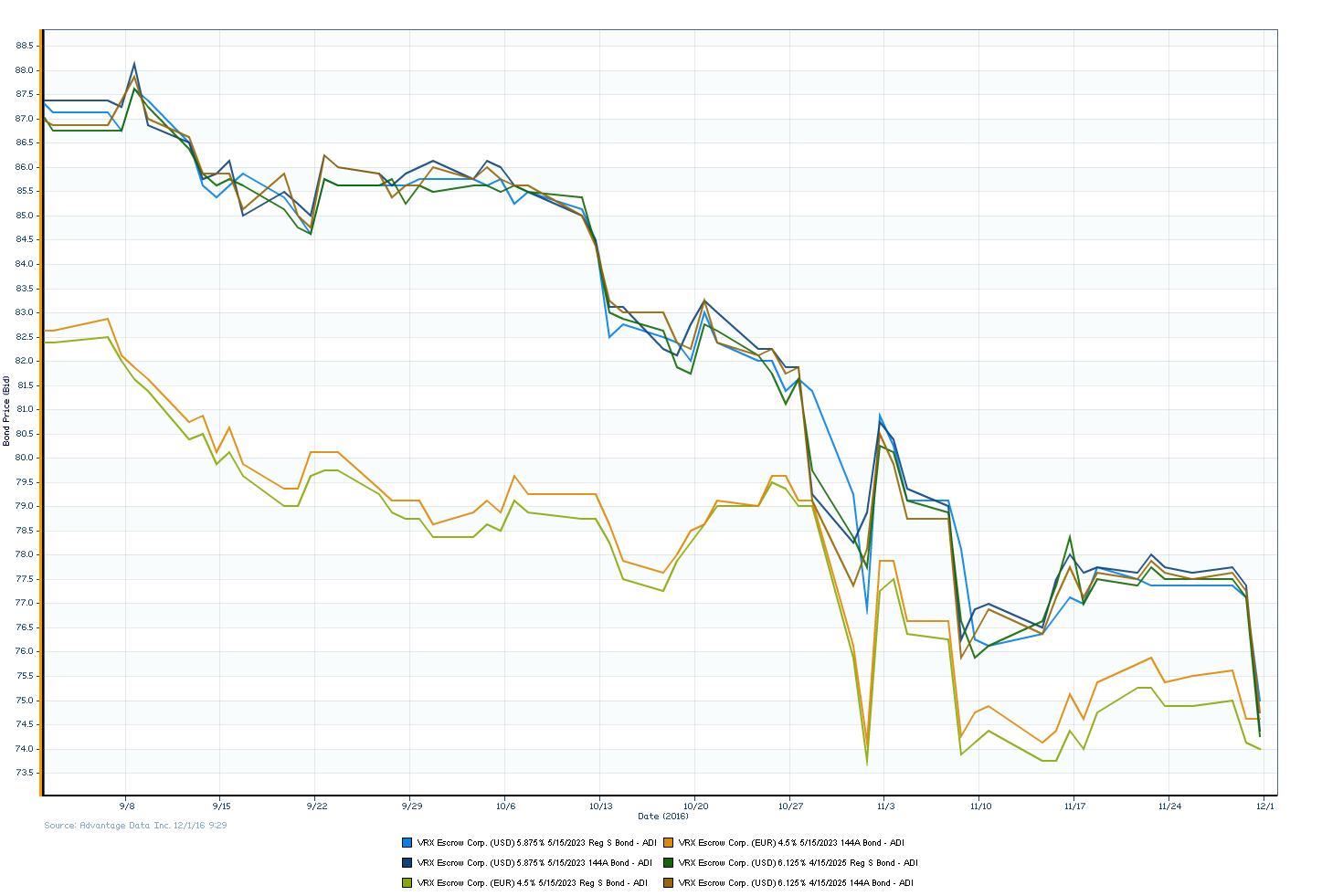

Controversial Valeant Pharmaceuticals (NYSE: VRX) in the news again as the deal to sell their division of Salix to the Japenese company, Takeda (TYO: 4502), broke down. The disagreement to sell the gastrointestinal-drugs division of Valeant caused further turmoil in their bonds as they dropped over 2 cents following the announcement. The volatility is nothing new to the pharmaceutical company as just earlier this month they experienced a significant drop in prices when they severed ties with Philidor Rx Services, LLC.

Valeant Pharmaceuticals Takes Another Hit as Takeda Deal Falls Through

Posted by

Nick Buenaventura on Dec 1, 2016 10:18:10 AM

0 Comments Click here to read/write comments

Topics: Valeant, Takeda, Salix, Philidor, Pharmaceuticals

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)