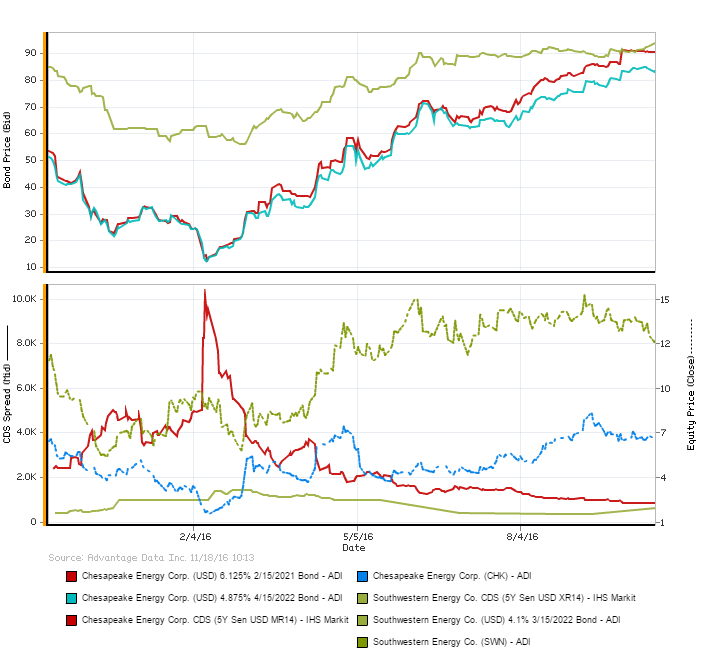

Divergence in Southwestern Energy and Chesapeake Energy bond and equity prices hit a high in Q1 2016 with the spike in Chesapeake 5 Year Senior USD MR14 CDS spread. Thereafter and through to present, equity prices remain divergent while bond prices converge.

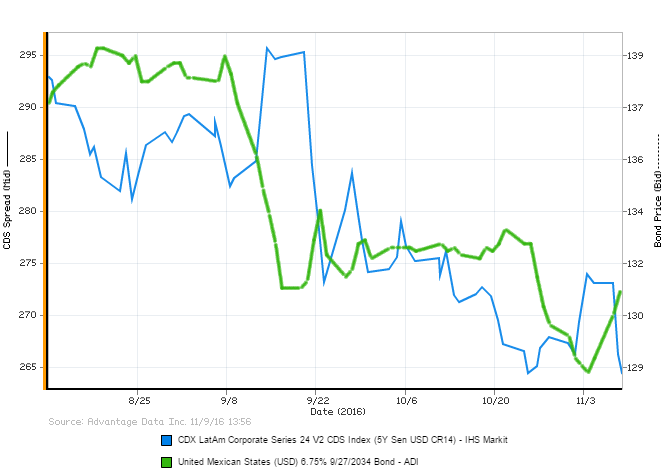

LatAm CDS spreads show fluctuations leading up to US election

Posted by

Alex Buzby on Nov 14, 2016 9:36:30 AM

High volatility in both the IHS Markit CDX LatAm Corporate Index and Mexico 6.75% 2034 note can be observed in the 90 days leading up to the Presidential election. Most recently, a sharp widening of the given CDS spread is noticeable at the end of October after Director James Comey stated that the FBI was reopening its investigation into Hillary Clinton's email scandal. This widening was quickly reversed just days before Election Day when Comey and the FBI determined there was no further evidence of wrongdoing by Clinton.

0 Comments Click here to read/write comments

Topics: credit default swaps, CDS, Election

Read More

0 Comments Click here to read/write comments

Topics: credit default swaps, IHS Markit, CDS

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)