Controversial Valeant Pharmaceuticals (NYSE: VRX) in the news again as the deal to sell their division of Salix to the Japenese company, Takeda (TYO: 4502), broke down. The disagreement to sell the gastrointestinal-drugs division of Valeant caused further turmoil in their bonds as they dropped over 2 cents following the announcement. The volatility is nothing new to the pharmaceutical company as just earlier this month they experienced a significant drop in prices when they severed ties with Philidor Rx Services, LLC.

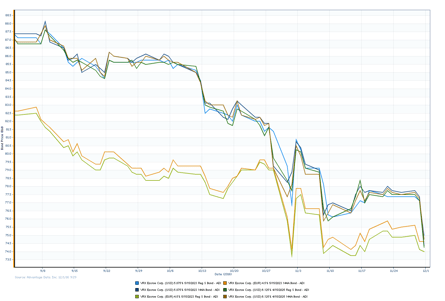

The peaks and valleys of Valeant's bonds are captured by AdvantageData's charting tool.

Follow the developments in the pharmaceutical industry in real-time by requesting a free trial of AdvantageData today.

.png)