Recent Posts

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

U.S. STOCKS STABILIZED ON Wednesday after two consecutive days of losses. The Dow Jones closed up 0.01% with the other two major indices falling for the third straight day. On the treasury side, there is some optimism regarding a trade deal between the U.S. and China which has decreased demand for U.S. treasuries, causing their yields to increase. 10-Year U.S. Treasury Notes rose 2.5 basis points. S&P -0.16%, Dow +0.01% , NASDAQ -0.26%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

U.S. STOCKS FELL FOR THE second consecutive day on Tuesday as trade tensions with China persist. The White House’s earlier threats to increase tariffs on Chinese imports appear to have escalated into an impending reality. Reactions today resulted in nearly a 500 point drop in the Dow Jones, which fell to 25,965. 10-Year U.S. Treasury Notes fell 3.3 basis points amid today's news. S&P -1.65%, Dow -1.79%, NASDAQ -1.96%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

U.S. STOCKS DROPPED MONDAY morning amid trade tensions with China. By mid-afternoon, most of the losses had been recovered, despite being down close to 500 points earlier in the day. Industrial and tech companies with exposure to China fared the worst, as shown by a 0.5% decline in the NASDAQ. 10-Year U.S. Treasury Notes fell 2.5 basis points.S&P-0.45%,Dow-0.25%,NASDAQ -0.50%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

JOBLESSNESS IN THE U.S. has fallen to 3.6%, marking the lowest level since December 1969. This is due in part to a shrinking labor force, but also indicates that the economy remains strong. The Dow Jones recovered well Friday after two days of significant loss, closing up 195 points. 10-Year U.S. Treasury Notes fell 1.5 basis points. S&P +0.96%, Dow +0.75%, NASDAQ +1.58%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

The Dow Jones continued to fall Thursday, dropping 122.35 points as the Federal Reserve refused to lower interest rates. Worker productivity in the U.S. is advancing at the fastest rate since 2010. Additionally, 10-year U.S. Treasury notes rose 3.6 basis points. S&P -0.21%, Dow -0.46%, NASDAQ -0.16%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

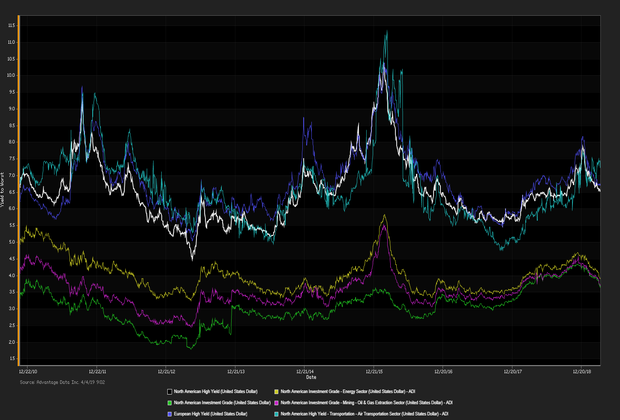

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)