'RISK-OFF' SENTIMENT WAS TONED DOWN relative to yesterday's levels, among a spectrum of European corporates. Investment-grade debt edged out junk bonds in net price gains nonetheless, amid continued attention to political risk emanating from 'across the pond' on the U.S. front. Corporate-bond investors took sector cues from gains in Deutsche Bank AG shares, moving up 2.1% before profit-taking set in. Upbeat views on financials were offset a bit by a 3.4% pullback in Italy's UniCredit SpA, as of 4 PM, London time. However, gains in retailer Hennes & Mauritz AB, Ocado Group PLC, and Alfa Laval AB buoyed the pan-European Stoxx 600, limiting its descent into the shallow red.

Recent Posts

Topics: High Yield, Investment Grade, debt

Expansive tone continued to build regarding a spectrum of risk-assets, leading European junk debt to draw a fresh wave of bids along with equities. A strong showing by the banking sector was kindled by upbeat earnings from Santander SA, sending the Spanish bank's shares up 4.7%. The news carried along a range of other European banks as well, including France's Societe Generale SA and Germany's Deutsche Bank AG. A rally in Logitech International SA, posting share gains of over 15.5% as of 4PM London time and supporting the European tech group, provided additional sector cues to corporate-bond traders.

Topics: High Yield, Investment Grade, debt

Defensive bias stepped higher, amid increasing attention by investors to statements by the U.K.'s Theresa May, and the U.S.' Donald Trump. Accordingly, investment-grade bonds easily outpaced junk debt on the European front, reflected in price gains linked to actual trades. High-yield bonds in the banking and retail sectors gave up some of last week's gains, while airline securities followed Lufthansa shares higher.

Topics: High Yield, Investment Grade, debt

European high yield debt held a slight edge over investment grade names, even as the pan-European Stoxx 600 equities index stayed mired in the shallow red.

Topics: High Yield, Investment Grade, debt

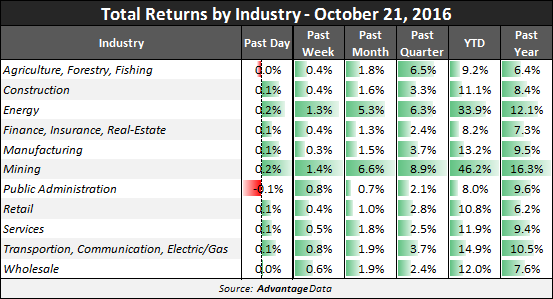

Total Returns by Industry: High Yield as of October 21, 2016

AdvantageData has the world’s most sophisticated corporate bond database. Buy-side and sell-side shops around the world rely on most powerful and up-to-date Market Analytics produced by AdvantageData’s proprietary database.

Topics: High Yield, Total Returns by Industry, Analytics

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)