CAUTION AND PROFIT-TAKING kept Europe's investment-grade bonds with a slight edge over junk debt in today's trading. A mix of European economic data kept price swings channeled in fairly thin bands, as inflation took a downturn, GDP came in above forecast, and jobs data showed the lowest unemployment since '09. The oil-and-energy group fared well, giving important sector cues to corporate-bond traders, as Nymex oil prices hovered around $54 and BP PLC shares initially rose 3.6%. HoweverBNP Paribas weighed on the financial group, off 2.9% on disappointing quarterly revenue, while Weir Group PLC tanked 7.3%.

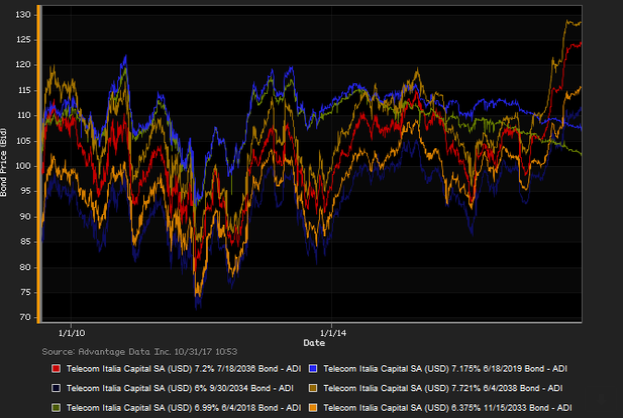

Investors shunned more risk for the most part, in trading of European corporate bonds today. Although the pan-European Stoxx 600 reflected sustained interest in speculative trades of stocks, bond traders kept an eye to details of this week's meetings of The Federal Reserve, The Bank of England, and The Bank of Japan. The last of these left its stimulus program unchanged, while trimming its forecasts for inflation.Attention to global political risk was also in the mix, amid scathing indictments 'across the pond' by special counsel Robert Mueller regarding involvements of former Trump aides with Russia. Meanwhile the oil-and-gas group looked very robust amid gains in Nymex crude oil and BP PLC shares (see above). Additional sector cues for bond traders were found in gains of Ryanair Holdings PLC shares, up over 5% at one point, while Croda International PLC added 3.6%, BNP Paribas was off 2.9%. ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for high-grade versus high-yield constituents. Investment-grade bonds edged out high-yield debt in net prices, as of 4 PMLondon time. Among European high-grade bonds showing a concurrence of top price gains at appreciable volumes, Santander UK PLC 2.875% 10/16/2020 made some analysts' 'Conviction Buy' lists. (See chart for Telecom Italia bonds, above.)

.png)