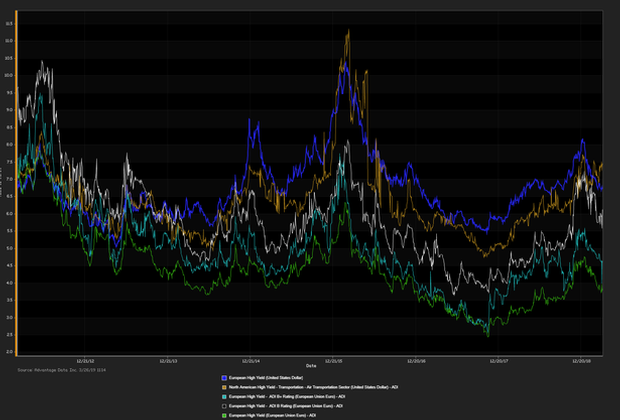

EUROPEAN INVESTMENT GRADE BONDS EDGED OUT HIGH YIELD DEBT in net prices linked to actual trades. In a report

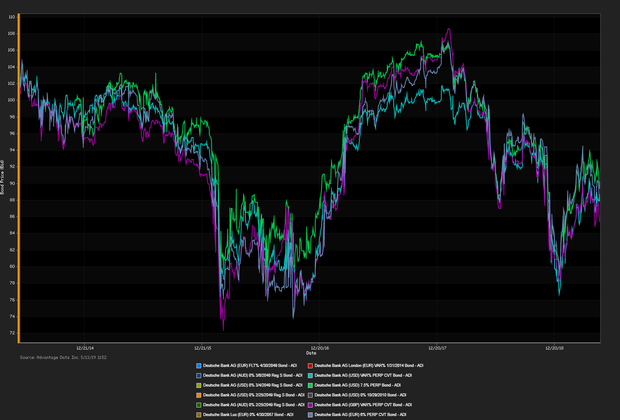

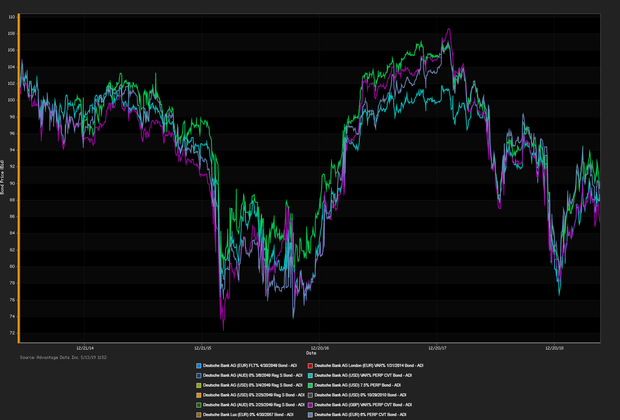

Deutsche Bank predicts Germany’s economy will deteriorate

despite solid growth in the first quarter citing

“several special factors”

including weak auto demand abroad and escalating global trade tensions. The

10-year

Gilt rose 2.3 basis points.

F

TSE 100 +0.16%,

German DAX +0.88%,

CAC 40+0.38%,

STOXX Europe 600

+0.52%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

INFLOWS TO EUROPEAN FIXED INCOME ETFs significantly

outweighed its equity counterparts

in April, absorbing 4.3 billion euros accounting for

20.2 percent of inflows year-to-date.

Equities settled lower as trade fears were reignited and Brexit uncertainty looms,

F

TSE 100 -0.56%,

German DAX -1.51%,

CAC 40

-1.43%,

STOXX Europe 600

-1.03%. The

10-year

Gilt gained 2.6 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN INVESTMENT GRADE BONDS EDGED OUT its high yielding counterparts in net prices linked to actual trades.

Equities settled lower as trade fears were reignited and Brexit uncertainty loom.

F

TSE 100 -0.07%,

German DAX -0.44%,

CAC 40

-0.11%,

STOXX Europe 600

-0.33%. The

10-year

Gilt lost 3.5 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROZONE TRADE SURPLUS with the US contracted in March, meanwhile widened with China. The trade surplus on a seasonally adjusted basis

decreased to 17.9 billion euros

in March from 20.6 billion February.

Equities settled higher

upon easing fears regarding a trade war,

F

TSE 100 +0.50%,

German DAX +1.51%,

CAC 40

+1.08%,

STOXX Europe 600

+1.06%. The

10-year

Gilt dipped 0.5 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

UNICREDIT PROGRESSES FORWARD with its plans to place a bid for

Germany’s Commerzbank

in a deal worth an estimated 9.3 billion euros,

Commerzbank shares spiked 4.7 percent. The German government will have to approve any merger given their

15 percent stake in the bank originating from a bailout in 2008. The

10-year

Gilt lost 3.4 basis points.

F

TSE 100 +0.70%,

German DAX +0.75%,

CAC 40 +0.33%,

STOXX Europe 600

+0.27%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

INVESTMENT GRAD EUROPEAN BONDS EDGED OUT HIGH YIELD DEBT

in net prices linked to actual trades. European

equities bounce back

following optimism from the US saying a trade deal will eventually be achieved with China,

“

We'll let you know in about three or four weeks whether or not it was successful”

. The

10-year

Gilt rose 0.6 basis points.

FTSE 100 +1.09%,

German DAX +0.97%,

CAC 40 +1.50%,

STOXX Europe 600

+1.01%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

RISK-OFF SENTIMENT PREVAILED ON MONDAY IN EUROPEAN MARKETS as trade tensions

intensified over the weekend

after China announced an

increase in tariffs to 25 percent

for goods exported to the US. France’s economy is

expected to expand at a consistent rate

in the second quarter of 2019 with

GDP forecasted to grow 0.3 percent. The

10-year

Gilt rose 3.6 basis points.

FTSE 100 -0.48%,

German DAX -1.30%,

CAC 40

-1.20%,

STOXX Europe 600

-1.13%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

BRITAIN’S ECONOMY EXPANDED IN THE FIRST THREE MONTHS OF 2019

as businesses prepared for Brexit delivering orders before the deadline.

GPD grew at an annual rate of 2 percent

compared to the previous quarter of 0.9 percent.

German exports bounced

back at rapid pace soaring 1.5 percent month-over-month in March,

exceeding analyst expectations.

The

10-year

Gilt rose 0.6 basis points. Equities settled higher on the positive economic placing trade concerns on the backburner,

FTSE 100 +0.14%,

German DAX +0.86%,

CAC 40 +0.41%,

STOXX Europe 600

+0.43%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN SHARES PLUMMETED ON THURSDAY AMID escalating trade

tensions

between U.S. and China. Beijing announced they would retaliate taking

"necessary countermeasures" sending European automaker stocks lower.

Shares of BMW and Daimler

sank 3 percent. The

10-year

Gilt dipped 1.2 basis points.

FTSE 100 -0.87%,

German DAX -1.69%,

CAC 40 -1.93%,

STOXX Europe 600

-1.64%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN MARKETS WAVERED ON WEDNESDAY struggling for direction amid

escalating global trade tensions. “Now we’re left wondering

whether it will happen at all

and what impact more tariffs will have on the

global economy

and markets.

The next few days could be massive.” Craig Erlam market analyst at Oanda in London. The

British pound

edged 0.47 percent lower against the dollar. The

10-yearGilt dipped 2.3 basis points.

FTSE 100 +0.18%,

German DAX +0.86%,

CAC 40 +0.41%,

STOXX Europe 600

+0.19%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

.png)