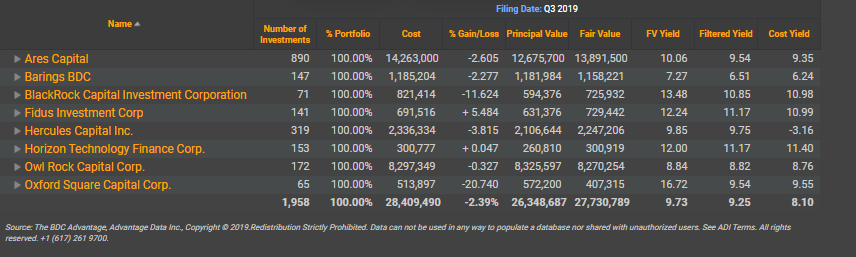

BDC Filing season is in full swing. This report will analyze 8 Public BDCs that have filed this week. Aggregate Fair Value reported by these BDCs is 27.7 Billion USD which is approximately 26% of aggregate AUM of all BDCs.

Topics: Analytics, BDC, AUM, market analytics, business development company, Non-accruals, BDC Filings, fair value, market update, top 5, adds & exits

3Q19 Portfolio Highlights: Ares Capital books big quarter for new issues, at $2.4B

Ares Capital yesterday reported a big quarter for new issues, $2.4 billion across 50 borrowers, compared to $1.3 billion in the previous quarter and $1.9 billion in the same period last year.

Topics: Loans, Middle Market, BDC, First Lien, debt, business development company, Non-accruals, portfolio, Direct Lending, syndicated, underperformers, Direct Lending Deals

Golub plans private party for Parts Town; Deal is latest large-cap to forgo wider distribution

Parts Town is coming to market next week via Golub Capital with a $788 million unitranche financing to back the add-on acquisition of Heritage Foodservice Group. The lender meeting, however, isn’t taking place in a fancy midtown hotel auditorium that can seat hundreds of investors. Instead, Golub is hosting a small group of invites to sell down only about half the deal.

Topics: Loans, Middle Market, BDC, First Lien, debt, business development company, Non-accruals, portfolio, Direct Lending, syndicated, underperformers, Direct Lending Deals

Unitranche: Integrity Marketing loan highlights better pricing for direct lenders

The $945M financing for Integrity Marketing that was put away quickly and quietly last month not only shows how direct lenders continue to log wins for larger mandates, but also the wider premiums they earn bypassing the syndicated market.

Pricing on the unitranche loan that Owl Rock Capital, Crescent Capital and Antares Capital put together for the company closed at L+575, according to sources. That's 150 bps higher than the L+425 on the insurance broker’s previous first-lien debt. It's also well above current averages in the more broadly syndicated market.

According to S&P Global LCD, the average all-in yield is 5.9% across large borrowers this month. With 3-month Libor at 2.14%, that puts the average spread at roughly L+375 for syndicated issuers.

Against other unitranche loans — the tool of choice for many direct lenders —the Integrity Marketing credit is right in the wheelhouse of where the majority of unitranches have priced in 2019, based on data provided by Advantage Data.

Topics: Loans, Middle Market, BDC, First Lien, debt, business development company, Non-accruals, portfolio, Direct Lending, syndicated, underperformers, Direct Lending Deals

Harvest Partners hit direct lending market for $945M unitranche loan at L+575 to support Integrity Marketing deal: Owl Rock, Crescent, Antares

Harvest Partners went with Owl Rock Capital, Crescent Capital and Antares Capital last month for $945 million in unitranche financing in connection with the private equity firm’s minority growth investment in Integrity Marketing Group, a national life and health insurance broker.

Topics: Middle Market, BDC, debt, business development company, Non-accruals, portfolio, Direct Lending, underperformers, Direct Lending Deals

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)