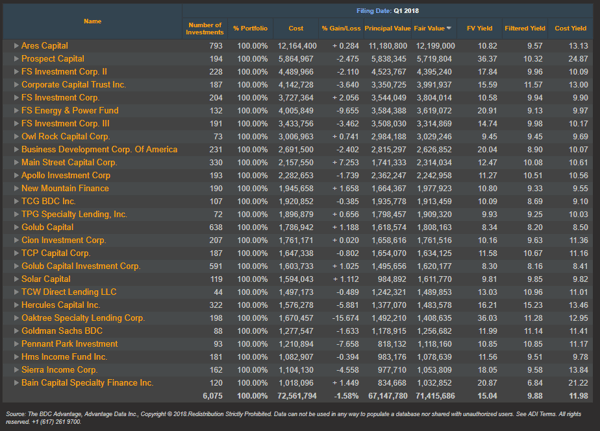

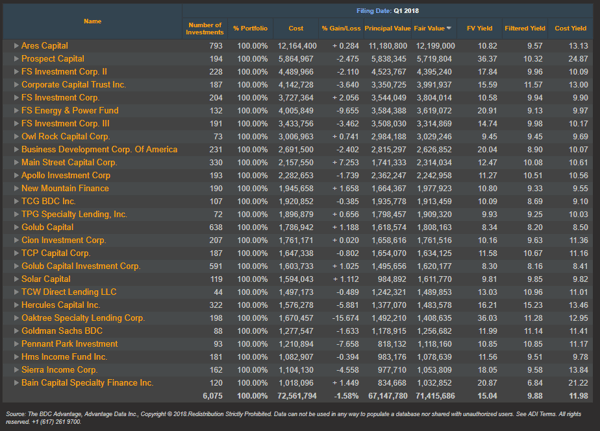

Below is the full list of public Business Development Companies found in AdvantageData's BDC Advantage. This post was originally published on October 18th, 2016. The contents on this post, and the business development companies herein, have been updated with the latest information available as of July 8, 2019. View an updated list as of November 2019 here.

| CIK |

Ticker |

AUM (FV) |

Name |

SEC URL |

| 1634452 |

|

211,693 |

AB Private Credit Investors Corp. |

|

| 1578620 |

ABDC |

213,749 |

Alcentra Capital Corp. |

|

| 1278752 |

AINV |

2,444,412 |

Apollo Investment Corp |

|

| 1287750 |

ARCC |

13,063,600 |

Ares Capital |

|

| 1633858 |

|

298,035 |

Audax Credit BDC Inc. |

|

| 1655050 |

BCSF |

1,913,609 |

Bain Capital Specialty Finance Inc. |

|

| 1379785 |

BBDC |

1,189,384 |

Barings BDC |

|

| 1326003 |

BKCC |

680,374 |

BlackRock Capital Investment Corporation |

|

| 1370755 |

TCPC |

1,631,580 |

BlackRock TCP Capital Corp. |

|

| 1736035 |

|

955,832 |

Blackstone / GSO Secured Lending Fund |

|

| 1490927 |

|

2,528,816 |

Business Development Corp. Of America |

|

| 17313 |

CSWC |

524,071 |

Capital Southwest Corporation |

|

| 1571329 |

CPTA |

455,390 |

Capitala Finance Corp. |

|

| 1534254 |

|

1,821,603 |

Cion Investment Corp. |

|

| 1578348 |

CMFN |

299,086 |

CM Finance Inc. |

|

| 1617896 |

|

179,230 |

Corporate Capital Trust II - T |

|

| 1633336 |

|

520,254 |

Crescent Capital BDC Inc. |

|

| 878932 |

EQS |

66,027 |

Equus Total Return |

|

| 1513363 |

FDUS |

670,481 |

Fidus Investment Corp |

|

| 1495584 |

SVVC |

201,526 |

Firsthand Technology Value Fund Inc. |

|

| 1701724 |

|

86,372 |

Flat Rock Capital Corp. |

|

| 1501729 |

|

3,713,949 |

FS Energy & Power Fund |

|

| 1637417 |

|

311,687 |

FS Investment Corp IV |

|

| 1525759 |

|

4,634,818 |

FS Investment Corp. II |

|

| 1579412 |

|

3,671,558 |

FS Investment Corp. III |

|

| 1422183 |

FSK |

7,440,200 |

FS KKR Capital Corp. |

|

| 1509892 |

GARS |

480,863 |

Garrison Capital |

|

| 1143513 |

GLAD |

387,720 |

Gladstone Capital Corp. |

|

| 1321741 |

GAIN |

624,172 |

Gladstone Investment Corporation |

|

| 1572694 |

GSBD |

1,405,097 |

Goldman Sachs BDC |

|

| 1683074 |

|

1,245,593 |

Goldman Sachs Middle Market Lending Corp. |

|

| 1674760 |

|

1,482,557 |

Goldman Sachs Private Middle Market Credit Corp. |

|

| 1476765 |

GBDC |

2,031,163 |

Golub Capital |

|

| 1715268 |

|

328,033 |

Golub Capital BDC 3 Inc. |

|

| 1627515 |

|

2,112,255 |

Golub Capital Investment Corp. |

|

| 1675033 |

GECC |

281,087 |

Great Elm Capital Corp. |

|

| 1509470 |

GSVC |

313,551 |

GSV Capital Corp. |

|

| 1618697 |

|

375,395 |

Guggenheim Credit Income Fund |

|

| 1661306 |

|

31,065 |

Hancock Park Corporate Income Inc. |

|

| 1559909 |

HCAP |

101,701 |

Harvest Capital Credit |

|

| 1280784 |

HTGC |

2,081,042 |

Hercules Capital Inc. |

|

| 1535778 |

|

1,122,774 |

Hms Income Fund Inc. |

|

| 1487428 |

HRZN |

266,152 |

Horizon Technology Finance Corp. |

|

| 1550913 |

|

100,373 |

Mackenzie Realty Capital Inc. |

|

| 1396440 |

MAIN |

2,496,591 |

Main Street Capital Corp. |

|

| 1490349 |

MCC |

612,500 |

Medley Capital Corp. |

|

| 1512931 |

MRCC |

596,945 |

Monroe Capital |

|

| 1742313 |

|

20,009 |

Monroe Capital Income Plus Corp |

|

| 1099941 |

MVC |

363,811 |

MVC Capital |

|

| 1496099 |

NMFC |

2,522,305 |

New Mountain Finance |

|

| 1588272 |

|

112,927 |

NexPoint Capital Inc. |

|

| 1414932 |

OCSL |

1,518,040 |

Oaktree Specialty Lending Corp. |

|

| 1577791 |

OCSI |

603,975 |

Oaktree Strategic Income Corp. |

|

| 1744179 |

|

169,986 |

Oaktree Strategic Income II Inc. |

|

| 1487918 |

OFS |

437,667 |

OFS Capital |

|

| 1297704 |

OHAI |

73,338 |

OHA Investment Corporation |

|

| 1655888 |

|

6,831,712 |

Owl Rock Capital Corp. |

|

| 1655887 |

|

921,261 |

OWL Rock Capital Corp. II |

|

| 1747777 |

|

623,711 |

Owl Rock Technology Finance Corp. |

|

| 1259429 |

OXSQ |

458,685 |

Oxford Square Capital Corp. |

|

| 1626899 |

|

61,792 |

Parkview Capital Credit Inc. |

|

| 1383414 |

PNNT |

1,274,979 |

Pennant Park Investment |

|

| 1504619 |

PFLT |

995,204 |

PennantPark Floating Rate Capital |

|

| 1372807 |

PTMN |

274,513 |

Portman Ridge Finance Corp. |

|

| 845385 |

|

39,932 |

Princeton Capital Corp. |

|

| 1287032 |

PSEC |

5,700,673 |

Prospect Capital |

|

| 81955 |

RAND |

32,491 |

Rand Capital Corp. |

|

| 1653384 |

|

312,427 |

Runway Growth Credit Fund Inc. |

|

| 1743415 |

|

53 |

SCP Private Credit Income BDC LLC |

|

| 1523526 |

|

941,787 |

Sierra Income Corp. |

|

| 1614173 |

|

33,263 |

Siguler Guff Small Business Credit Opportunities Fund Inc. |

|

| 1418076 |

SLRC |

1,750,247 |

Solar Capital |

|

| 1508171 |

SUNS |

467,673 |

Solar Senior Capital |

|

| 1551901 |

SCM |

517,412 |

Stellus Capital Investment Corp. |

|

| 1702510 |

|

696,897 |

TCG BDC II Inc. |

|

| 1544206 |

CGBD |

2,155,209 |

TCG BDC Inc. |

|

| 1603480 |

|

1,149,822 |

TCW Direct Lending LLC |

|

| 1715933 |

|

722,676 |

TCW Direct Lending VII LLC |

|

| 1577134 |

|

62,570 |

Terra Income Fund 6 Inc. |

|

| 1464963 |

TCRD |

497,564 |

THL Credit |

|

| 1521945 |

|

19,613 |

TP Flexible Income Fund Inc. |

|

| 1508655 |

TSLX |

1,824,861 |

TPG Specialty Lending, Inc. |

|

| 1580345 |

TPVG |

507,652 |

TriplePoint Venture Growth BDC Corp. |

|

| 1717310 |

|

98,305 |

Venture Lending & Leasing IX Inc. |

|

| 1557424 |

|

170,448 |

Venture Lending & Leasing VII Inc. |

|

| 1642862 |

|

394,754 |

Venture Lending & Leasing VIII Inc. |

|

| 1552198 |

WHF |

468,385 |

WhiteHorse Finance |

|

With BDC Advantage, users can view and download current and historical BDC’s holdings data and relevant analytics by seniority quickly and easily — all on one screen. Through the interactive platform users can manipulate and screen through schedules of investments from the top down or do in-depth individual security analysis.

All line items of the schedule of investments are standardized to one uniform format within 8 hours of the filing release. Investment data is fed through proprietary algorithms to generate security-level and portfolio level statistics. Investments are also mapped together to link exposure across the capital structure, link multiple BDCs’ exposure and look back through time to track changes historically.

AdvantageData’s mission is to provide extremely cost effective products that ease the burden of financial professionals. BDC Advantage aims to save users time and increase their team’s productivity. Stop spending hours aggregation quarterly filings; instead, spend that time turning data into deals.

.png)