UK ECONOMY LEANS ON CONSUMERS AS BREXIT DRAGS

ON BUSINESSES.

Britain’s economy only grew 1.4 percent in 2018, the weakest increase in

six years. Bank of England’s Governor,

Mark Carney, stated: “When the economy is reliant on consumers, growth becomes very one-dimensional.”

Bank of England has signaled not raising interest rates

allowing cheaper capital to circulate around the economy. The value of business investment lost in Britain’s economy since the June 2016 referendum is roughly 10 billion pounds. Business investment fell every quarter of 2018, the longest decline since the 2008 financial crisis. The

UK 10-year Gilt

increased two-basis points.

FTSE 100 -0.03%,

STOXX Europe 600

+0.14%,

CAC 40 +0.09%,

German DAX +0.18%.

TRADE NEGOTIATIONS between the EU and the United States will not be easy, “but both sides should benefit in the end,

German economy Minister Peter Altamaier

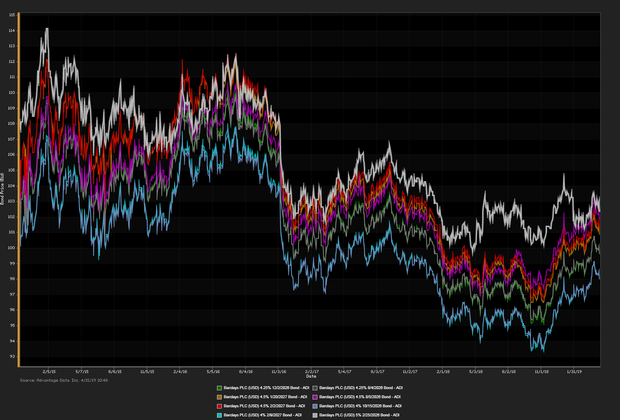

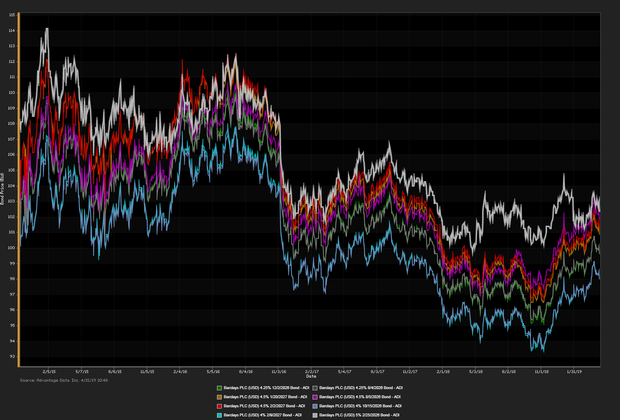

said on Monday." The goal is to reduce tariffs to zero and ultimately fend off a trade conflict. Negotiations will commence later this week and will continue for the upcoming months. Among European high-yield bonds showing a concurrence of top price gains at appreciable volumes traded,

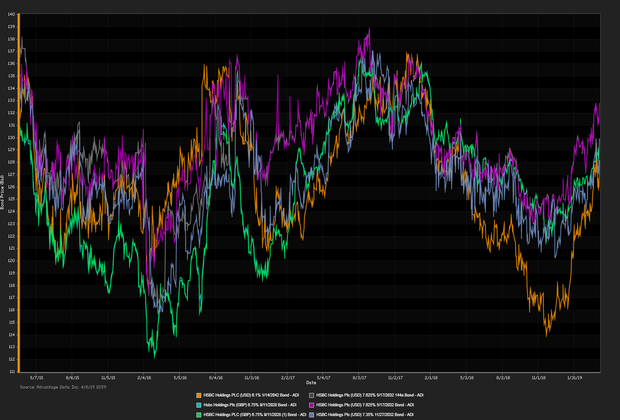

Barclays PLC (USD) 4.375% 9/11/2024 made some analysts' 'Conviction Buy' lists. (See the chart for

Barclays PLC bonds

below).

Niral Mehta (

nmehta@advantagedata.com).

Sovereign-Debt Snapshot

| Country |

Maturity (Y) |

Yield (%) |

Previous (%) |

Spread (bp) |

| Australia |

10 |

1.893 |

1.869 |

-66.5 |

|

| Belgium |

10 |

0.495 |

0.434 |

-206.2 |

|

| France |

10 |

0.402 |

0.334 |

-215.5 |

|

| Germany |

10 |

0.059 |

-0.007 |

-249.9 |

|

| Italy |

10 |

2.395 |

2.372 |

-16.2 |

|

| Japan |

10 |

-0.048 |

-0.059 |

-260.5 |

|

| Netherlands |

10 |

0.134 |

0.073 |

-242.3 |

|

| Portugal |

10 |

1.169 |

1.130 |

-138.8 |

|

| Spain |

10 |

1.053 |

1.009 |

-150.4 |

|

| Sweden |

10 |

0.264 |

0.228 |

-229.3 |

|

| U.K. |

10 |

1.214 |

1.150 |

-134.3 |

|

| U.S. |

10 |

2.557 |

2.498 |

... |

Credit-Default Swap Market

LATEST NEWS:

Top moves, sovereign tighteners (5Y): Belgium 23 bp and Finland 12 bp. Sovereign wideners (5Y): France 27 bp and China 41 bp.

New Issuance

| New Issues |

New Issues [Continued] |

| 1. Basellandsch KTBK (CHF) 0.375% 5/13/2030 (04/15/2019):180MM Senior Unsecured Notes, Price at Issuance 100.865, Yielding .3%. |

|

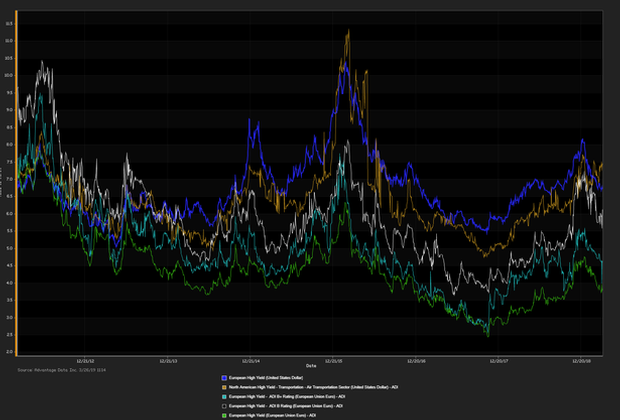

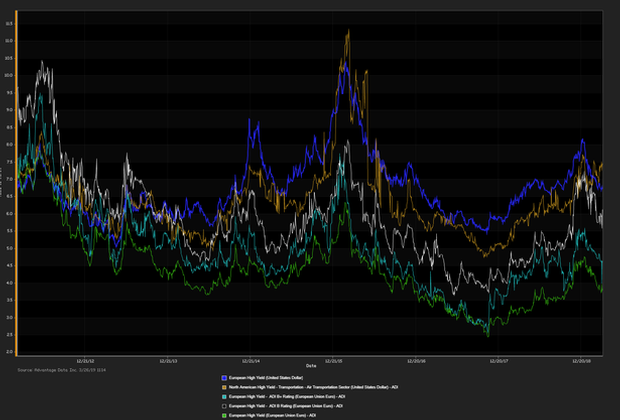

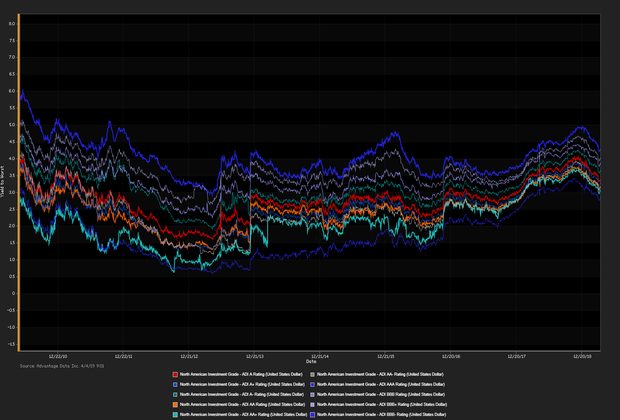

ADI Indexes

DATA CHECK:

| iShares Core EUR UCITS |

iShares Euro High Yield UCITS |

| NAV as of 04/15/2019, 131.30 |

NAV as of 04/12/2019, 104.39 |

| Daily NAV Change (%) -0.02% |

Daily NAV Change (%) +0.05% |

OVERALL EUROPEAN CREDIT MARKET:

The euro-zone economy shows signs of positive momentum, although conditions are expected to deteriorate hindered by the termination of quantitative easing, weakening credit rating quality, and uncertainty regarding the outcome of Brexit. Closely watched indicators and rates:

- Eurostat's unemployment rate: currently 7.8% (seasonally adjusted, February 2019)

- Eurostat's quarterly GDP: 0.2% (2018 Q3 Final)

- 6-month Euribor: current value -0.232%, as of 04/12/2019

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

GERMAN GOVERNMENT EXPECTS THE ECONOMY TO GROW BY 0.5 PERCENT THIS YEAR, LOWER THAN A RECENT ESTIMATE OF 0.8. German Finance Minister mentioned, “

The economy is losing momentum but still growing, with private consumption and state spending expecting to support overall growth this year.”

Unresolved trade disputes, Brexit uncertainty and a sluggish world economy have hit foreign demand and hurt manufacturers.

Stricter pollution standards are challenging the country’s car manufacturers, a critical component of their GDP. If

the slowdown worsens, it will put pressure on the ECB to provide more

stimulus for the Eurozone economy. The

UK 10-year Gilt

increased six-basis points.

FTSE 100 -0.14%,

STOXX Europe 600

+0.11%,

CAC 40 +0.33%,

German DAX +0.54%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EU GRANTS BRITAIN SIX MORE MONTHS TO LEAVE THE BLOC

EXTENDING THE DEADLINE INTO OCTOBER, ALTHOUGH, IT COULD HAPPEN QUICKER ACCORDING TO THERESA MAY.

“There is huge frustration from many people that I had to request this extension, but it was the logical thing to do,” stated Theresa May. German Chancellor, Merkel mentioned, “An orderly exit by Britain can be best ensured if we

prolong the duration of a deal.” The ECB will keep its monetary policy as accommodative as possible to ensure positive growth across the economy. The

ECB hinted they will leave interest rates unchanged amid trade tensions and uncertainty around

Brexit. The

UK 10-year Gilt

increased five-basis points.

FTSE 100 -0.09%,

STOXX Europe 600

+0.13%,

CAC 40 +0.83%,

German DAX +0.34%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

News,

Syndicated Bonds,

research,

EU,

market update,

European

EUROZONE’S GOVERNMENT BOND AND EQUITIES MARKETS RALLIED, WHILE THE EURO DECLINED AFTER THE ECB CHIEF MARIO DRAGHI WARNED THAT THE ECONOMY FACES MANY HEADWINDS. The ECB remains

dovish on the outlook for inflation as it sees further depreciation over the upcoming months.

Germany’s benchmark 10-year bond yield fell to a one-week low of minus 0.038 percent and the

French 10-year bond yields fell 3 bps, resulting in higher bond prices. The ECB and Bank of England have

implemented “swap-lines” in place to offer each other’s currencies in banks in their respective jurisdictions if money markets freeze up. European Union leaders

will

grant Prime Minister Theresa May a “second delay to Brexit at an emergency summit; timeframe and terms have not been disclosed.” The

UK 10-year Gilt

declined one-basis point.

FTSE 100 -0.03%,

STOXX Europe 600

+0.26%,

CAC 40 +0.26%,

German DAX +0.51%.

Read More

Topics:

Analytics,

bonds,

bond market,

market analytics,

News,

research,

EU,

market update,

European

“

UK ECONOMY TO LOSE 3.5 PERCENT OF GDP IN NO-DEAL BREXIT,” STATED THE IMF. The increase in trade barriers has a

detrimental

impact on UK foreign domestic demand. The

IMF downgraded

its

forecast for economic growth in Britain this year to 1.2 percent from a forecast of 1.5 percent, the weakest since 2009.

Britain could suffer a

loss of 2-3 years of positive GDP if it departs the EU without a deal. The downward revisions reflect the negative effect of

prolonged uncertainty about the Brexit outcome. BoE stated, “We are ready to take

a cautious, data-dependent approach

to monetary policy.” The

UK 10-year Gilt

declined one basis point.

FTSE 100 -0.35%,

STOXX Europe 600

-0.47%,

CAC 40 -0.65%,

German DAX -0.94%.

Read More

Topics:

Analytics,

bonds,

bond market,

market analytics,

News,

research,

EU,

market update,

European

WEAK TRADE DATA CASTING DOUBT ON GERMANY’S ECONOMIC

STRENGTH

. German exports and imports declined more than expected in February dropping by an aggregate of 1.3 percent

in February. German exporters are suffering from a

slowing world economy, trade disputes and Brexit angst.

The trade surplus edged up to

18.7 billion euros

from a

revised 18.6 billion euros the previous month. German industrial orders fell by the biggest margin in more than two years.

Brexit deadline is looming and a “no-deal Brexit makes no sense and is the worst possible solution,”

stated European Agriculture Commissioner, Phil Hogan. The

UK 10-year Gilt

declined one-tenth of a basis point.

FTSE 100 +0.07%,

STOXX Europe 600 -0.19%,

CAC 40 +0.38%,

German DAX -0.39%.

Read More

Topics:

Analytics,

bonds,

bond market,

market analytics,

News,

research,

EU,

market update,

European

UK HEADED FOR A DOWNTURN AS BREXIT WORRIES

NEGATIVELY

IMPACT SERVICES SECTOR. The PMI, a barometer of the economy’s health

tumbled to 48.9 in March from 51.3 in February, inducing the sterling to dip to $1.3156.

“A stalling of the economy in the first quarter will create further

stress on the second quarter unless demand revives suddenly, which seems highly improbable with

Brexit looming,” mentioned IHS Markit. “In a no-deal scenario, both the EU and the UK would face a challenge of protecting their single markets,” mentioned

European Commissioner, Pierre Moscovici. The UK 10-year Gilt

increased

seven basis points.

FTSE 100, +0.23%,

STOXX Europe 600 +0.

91%,

CAC 40 +0.76%,

German DAX +1.68%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

News,

research,

EU,

market update,

European

BANK OF ENGLAND TO EXTEND BREXIT LIQUIDITY AUCTIONS

UNTIL END OF JUNE, providing smooth

market conditions given Britain leaves the European Union. “

The bank will continue to monitor growth

and market liquidity on a daily basis, and stands ready to take additional action if necessary.” The EU has placed a series of

contingency measures

to deal with a no-deal Brexit; including a

temporaryrecognition of Britain-based clearing houses which processes multi-trillion euro

derivatives transactions. The

euro fell below $1.12 as U.S. economic data outperforms expectations. The pound fell half a percent after lawmakers rejected four

Brexit proposals. The UK 10-year Gilt declined

four basis points.

FTSE 100, +1.08%,

STOXX Europe 600 +1.

68%,

CAC 40 +0.41%,

German DAX +0.77%.

Read More

Topics:

Analytics,

bonds,

bond market,

market analytics,

News,

research,

EU,

market update,

European

DEUTSCHE BANK TURNS BEARISH ON THE STERLING AS BREXIT

CHAOS DEEPENS. The

bank has raised its estimate for the chances of a no-deal

Brexit to 25 percent from 20 percent. Brexit uncertainty has cost the European Union

600 million pounds per week since the 2016 referendum. It has cost the world’s fifth largest economy nearly

2.5 percent of GDP, inducing larger economic output losses compared to other countries. Eurozone inflation

declined, adding to the pressure on the

ECB as it battles economic slowdown. Although—wages

are rising and employment is at a record high, consumer prices have repeatedly disappointed. “It is likely to remain well

below the ECB’s inflation target of close to 2 percent over the rest of the year." The UK 10-year Gilt increased

four basis points.

FTSE 100, +0.54%,

STOXX Europe 600 +1.

23%,

CAC 40 +1.06%,

German DAX +1.37%.

Read More

Topics:

Analytics,

bonds,

bond market,

market analytics,

News,

research,

EU,

market update,

European

BRITAIN AGREED WITH THE EU TO DELAY BREXIT FROM THE ORIGINALLY PLANNED MARCH 29 UNTIL APRIL 12. A

further delay is imminent until May 22 “if the withdrawal agreement is approved this week,” House of Commons Leader, Andrea Leadson. The

volatility of the crisis had led investors fatigued over uncertainty, creating an unstable market. Britain’s financial regulators have given

European Union banks,

insurers and asset managers ample time to prepare for a no-deal Brexit.

Trade in a host of countries will take a hit creating import and export barriers if there is no

transition deal in place. The UK 10-year Gilt decreased

one basis point.

FTSE 100, +0.50%,

STOXX Europe 600 +0.48%,

CAC 40 +0.83%,

German DAX +0.75%.

Read More

Topics:

Analytics,

bonds,

bond market,

market analytics,

research,

EU,

market update,

European

.png)