BDC COMMON STOCKS

Come Back

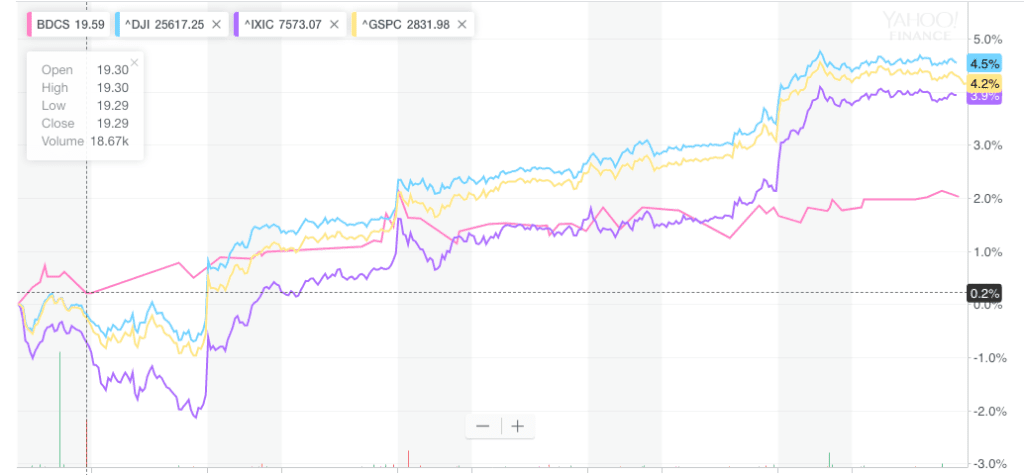

In a week where the major indices came roaring back, following a worrying slump, the BDC sector joined the party.

But only up to a point.

As the chart below, the 3 major indices were up between 3.9% and 4.5%, but the BDC sector – as measured by BDCS – trailed significantly.

Partial

BDCS was up 2.4% on the week, clawing back most of the loss from the week before, but only two-thirds of the drop from a fortnight earlier.

The related Wells Fargo BDC Index – which is a total return calculator – was up 2.0%.

Good News

Other metrics reflected the turnaround in sentiment during the week:

33 of the 45 BDCs we track were up or flat in price, and only 12 dropped.

That was far better than the 4 in the green the week before !

There are now 16 BDCs trading above their 50 Day Moving Average price and 24 over the more useful 200 Day Moving Average.

That last statistic suggests a market neatly balanced between stocks going up and stocks going down.

This week a healthy 8 BDCs went up 3.0% or more in price, a phenomenon we’d not experienced since mid-April.

Drama

However, there were two BDCs which dropped more than (3.0%) as well.

In each case, there’s a backstory.

The Biggest Loser was Medley Capital (MCC), down a whopping (8.6%) and breaking through its prior 52 week low.

Infomercial Interruption

You could have followed this in near real-time as we commented on this decline – and much else regarding MCC – on our Twitter feed.

We’d like to remind our readers that any time anything notable happens to a BDC – or in the leveraged finance world for that matter – we’re reporting and commenting on Twitter.

Always with a BDC mind-set. No politics. No celebrity pics. No cat videos.

We’ve got hundreds of followers – given that we’re the only source for BDC news at all times, – but we could always use more.

Back To Medley

As we reported in a Featured Article earlier in the week, MCC had a shareholder vote about the re-election of two directors.

Tellingly, when the incumbents won the vote at the expense of the NexPoint nominees, the stock price collapsed.

Presumably, investors calculated that a victory by the BDC – and its controversial managers and Board – made more likely the merger with Sierra Income and Medley Management.

Even though the said deal is reported to being restructured to be more favorable to MCC – despite the deteriorating value of the business – shareholders voted with their feet.

Know Nothing

The BDC Reporter – despite spending a disproportionate amount of time on the Medley imbroglio – continues to be puzzled about what’s happening and what might happen next.

All we know for sure is that the MCC situation is far from resolved and NexPoint remains willing to be drafted to provide a solution.

Everybody else – including the BDC’s Israeli and U.S. bond holders, Sierra Income shareholders, Medley Management stock and bond holders and MCC’s own investors – are left hanging.

For all those parties – and several other constituencies we won’t even mention – what happens in the weeks and months ahead will be critical.

Plus Ca Change, Plus C’est La Meme

The other casualty in the week was Portman Ridge Finance (PTMN).

The stock price dropped again this week, following the recent release of the IQ 2019 results, to close at $2.57.

That’s a hair’s breadth away from the newly renamed BDC’s 52 week low of $2.50.

Back on February 27, 2018 – after the release of the IVQ 2018 financials – we expressed our concern about the BDC’s prospects, despite the market enthusiasm at the time.

At the time the BDC was trading at $3.56.

The new external manager may have the best of intentions but the KCAP that was came with multiple credit flaws which have not gone away with a name change.

This BDC – and the turnaround that is now needed – will require monitoring.

Sidebar

(By the way – for our internal purposes – we keep a list of how many BDCs are in “turnaround” mode where their portfolios are concerned.

With the addition of PTMN that number is now 11, or a quarter of the universe.

We also count how many BDCs are “re-positioning” their portfolios (usually from riskier to safer assets, and typically after nasty credit results) and that adds up to 18, or 40% of the BDC universe.

As you’d expect, there is plenty of overlap in the two lists.

That’s a lot of chopping and changing happening beneath the surface.

Turnarounds and repositionings take time – some BDCs have been on our list for many quarters – and leave the players involved vulnerable to market shocks.

We’ll begin writing a quarterly update about the BDCs involved and the progress being made – or not – shortly).

No Happy Talk Here

Anyway, while the BDC sector had a decent week – which almost always happens when the major indices surge forward – the data suggests we are far from being out of the woods.

Taking a 4 week time horizon, 36 BDCs are down in price and only 9 up.

The Resilient Nine include OCSL (3.4%), off the back of an increasingly successful – guess what ? – turnaround since Oaktree took over from Fifth Street.

MAIN is on the list (2.4%) as the ever popular BDC appears to chug along.

More surprisingly, GECC is on this list (although down on a 12 month basis); up 2.4% despite the continuing sale of Mast Capital’sposition in the BDC.

Investors seem to be warming to GECC’s unique business model of trading bonds and loans now that most of the under-performing Full Circle investments have been dealt with.

Tough

At the other end of the spectrum, the markets are cold bloodedly punishing – judging by the 4 week price moves – BDCs whose results have disappointed.

Top of the list in double digit negative figures are the aforementioned MCC and PTMN.

Just below, though, there’s also PFLT (11.6%) and sister BDC PNNT (6.6%) who share the same bankrupt portfolio company (Hollander Sleep Products).

MRCC, despite the best efforts of the manager to argue that everything is awesome, is off (6.9%) and (20.8%) over 12 months.

Even previous high flyer GAIN has drawn the skeptics after a long run of capital gains, down (8.3%) over 4 months and in the red over a 1 year horizon.

Glass Darkly

Looking forward, we continue to be concerned that the odds seem to point to decline rather than further increase in the BDC sector’s price level.

There may be a collective sigh of relief that the tariffs on Mexican goods won’t be happening, but the bulk of the fundamentals militate against optimism.

This week we had the weak payroll report.

More importantly, the likelihood that rates will drop substantially – and soon – increased.

Line Of Fire

As we’ve been pointing out, that’s bad news for a BDC sector which – almost universally – has its investment assets pegged to floating rates.

And BDCs have many debt liabilities fixed. As well as most of its costs.

Not a good combination.

Analysts and pundits that we’ve read have begun to wake up to the earnings erosion that is already occurring but could steadily worsen if rates drop through 2020.

LIBOR

By the way, the 1 month LIBOR rate (the most popular standard in the BDC sector) is down from a month ago to 2.42% from 2.46%.

At the beginning of the year – when all the talk was about ever higher rates – 1 month LIBOR was at 2.50713%.

As we said: erosion.

Credit Chills

Also, we continue to be concerned that we seem to be waking up every day to a new BDC portfolio company filing for bankruptcy.

Admittedly we’re more aware of these developments now we’re tracking all 3,000 plus BDC portfolio companies daily as we prepare to launch a second publication: the BDC Credit Reporter.

As we’re still in data gathering mode, we don’t have hard numbers to claim BDC credit is getting better or worse, and we don’t want to be alarmist.

Informed Guesswork

Anecdotally, though, and with all those caveats, there seems to be a downward shift in credit.

That’s not only companies filing Chapter 11 (see what we wrote about Fusion Connect this week), but also more names moving onto our Watch List and very few moving out.

Except by being written off.

Doubts

Then there are – and this is more controversial and hard to prove – a slew of companies which BDCs still rate close to par, but which we have our credit doubts about.

Plus, the “zombie” companies sitting in BDC portfolios – often in the Control section – which never seem to improve and which may never recover.

If we get a recession – or even a bad economic run – many of the companies in both groups may go bankrupt and get written down/off.

Are the BDCs – and their highly paid independent valuation firms – sharpening their pencils and valuing under-performing companies “conservatively” ?

In most cases our (still anecdotal) experience suggests not.

Think Sisyphus

We’ll be bringing readers more of the credit data we’re collecting in the weeks ahead and let you draw your own conclusions.

Unfortunately, we’re not moving as fast as we’d like as we have to become familiar with several hundred under-performing names in a short time and dig into their backstories.

The effort – we (naively ?) believe – will be worth it and save ourselves and our readers from being reliant solely on quarterly updates from the BDCs themselves.

.png)