inc. prepaid their outstanding principal of $3.2 million on the venture loans held by Horizon, interest, end of term payment, and payment fees. Horizon still holds warrants in Nanocomp.

In May, ControlScan, Inc. prepaid outstanding principal of $4.5 million on a venture loan, interest, end of term payment, and prepayment fee. Horizon also realized a $290,000 gain in accordance to its sale of ControlScan warrants.

The aforementioned payments totaled $12.3 million in Q2 2017, dipping from the $27.2 million Q1 payments received by Horizon. Their received scheduled principal payments on outstanding loans also fell from $12.3 million in Q1 to $8.5 million in Q2.

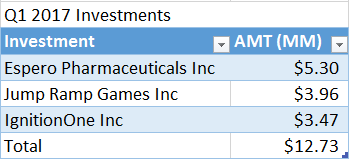

COMMITMENTS:

Horizon closed 5 new loan deals, committing $43.8 million in total. This amount is up from the 3 commitments closed in Q1 (a $5.3 million deal with Espero Pharmaceuticals, $3.96 million deal with Jump Ramp Games, and a $3.474 million deal with IgnitionOne Inc), which totaled at $19.5 million.

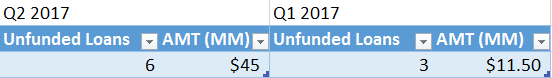

PIPELINE:

Currently, Horizon has loan commitments that remain unfunded to six different companies totaling in $45 million. This is almost four times the $11.5 million Horizon unfunded loans to 3 companies at the close of Q1.

As of June 30th, 2017, Horizon holds equity positions in 77 different portfolio companies, 64 of which are private. In Q1, Horizon held equity positions in 37 public portfolio companies.

.png)