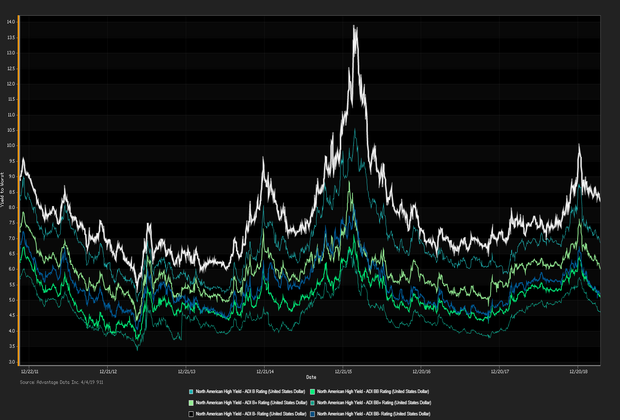

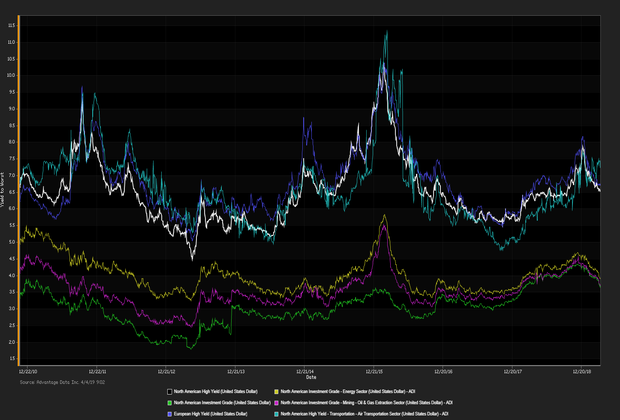

HIGH-YIELD DEBT ROSE AGAINST INVESTMENT GRADE BONDS in net prices linked to actual trades. Treasury yields ticked higher resulting in a steeper curve as crude oil prices push higher, the two often move hand in hand. In addition, the spread between the two and 10-year note widened 1.3 basis points. 10-year Treasury note rose 0.2 basis points. S&P -0.01%, DOW -0.22%, NASDAQ +0.07%

EXISTING U.S. HOME SALES PLUMMET 4.9 PERCENT IN MARCH to start the spring selling season off on a low note. The underlining issue remains with the

lack of affordable inventory

causing the slowdown. Doug Duncan, chief economist at Fannie Mae states “

There simply isn’t supply at the entry level where people actually want to buy”. Crude oil soared 2.59 percent as the U.S. announced the

termination of waivers

for countries to import Iranian oil. U.S. Secretary Mike Pompeo declared

“U.S. will not issue any exception to Iranian oil importers,”

currently

eight countries have waivers

expiring May 2.

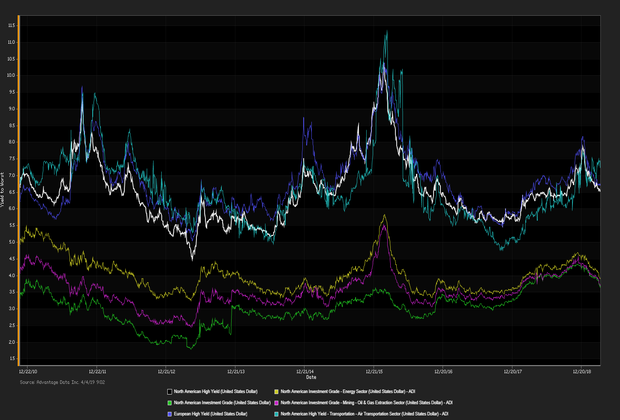

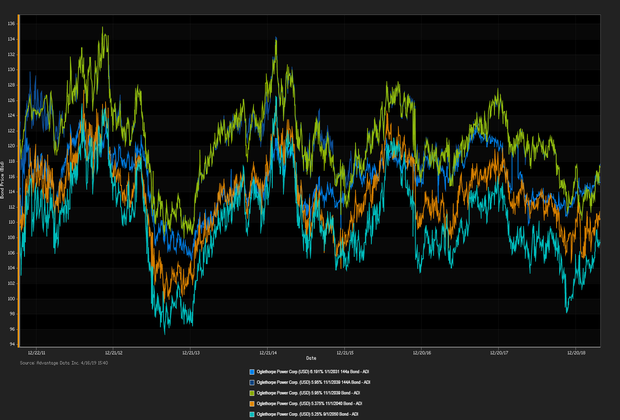

ADI proprietary index data showed a net

yield increment for high-yield versus high-grade bonds.

High-yield edged out high-grade. Among high-yield bonds showing topmost price gains at appreciable volumes traded,

Lennar Corp. (USD) 4.75% 4/1/2021

made analysts' 'Conviction Buy' lists. (See the chart for

ADI indices above.)

Corey Mahoney

cmahoney@advantagedata.com).

| Key Gainers and Losers |

Volume Leaders |

| + |

Quest Diagnostics Inc. 4.75% 1/30/2020 |

+ 0.0% |

| |

Boston Properties Inc. 3.85% 2/1/2023 |

+ 0.2% |

| - |

Toyota Motor Credit Corp. 1.95% 4/17/2020 |

-0.1% |

|

CVS Health Corp. 4.3% 3/25/2028

Toronto-Dominion Bank 2.125% 4/7/2021

|

| Industry Returns Tracker |

| Industry |

Past Day |

Past Week |

Past Month |

Past Quarter |

YTD |

Past Year |

| Agriculture, Forestry, Fishing |

0.17% |

-0.30% |

1.28% |

4.20% |

4.56% |

4.57% |

| Mining |

0.14% |

0.17% |

1.82% |

4.79% |

6.06% |

4.85% |

| Construction |

0.14% |

0.06% |

1.31% |

3.74% |

4.00% |

4.50% |

| Manufacturing |

0.11% |

-0.08% |

1.31% |

3.77% |

4.14% |

4.10% |

| Transportion, Communication, Electric/Gas |

0.20% |

0.11% |

1.83% |

4.98% |

5.32% |

5.45% |

| Wholesale |

0.12% |

0.05% |

1.30% |

4.13% |

4.89% |

4.10% |

| Retail |

0.09% |

-0.07% |

1.25% |

4.07% |

4.32% |

4.41% |

| Finance, Insurance, Real-Estate |

0.09% |

-0.05% |

0.88% |

3.26% |

3.59% |

4.80% |

| Services |

0.08% |

-0.12% |

1.09% |

3.39% |

3.85% |

4.88% |

| Public Administration |

0.04% |

-0.04% |

0.32% |

1.22% |

1.04% |

3.47% |

| Energy |

0.17% |

0.10% |

1.78% |

5.05% |

6.11% |

5.33% |

| |

| Total returns (non-annualized) by rating, market weighted. |

|

| New Issues |

New Issues [Continued] |

|

(None Current 04/22/2019)

|

|

Additional Commentary

NEW ISSUANCE WATCH: on 4/17/19 participants welcome a $1500MM new corporate-bond offering by

Bank of America Corp.

The most recent data showed money flowed out of high-yield ETFs/mutual funds for the week ended 4/18/19, with a net inflow of $1.1B, year-to-date $14.4B flowed into high-yield.

| Top Widening Credit Default Swaps (CDS) |

Top Narrowing Credit Default Swaps (CDS) |

Hertz Corp. (5Y Sen USD XR14)

Hovnanian Enterprises Inc. (5Y Sen USD MR14) |

SuperValu Inc. (5Y Sen USD XR14)

San Miguel Corp. (5Y Sen USD CR14) |

Loans and Credit Market Overview

SYNDICATED LOANS HIGHLIGHTS:

Deals recently freed for secondary trading, notable secondary activity:

- Prysmian, Project Maple II BV, Trade Me Group LTD, Jane Street, Six Flags Inc.

Long-term bond yields are expected to hit a cyclical peak in 2019 given tight fiscal policy and lagging global economies. Europe remains checked by stubbornly low inflationary forces. Positive effects remained in force:

- TED spread held below 17 bp (basis points), as of 04/22/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

Read More

Topics:

High Yield,

Investment Grade,

Loans,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

New Issues,

Finance,

Fixed Income,

News,

Syndicated Bonds,

syndicated,

research,

market update

JUNK BONDS SLIGHTLY EDGED OUT INVESTMENT-GRADE DEBT in net prices linked to actual trades. Equities slip as healthcare stocks took a significant hit on Wednesday amid the developing political environment surrounding healthcare. UnitedHealth plummeted 7 percent in the past two days alone despite an earnings beat on Tuesday. 10-year Treasury note rose 0.2 basis points S&P -0.19%, DOW+0.06%, NASDAQ -0.05%

U.S. TRADE DEFICIT CONTRACTS TO AN EIGHT MONTH LOW in February as

imports from China narrowed 3.4 percent

. Economist suspect a trade deficit will remain high

,

“Even if trade negotiations are resolved in such a way as to reduce the bilateral trade deficit with China…[it] would likely divert trade flows to other countries”.

The labor market remains strong, “

Wages grew moderately

in most districts for both skilled and unskilled workers, with only three reporting slight growth in workers’ pay”.

Pinterest is targeting an IPO price of $19

a share and will begin trading on Thursday $2 above the high end of the range.

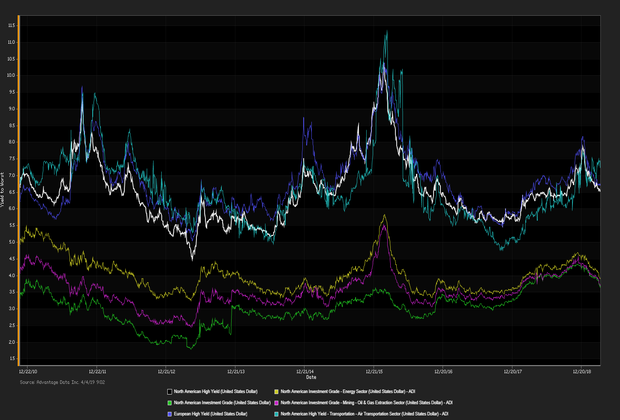

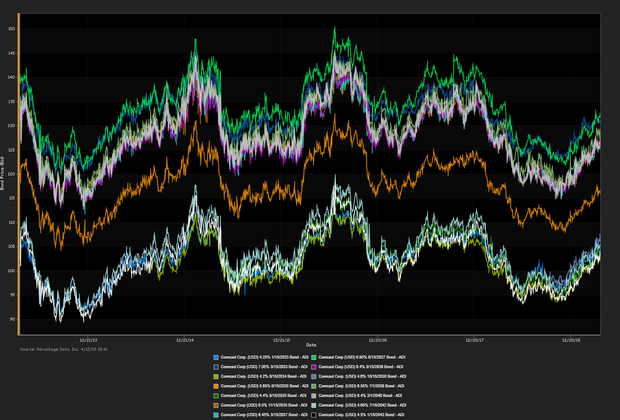

ADI proprietary index data showed a net

yield increment for high-yield versus high-grade bonds.

High-yield edged out high-grade. Among high-yield bonds showing topmost price gains at appreciable volumes traded,

Albertsons Inc (USD) 7.45% 8/1/2029

made analysts' 'Conviction Buy' lists. (See the chart for

ADI indices above.)

Corey Mahoney

cmahoney@advantagedata.com).

| Key Gainers and Losers |

Volume Leaders |

| + |

GE Capital Intl. Funding Co. 4.418% 11/15/2035 |

+ 0.0% |

| |

Comcast Corp. 4.7% 10/15/2048 |

+ 0.7% |

| - |

Bank of America Corp. 3.124% 1/20/2023 |

-0.1% |

|

JPMorgan Chase & Co. 3.964% 11/15/2048

CVS Health Corp. 4.1% 3/25/2025

|

| Industry Returns Tracker |

| Industry |

Past Day |

Past Week |

Past Month |

Past Quarter |

YTD |

Past Year |

| Agriculture, Forestry, Fishing |

-0.30% |

0.03% |

1.16% |

4.34% |

4.45% |

4.44% |

| Mining |

-0.15% |

0.14% |

1.72% |

4.73% |

5.83% |

4.56% |

| Construction |

-0.14% |

-0.21% |

1.05% |

3.46% |

3.59% |

4.33% |

| Manufacturing |

-0.10% |

0.01% |

1.27% |

3.78% |

4.04% |

3.95% |

| Transportion, Communication, Electric/Gas |

-0.13% |

-0.02% |

1.77% |

4.89% |

5.19% |

5.15% |

| Wholesale |

-0.04% |

0.13% |

1.24% |

4.15% |

4.85% |

4.20% |

| Retail |

-0.07% |

-0.03% |

1.24% |

4.02% |

4.19% |

4.25% |

| Finance, Insurance, Real-Estate |

-0.10% |

-0.05% |

0.81% |

3.21% |

3.49% |

4.56% |

| Services |

-0.07% |

-0.02% |

1.20% |

3.63% |

3.94% |

4.70% |

| Public Administration |

-0.06% |

-0.12% |

0.26% |

1.00% |

0.95% |

3.25% |

| Energy |

-0.19% |

0.05% |

1.65% |

4.95% |

5.89% |

5.03% |

| |

| Total returns (non-annualized) by rating, market weighted. |

|

| New Issues |

New Issues [Continued] |

| 1. PNC Financial Services Group Inc. (USD) 3.45% 4/23/2029 (04/16/2019): 1500MM Senior Unsecured Notes, Price at Issuance 99.84, Yielding 3.47%. 2. Wal-Mart Stores Inc. (USD) 3.05% 7/8/2026 (04/16/2019): 1250MM Senior Unsecured Notes, Price at Issuance 99.868, Yielding 3.07%. |

|

Additional Commentary

NEW ISSUANCE WATCH: on 4/17/19 participants welcome a $1500MM new corporate-bond offering by

Bank of America Corp.

The most recent data showed money flowed out of high-yield ETFs/mutual funds for the week ended 4/12/19, with a net inflow of $0.655B, year-to-date $13.3B flowed into high-yield.

| Top Widening Credit Default Swaps (CDS) |

Top Narrowing Credit Default Swaps (CDS) |

Hertz Corp. (5Y Sen USD XR14)

Hovnanian Enterprises Inc. (5Y Sen USD MR14) |

Cable & Wireless Communication (5Y Sen USD CR14)

San Miguel Corp. (5Y Sen USD CR14) |

Loans and Credit Market Overview

SYNDICATED LOANS HIGHLIGHTS:

Deals recently freed for secondary trading, notable secondary activity:

- Project Maple II BV, Trade Me Group LTD, Jane Street, Six Flags Inc., MW Industries Inc.

OVERALL CREDIT MARKET:

Long-term bond yields are expected to hit a cyclical peak in 2019 given tight fiscal policy and lagging global economies. Europe remains checked by stubbornly low inflationary forces. Positive effects remained in force:

- TED spread held below 18 bp (basis points), as of 04/17/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

Read More

Topics:

High Yield,

Investment Grade,

Loans,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

New Issues,

Finance,

Fixed Income,

News,

Syndicated Bonds,

syndicated,

research,

market update

HIGH-YIELD BONDS OUTPACED INVESTMENT-GRADE in net prices linked to actual trades. Treasury prices dipped sending yields higher, the 10-year Treasury note rose 3.8 basis points and the 30-year notegained 2.4 basis points. Gold slid to its lowest point in 2019 as a risk-on appetite picks up sending equity indexes near record highs. S&P +0.14%, DOW +0.31%, NASDAQ +0.45%.

Read More

Topics:

High Yield,

Investment Grade,

Loans,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

New Issues,

Finance,

Fixed Income,

News,

Syndicated Bonds,

syndicated,

research,

market update

JUNK BONDS RETAIN A SLIGHT EDGE OVER INVESTMENT-GRADE DEBT in net prices linked to actual trades despite lackluster bank earnings. Goldman Sachs sank 3.41 percent upon releasing weaker than expected revenue for the first quarter, meanwhile, Citigroup reported a rise in profit by 2 percent from a year ago lifted by an expansion in U.S. consumer banking. “Both our consumer and institutional businesses performed well and we saw good momentum in those areas where we have been investing,” stated Chief Executive Mike Corbat. 10-year Treasury note slipped 1.9 basis points. S&P -0.07%, DOW-0.11%, NASDAQ -0.07%.

Read More

Topics:

High Yield,

Investment Grade,

Loans,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

New Issues,

Finance,

Fixed Income,

News,

Syndicated Bonds,

syndicated,

research,

market update

RISK-ON SENTIMENT INTENSIFIED FOLLOWING A SLEW OF POSITIVE EARNINGS as the Dow Jones Industrial Average spiked 230 points. J.P. Morgan and Disney were among the companies that reported on Friday, J.P. Morgan announced the “impact of higher rates” elevated earnings, JPM closed 4.5 percent higher. Disney surged 11 percent after revealing a rival streaming service to Netflix. Economic concerns have dissipated, “Strength in [JPMorgan’s] consumer franchise shows that despite the uncertainty in the fourth quarter of last year, consumers continue to spend and give strength to the overall U.S. economy”. 10-year Treasury note rose 6.4 basis points. S&P +0.64%, DOW +0.96%, NASDAQ +0.44%.

Read More

Topics:

High Yield,

Investment Grade,

Loans,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

New Issues,

Finance,

Fixed Income,

News,

Syndicated Bonds,

syndicated,

research,

market update

TREASURY YIELDS ROSE ON THURSDAY upon the release of positive economic data on the labor market calming fears of a slowing economy, 10-year Treasury note increased 3.4 basis points. Equities settled lower as investors anticipate a lackluster quarterly earnings season set to kick off this Friday. Chief equity strategist Terry Sandven at U.S. Bank Wealth Management sees opportunity, “Expectations for first-quarter results have been ratcheted down on the heels of sluggish global growth, so the bar is low and it could set the stage for upside surprises”. S&P -0.11%, DOW -0.19%, NASDAQ -0.31%

Read More

Topics:

High Yield,

Investment Grade,

Loans,

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

Syndicated Bonds,

syndicated,

research,

market update

TREASURY YIELDS ROSE ON THURSDAY

upon the release of positive economic data on the labor market calming fears of a slowing economy,

10-year Treasury note increased 3.4 basis points. Equities settled lower as

investors anticipate a lackluster quarterly earnings

season set to kick off this Friday. Chief equity strategist Terry Sandven at U.S. Bank Wealth Management sees opportunity,

“Expectations for first-quarter results have been ratcheted down on the heels of sluggish global growth, so the bar is low and it could set the stage for upside surprises”.

S&P

-0.11%,

DOW

-0.19%,

NASDAQ

-0.31%

Read More

Topics:

High Yield,

Investment Grade,

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

Syndicated Bonds,

research,

market update

U.S. THREATENED TO SLAP TARIFFS ON HUNDREDS OF EUROPEAN GOODS

dragging stocks lower on Tuesday.

Job openings fell sharply

in February by more than a half million

slipping to levels

not seen in over a year,

“Like the rest of the economy, the labor market is not perfectly steady on its feet”.

Gold rose to nearly two-week highs settling above $1307.8 per ounce.

10-year Treasury note dipped 2.5 basis points.

S&P

-0.58%,

DOW

-0.68%,

NASDAQ

-0.46%

Read More

Topics:

High Yield,

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

News,

research,

market update

JUNK BONDS SLIGHTLY REGAINED FAVOR AGAINST INVESTMENT-GRADE DEBT

in net prices linked to actual trades. Treasury yields for U.S.

Government bonds ticked higher

as investors await the release of

critical inflation data,

10-year Trea

sury note gained 2.7 basis points and the

30-year note

rose 0.7 basis points. Equities settled

predominantly higher despite

the

DOW shedding nearly 100

points following

Boeing receiving a downgrade

from Bank of America Merrill Lynch and JPMorgan

downgrading GE.

S&P

+0.04%,

DOW

-0.48%,

NASDAQ

+0.15%

Read More

Topics:

High Yield,

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

News,

research,

market update

U.S. EMPLOYMENT ACCELERATED IN MARCH growing by 196,000 jobs rebounding from a 17-month low in February. “This was a Goldilocks report, with a rebound in job growth to calm fears of an imminent recession, and wage growth that was solid enough without triggering inflationary concerns,”said Curt Long, chief economist at the National Association of Federally-Insured Credit Unions. 10-year Treasury note shed 2.2 basis points. Equities rise to six month highs amid strong economic data, S&P+0.44%, DOW +0.18%, NASDAQ +0.58%

Read More

Topics:

High Yield,

Investment Grade,

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

News,

research,

market update

.png)