EUROZONE ECONOMY EXPANDED in the first quarter of 2019 accelerating by 0.4 percent

driven predominantly by household spending. Despite the strong performance in the first quarter, the outlook for the

second quarter remains gloomy

as indexes continue to trade in

a vigilant fashion. The

pound slipped 0.33 percent against the euro. The

10-year

Gilt lost 3.1 basis points.

FTSE 100 +0.49%,

German DAX -0.36%,

CAC 40

-0.34%,

STOXX Europe

600

-0.07%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

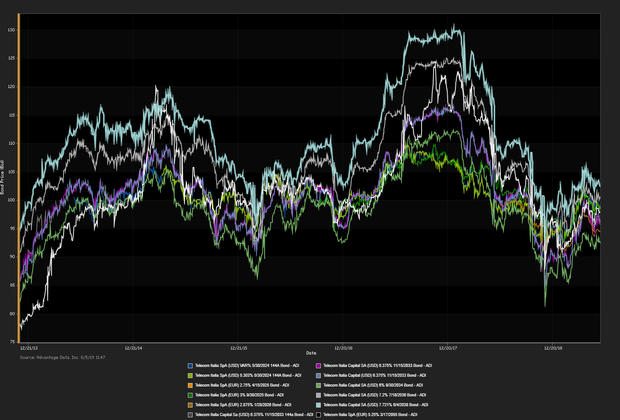

IN BRUSSELS THE EUROPEAN COMMISSION DECLARED Italy’s ballooning debt will

violate the agreed budget

potentially leading to the EU

imposing sanction

on the state. The EU made known Italy’s economy is deteriorating

, "When we look at the Italian economy, we are seeing the damage recent policy choices are doing". In addition, on Wednesday the IMF

advised Italy presents a “major risk”

to the Euro. The

10-year

Gilt sank 3.5 basis points.

FTSE 100 +0.08%,

German DAX +0.08%,

CAC 40 +0.45%,

STOXX Europe

600

+0.38%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

UK CONSTRUCTION ACTIVITY SUDDENLY CONTRACTED IN May to 48.6 falling short of expectations and Aprils record high of 50.5.

“Commercial building remained hardest-hit by Brexit uncertainty, with construction firms reporting the steepest fall in this category of activity since September 2017.” Construction and engineering firms are

taking a significant

hit

as Brexit uncertainties persist along with a weak economic outlook. The

10-year

Gilt rose 3.9 basis points.

F

TSE 100 +0.38%,

German DAX +1.53%,

CAC 40

+0.54%,

STOXX Europe 600

+0.58%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

THE EUROPEAN COMMISSION IS PROBING AN ANTITRUST CASE where Spotify claims

Apple’s 30 percent App Store fee is unfair

and the

restriction on third-party developers

from communicating with customers is unnecessary. Three years ago European Competition Commissioner Margrethe Vestager

demanded Apple repay 13 billion euros

to Ireland following an

illegal tax incentive deal. The

10-year Gilt declined 2.5 basis points.

F

TSE 100 +0.30%,

German DAX +0.42%,

CAC 40

+0.52%,

STOXX Europe 600

+0.30%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

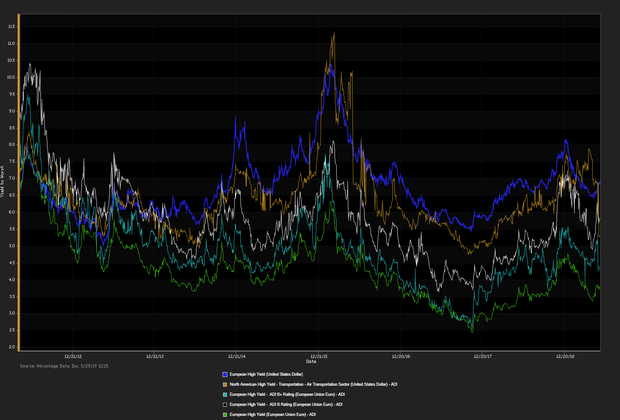

NEARLY HALF OF EURO GOVERNMENT DEBT is yielding less than zero percent, the Netherlands is the latest country to see negative yields. The proportion of

negative yielding debt

hit its highest level since September 2016

tallying $3.71 trillion euros or 48 percent. Elevated trade tensions, Brexit uncertainty, and fears over Italy’s budget resulted in the

accelerating trend. The

10-year

Gilt fell 2.1 basis points.

F

TSE 100 -0.91%,

German DAX -1.58%,

CAC 40

-1.14%,

STOXX Europe 600

-1.05%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

TRADING REVENUES SLIPPED FROM THE 12 LARGEST GLOBAL INVESTMENTS BANKS in March hindered by a steep decline in

trading government paper. Revenues from trading Government debt are

down 12 percent

year-over-year due to

lackluster rates

in the Asian and European Markets. The

10-year Gilt advanced 0.7 basis points.

F

TSE 100 +0.55%,

German DAX +0.48%,

CAC 40

+0.42%,

STOXX Europe 600

+0.41%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

AMIDST BREXIT CONCERNS, high import levels coupled with weak market demand

in Europe has lead Arcelor Mittal to

cut back it's steel making plants

in France and Germany. Additionally, in a recent study conducted by the CBI, firms in the

service sector reported weaker profits

in recent month.

Brexit

"paralysis"

is continuing to take a toll on the UK's service firms as stated by the CBI's deputy chief economist Anna Leach.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

ECONOMIC SENTIMENT ROSE IN MAY

surpassing expectations

rebounding after 10 consecutive months of declines; the indicator improved to 105.1 in May from 103.9 in April.

In France,

consumer

confidence hit a one-year-high

reflecting households’ positive personal financial situations, meanwhile in

Germany Europe’s largest economy, confidence dipped. The

10-year

Gilt slipped 2.8 basis points.

F

TSE 100 +0.11%,

German DAX -0.11%,

CAC 40

-0.18%,

STOXX Europe 600

-0.04%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

THE EUROPEAN CENTRAL BANK IS CONCERNED with the unexpected slow growth the Eurozone has experienced and in response plans to

stimulate growth

by implementing

a loan program to banks. Banks will be given loans with

generous terms

knows as targeted longer-term refinancing operations or

TLTRO’s. The

pound sterling fell

to its lowest levels against the euro since the 2008 financial crisis,

“Investors should not be complacent about the threat of a no-deal exit”. The

10-year

Gilt dipped 6.1 basis points.

F

TSE 100 -1.66%,

German DAX -1.74%,

CAC 40

-1.91%,

STOXX Europe 600

-1.52%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN INVESTMENT GRADE BONDS HELD AN EDGE against its high yielding counterparts in net prices linked to actual trades. London housing prices continue to slump as Brexit uncertainty looms,

prices are expected to further decline 2 percent in London

this year in London. Despite the concerns surrounding Brexit

“The UK market has remained remarkably resilient”.

UK inflation

rose slower than anticipated in

April increasing 2.1 percent

versus an expected rise of 2.2 percent. The

10-year

Gilt sank 6.7 basis points.

F

TSE 100 +0.21%,

German DAX +0.22%,

CAC 40

-0.03%,

STOXX Europe 600

-0.02%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

.png)