BDC Common Stocks

Bleeding Stopped

In the wider markets, the dramas of the past couple of weeks continued through October 19, 2018. “The S&P’s lower close on Friday marked the tenth down day in the past 12 trading sessions”, according to Yahoo Finance.

BDC common stocks, though, generally consolidated after weeks of decline. The UBS Exchange Traded Note with the ticker BDCS, which includes most of the individual players in the sector on a weighted adjusted basis, dropped to $19.39 from $19.40. The Wells Fargo BDC Index – more useful as a Total Return measuring stick than just the price change at BDCS – dropped to $2,505.24, down 0.42%.

Taking A Breather

The rest of the metrics we look at weekly confirmed that the sector was plateauing after a sharp fall fall in the last 7 weeks. For example, the number of BDCs trading in the green for the week was 15, versus a measly 2 the week before at the height of the melting down process.

Two BDCs were up more than 3% this week and only 2% were down more than 3.0%. Yet, the week before the respective numbers were 0 and 16. The number of BDCS trading within 5% of their 52 Week Low increased slightly from 11 to 12. The number at the other end of the spectrum – within 5% of their 52 Week High- dropped to 2 from 3.

All Done

However, there’s no doubt that the BDC rally which began in March 2018 can be consigned to the history books.

As the BDC Sector’s self designated and unofficial historian, the BDC Reporter has the following highlights to record: This BDC rally began March 1, 2018 with BDCS at a nadir of $19.05. That was just a little more than 20% below the March 27, 2017 high of the prior BDC rally, which itself had begun more than a year earlier- in February 2018. That massive rally – which followed a market wide pullback – saw BDC prices going up from an intra-day low to an intra-day high 13 months later by 42%.

Smaller

This latest rally lasted a shorter time (just over 7 months) and only saw the BDCS needle move up a maximum of just over 10.0%.

As the chart shows – and as we’ve mentioned in the past – this latest rally moved up pretty steadily by BDC standards with only modest air pockets along the way.

For example, that drop between April and May, when BDCS almost returned to its starting point, was “only” (3.6%) over a 4 week period. As readers of this column will know we often had several weeks of higher BDC prices in a row and an ever broadening number of funds hitting new highs.

That Was Then

All of that ended, depending on the arbitrary rules we apply to rally watching, this week or last. With the benefit of hindsight, and the BDCS chart, we can see that the apex was reached on August 30, 2018.

Since then, and adjusting for the BDCS distribution along the way, the sector is down (5.8%) in price terms. That’s confirmed by the drop since late August in the Wells Fargo Index: down (5.4%). So much for the now-departed BDC rally.

Yet, as this supplementary chart shows, for those 6 upward trending months BDCS managed to beat – in price terms – the S&P 500 and the Dow Jones Index.

Snapshot

Let’s have a look at where the BDC Sector stands now, with earnings season just around the corner and after this fall from grace.

We are tracking 45 public companies, but will soon be down to 44 when FS Investment (FSIC) swallows up Corporate Capital Trust (CCT).

Sidebar

The Investment Advisor has been busy all week hounding shareholders to vote, but the ultimate outcome is not in doubt. However, both FSIC and CCT’s stock price have taken a hammering in recent weeks.

We felt compelled earlier in the week when FSIC hit a new 52 Week Low to bring the matter to readers attention, and speculate as to the causes.

At the time, FSIC had reached a new low of $6.73. Since then the BDC with high hopes and a huge balance sheet, has dropped to $6.66. We couldn’t help noticing – with Halloween coming up – that’s the sign of the devil! Make of that what you will.

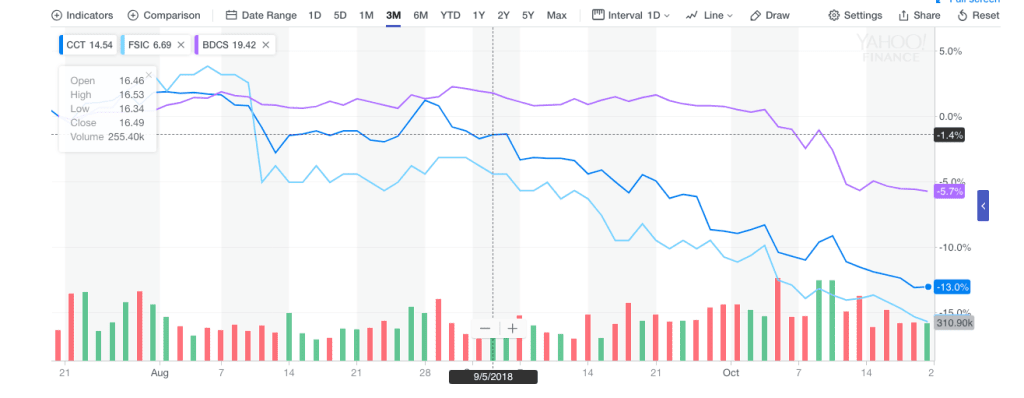

Both FSIC and CCT have been dropping like lead balloons for the past 3 months. As this chart shows – to which we’ve added BDCS for a sense of proportion – the soon-to-be-merged BDCs have dropped (13%-15%). BDCS – by contrast – was off (5.7%).

One Theory

One reader wrote to the BDC Reporter to suggest the FSIC price drop was related to the Board’s decision to seek shareholder approval – along with the merger – of issuing shares below book. We doubt that FSIC shareholders – a trusting lot – will say no, but we can’t imagine KKR-FS Investment cashing that blank cheque with the stock price trading 27% below book.

Judging by what happened to Fifth Street Finance and Medley Capital (MCC) in years gone by after picking that poisoned fruit, we’d expect the Investment Adviser duo to be wary of raising capital in that controversial way. But you never know. Hence – as my correspondent suggests – the drop in FSIC’s price.

Another Sidebar

Also reaching a 52 Week Low this week was THL Credit (TCRD), still smarting from multiple bad debts. Despite many promises of credit redress and multiple fee waivers from the TH Lee organization, investors continued to abandon ship in orderly fashion.

In just under 5 years, TCRD has managed to lose half of its market value, and the leakage in the BDC’s balloon does not seem to be repaired as yet. TCRD is trading 23% below book.

Most Everybody

In fact, and reflecting the new atmosphere that’s developed in the last few weeks, 38 of 45 BDCs are trading below book value. Just a few weeks ago 14 BDCs were trading at or above that magical level that investors sometimes use to assess market sentiment. Now the number is down to 7.

Other Data Points

Only 2 BDCs are trading in price above their 50 Day Moving Average and 13 above the 200 Day Moving Average. BDCS is trading (6.6%) below its year-end 2017 level, and (10.2%) below the 52 Week High.

You Must Remember This

We will be using stats like these as a reference point to determine where the BDC sector goes from here. Will we see an ever lower BDCS price and less and less BDCs trading above book and more and more pushing down towards 52 week lows? Or will there be a rebound as BDCs report earnings, especially if there is no unexpected deterioration in profits or credit?

Staying Calm Etc.

For our part, we remain relatively sanguine regardless of the agonizing shrieks from the BDC and broader markets. Although little new was learned this week, most BDCs continue to chug along from a performance standpoint.

Deep In the Weeds

We’re now tracking developments at over 1,000 BDC portfolio companies daily (1,149 to be specific) and have not noticed any systematic credit issues developing. In fact, over the month of October we’ve had news from three dozen companies, which has mostly been positive.

Fidus Investment Corporation (FDUS), TPG Specialty (TSLX), Capital Southwest (CSWC), Apollo Investment(AINV) and several other BDCs have received good news from their investments. The only material set-back we’ve encountered is the surprise bankruptcy of Francis Drilling Fluids, which we brought to readers attention earlier in the week.

The Sears bankruptcy has not had any material impact on BDC lenders as far as we can tell. Moreover, several Chapter 11 cases in which BDC-funded borrowers are involved coming to fruitful conclusions, based on what we’ve been learning.

Of course there could be new credit troubles we’ve not picked up on yet. We’ll be learning much more in the weeks ahead as third quarter filings come out.

Collateral Damage

However, what happens to BDC prices in the short term is likely to have much more to do with overall market sentiment. That’s always the case at times of high volatility and changing investor sentiment.

BDCs are not an island unto themselves and are not spared the rocking and the rolling that has been investors lot in recent weeks.

.png)