U.S. STOCKS RECOVERED LOSSES WEDNESDAY after news broke that the White House plans to delay an auto tariffs decision by up to six months. The news was well received in the equities market, which has been turbulent for the better part of the last two weeks. The technology sector performed particularly well today as the NASDAQ rose 1.13%. 10-Year U.S. Treasury Yields fell 3.4 basis points. S&P +0.58%, Dow +0.45%, NASDAQ +1.13%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

JUNK BONDS ROSE AGAINST INVESTMENT GRADE DEBT in net prices linked to actual trades. Treasury yields ticked higher on Tuesday following optimism from the White House regarding China trade talks stating the tariff war is “a little squabble”.The 10-year note gained 1.6basis points. Equities regained some losses from yesterday,S&P - +1.03%, Dow+1.05%, NASDAQ +1.34%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

STOCKS PLUMMETED MONDAY MORNING as China retaliated with movements to raise tariffs on $60 billion worth of U.S. goods. Starting June 1, Chinese officials say tariffs will be raised to as high as 25%on products that currently face levies of 5-10%. All three major indices dropped at least 2% amid the continued trade tensions, with the NASDAQ falling 3.41%. Crude Oil was down 1.3%. S&P -2.41%, Dow-2.38%, NASDAQ -3.41%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

U.S. STOCKS RECOVERED SOME LOSSES FRIDAY despite trade talks with China failing to reach a deal. Of the three major indices, the tech-heavy NASDAQ produced the smallest gains as a result of its exposure to China, closing up 0.08%. 10-Year U.S. Treasury yields rose 2.5 basis points. S&P +0.37%, Dow +0.44%, NASDAQ +0.08%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

STOCKS DECLINED AGAIN ON THURSDAY as a week of uncertainty over U.S.-China trade relations continues. The world's two largest economies have yet to strike a trade deal, but proceedings have officially begun to increase tariffs on Chinese imports from 10% to 25%. In the midst, the Dow Jones dropped 139 points. 10-Year U.S. Treasury Notes fell 3 basis points. S&P -0.30%, Dow -0.54% , NASDAQ -0.41%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

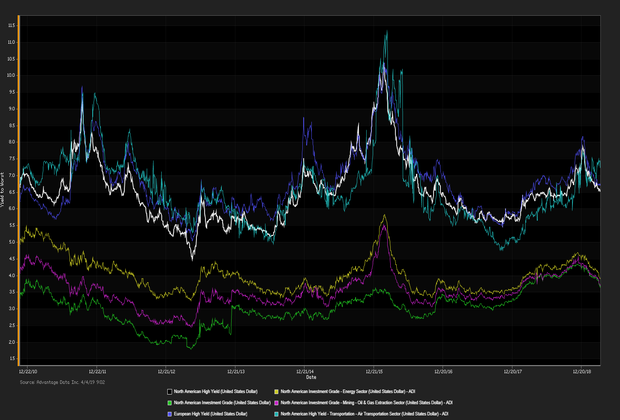

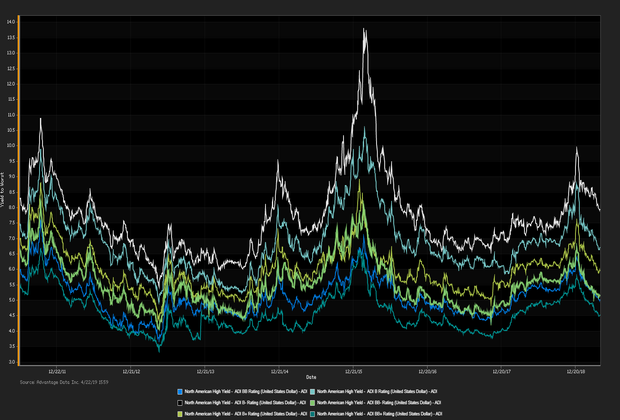

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)