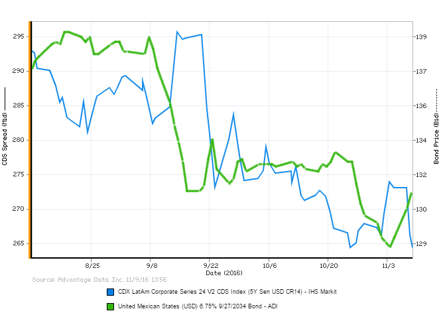

High volatility in both the IHS Markit CDX LatAm Corporate Index and Mexico 6.75% 2034 note can be observed in the 90 days leading up to the Presidential election. Most recently, a sharp widening of the given CDS spread is noticeable at the end of October after Director James Comey stated that the FBI was reopening its investigation into Hillary Clinton's email scandal. This widening was quickly reversed just days before Election Day when Comey and the FBI determined there was no further evidence of wrongdoing by Clinton.

To create your own cross-asset chart and access other AdvantageData tools simply request a free trial.

.png)