BDC COMMON STOCKS

Proof Positive

Once again, the weekly performance of the BDC sector demonstrated that its ups and downs are tied to the broader markets.

We’ve watched for weeks now BDC prices rise and fall with the major indices, which are themselves apparently fixated on the progress of the trade war.

This week was no exception.

The S&P 500 moved up 0.62%, mostly late in the 5 day period, due to the promise of a trade armistice or partial deal of some sort.

“Hurrah” said the markets, but as CNBC is reporting, second and third thoughts are already running rife so the trade tease is likely to continue.

This week at least, though, the late-in-the-week optimism brought the Wells Fargo BDC Index up 0.73%, after two prior weeks in the dumps.

Left Out

(We’re not looking to the UBS Exchange Traded Note with the ticker BDCS for price guidance this week as the ETN just went ex-dividend, and thus dropped to close at $19.40.

That’s (0.77%) down from the week before but up 1.3% when we add-back the latest $0.441 distribution).

Good Week

Other metrics we typically look at were also positive this week.

For example, 33 individual issues were up on the week and only 13 down in price, a roughly 75:25 split.

There were 4 BDCs up over 3.0% this week compared to zero in the two prior weeks.

No BDC dropped more than (3.0%) but the week before there were 18 in that category.

Finally, we note that the number of BDCs trading over their 50 day moving average price was up to 20 from 11 the week before.

Headed Nowhere

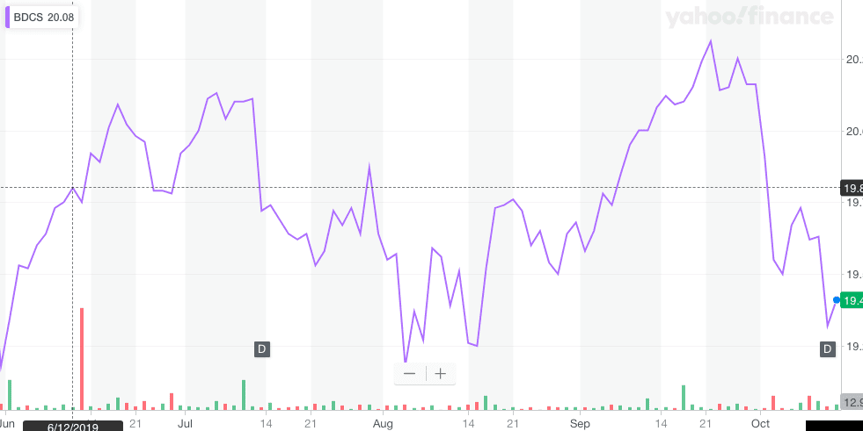

Yet, if we take just a slightly wider perspective, we can see that months of trade conflict have left the BDC sector effectively treading water from a price perspective.

Back on May 31, 2019 we wrote an article in our sister blog called BDC Best Ideas entitled “Time To Hunker Down”.

We were referring to the investment strategy in our own fund, rather than a suggestion to anyone else.

At the time we were worried that with trade wars, lower interest rates and a weaker global economy might cause BDC stock prices to trend down, or materially drop.

We believe – based on the cracks that have appearing in BDC sector prices and the current miasma in the markets surrounding tariffs; the possible weakness of the U.S. economy and the prospect of lower interest rates – that there’s a good chance we may face another December 2018 market meltdown….We could be wrong – because no one can read the market tea leaves – but we choose caution and always will 10 years into an economic expansion and any time the word “war” is mentioned 1,000 times a day.

Not As Bad

Of course, since then we have not had a repeat of 2018’s late year melt-down, although there’s still time…

Not So Good Either

Instead, BDC prices rallied from that low point in the late spring, then dropped back in the summer, then rallied again in in the early fall and are now close to the original level.

See the BDCS chart for the period under discussion:

Price Tracker

We’ve also tracked the performance of individual BDC prices since May 31 till this last Friday, to see what we might learn.

We found that 21 increased in price since May 31, and 25 dropped.

More evidence that the BDC sector – from a price standpoint – has been treading water.

The Good Old Days

In fact, since the February 22 high of this year only 11 individual BDC stocks are up in price and 35 are down.

By our reading of these data leaves – and much else we don’t have the time to review – the BDC sector appears to be have been in a yo-yo phase for the past 6-months.

Through A Glass Darkly

Of course, of greatest interest is what comes next.

As usual we don’t know, but the chances are that whatever your outlook is for the major indices in the months ahead, the BDC sector will be following suit.

Results Matter

We’ll throw in one caveat: should the results of the BDC earnings season differ substantially – to the downside – from expectations, that could hurt BDC prices.

We expect lower LIBOR will have managed to erode – as just evidenced in Saratoga Investment’s (SAR) latest results – net earnings, but with most BDCs in a growth mode thanks to the SBCAA the impact might not be noticeable.

Credit problems persist at many BDCs, but there seems to be no systemic deterioration and nothing that the market has not looked the other way about in prior periods.

For what it’s worth, the analyst community seems to be also approaching this coming earnings season with diminished expectations.

Expected Vs Actual

We’ve just compared 44 BDCs projected IIIQ earnings versus actual IIQ results and found that analysts expect Net Investment Income Per Share overall to drop (3.4%) this quarter.

13 BDCs are expected to increase NIIPS, 20 are expected to decrease and 11 stay unchanged.

However, given the nature of BDC lending to principally private companies, there’s always the chance of being surprised by even more substantial earnings drops than are reflected in the current estimates.

Those are the best conditions for a possible BDC market freak-out if the modest expectations for this coming quarter prove to be wrong.

There are ten BDCs where analysts are expecting EPS to be more than 10% higher or lower than in the prior period.

Those BDCs could be subject to above average price fluctuations if actual results and expectations materially diverge.

Previewed

We’ll have a much clearer picture starting at month’s end when the first results of many start coming in, led by the biggest BDC of all – Ares Capital (ARCC).

Until then the BDC Reporter will continue to prepare readers for what to look out for when that mountain of disclosure arrives.

We’ve already published previews for ARCC, Barings BDC (BBDC), Solar Senior Capital (SUNS) and BlackRock Capital (BKCC).

Worth Watching

Of these names, only BKCC is expected by analysts to report substantially different NIIPS than last quarter.

The current consensus is that BKCC’s results will drop to $0.14 from $0.16, a (13%) drop.

That would be challenging for the long-troubled BDC with the famous parent given that the dividend was just cut from $0.18 to…..$0.14.

As we pointed out in the Preview, even that result is boosted by temporary fee waivers.

Even though BKCC is already trading at a 10 year low, a worst than expected performance could drag the stock down even further.

Coming Soon

Many more BDC Previews have been drafted or are in process, as we seek to prepare for the deluge of reporting ahead.

This is the best time to get ready, so we’ll be busy in the days ahead.

Forewarned is forearmed.

.png)