U.S. STOCKS DECLINED WEDNESDAY after the Federal Reserve indicated it will hold off on an interest rate change. Voting member of the Fed James Bullard stated, “Rates are at a good place in the U.S. right now, if anything we are a little restrictive I would say”. The Fed was in agreement that the current policy can stay, but was split on whether it would change if the economy continues on its expected path. Combined with persisting tariff tensions, all three major indices fell today. S&P -0.28%, DOW -0.39%, NASDAQ -0.45%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

BOSTON FED RESERVE CHAIRMAN ERIC ROSENGREN stated he sees “no clarion call” to increase interest rates any time soon emphasizing “the Fed can afford to wait and see.” Unemployment is hovering at 50-year lows, In April the jobless rate was 3.6 percent. Treasury yields ticked higher after a report the US eased trade restrictions on Chinese telecom giant Huawei Technologies. The 10-year note gained 1.2 basis points. S&P +0.84%, DOW +0.72%, NASDAQ +1.05%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

THE NASDAQ FELL SHARPLY MONDAY morning as U.S. tech companies cut off supplies to Chinese electronics manufacturer, Huawei Technologies. In compliance with a decision from the White House, chipmakers have halted business with Huawei until further notice. Amid the escalating trade tensions, all three major indices suffered losses, with the NASDAQ dropping 113 points. S&P -0.67%, Dow -0.33%, NASDAQ -1.46%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

U.S. STOCKS RECOVERED EARLY LOSSES on Friday as positive economic data weighs against trade concerns. News that China is hesitant to resume trade talks with the U.S. reinforced investors' concerns that tensions will persist. However, news that consumer sentiment is at a 15-year high bolstered stocks and stabilized U.S. treasury yields, with the 10-Year Note at 2.39%. S&P -0.58%, Dow -0.38%, NASDAQ -1.04%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

STOCKS ROSE FOR THE THIRD STRAIGHT DAY behind strong earnings from Walmart and Cisco Systems. Troy Gayeski of SkyBridge Capital states, “The U.S. consumer is in exceptional shape, and Walmart’s results reinforce that view”. All three major indices settled about where they started at the beginning of the week, showing resilience in the the equities market.Crude Oil rose 1.69%. S&P+0.89%,Dow+0.84%,NASDAQ+0.97%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

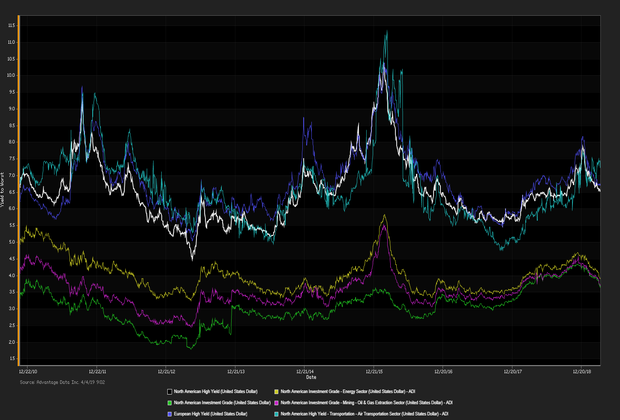

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)