AMAG Pharmaceuticals (NASDAQ:AMAG) saw a sharp drop in its debt in the past week following the release of its actual results in sales. Although the pharma company saw its sales rise to a new record in this past year, investors are concerned as its top-selling drug, Makena, is set to lose its patent exclusivity in 2018. The maternal drug aid currently makes up 70% of AMAG's sales and with no defense to differentiate it from generics, investors are uncertain of how the company will be able to cope.

0 Comments Click here to read/write comments

Topics: Loans, AMAG, Pharmaceuticals

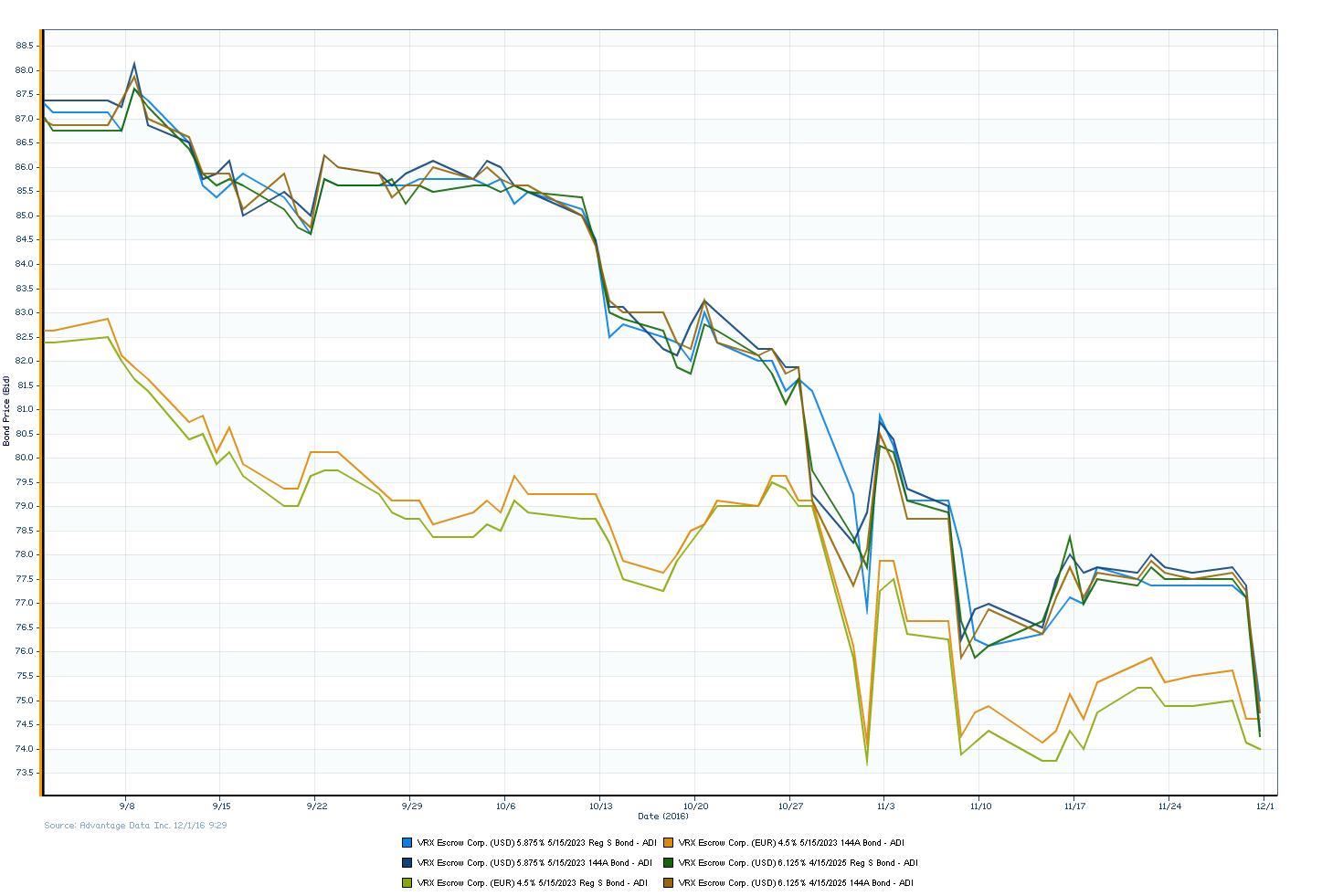

Valeant Pharmaceuticals Takes Another Hit as Takeda Deal Falls Through

Posted by

Nick Buenaventura on Dec 1, 2016 10:18:10 AM

Controversial Valeant Pharmaceuticals (NYSE: VRX) in the news again as the deal to sell their division of Salix to the Japenese company, Takeda (TYO: 4502), broke down. The disagreement to sell the gastrointestinal-drugs division of Valeant caused further turmoil in their bonds as they dropped over 2 cents following the announcement. The volatility is nothing new to the pharmaceutical company as just earlier this month they experienced a significant drop in prices when they severed ties with Philidor Rx Services, LLC.

0 Comments Click here to read/write comments

Topics: Valeant, Takeda, Salix, Philidor, Pharmaceuticals

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)